Weekly Market Wrap: Gold and Crypto Broke New Highs!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technical, economics, and portfolio management:

Click here to subscribe for the latest market report (4 December 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Last week saw the stock market continue its impressive comeback in 2023, with gains nearing 20% this year, a stark contrast to the struggles of 2022.

The momentum was particularly strong in November, marking the first monthly gain for the S&P 500 since July.

This rally was fueled by a combination of factors: inflation showing a downward trend, the Federal Reserve hinting at a halt in policy tightening, resilient economic performance despite high interest rates, and corporate earnings exceeding expectations. The robust November rally, backed by solid economic data, suggests a promising end to 2023 and potential for sustained growth into 2024, even as challenges loom.

In terms of market performance, U.S. stocks soared by 9% in November, marking the best month in over a year and a half and ranking as one of the top monthly returns in the last 30 years. This surge erased the downturn experienced from August to October, driven by renewed interest rate concerns.

Market leadership was largely from cyclical sectors and those sensitive to interest rate drops, including small-cap stocks and sectors like financial services, consumer discretionary, technology, and real estate. With the S&P 500 inching closer to its all-time high from January 2022, the outlook for the next year, despite expected challenges, leans towards a likely return to new highs and potential double-digit returns.

Investment-grade bonds also saw a significant upswing, logging their best monthly return in three decades, buoyed by a less restrictive Fed outlook.

This week, the focus for market observers will be primarily on the labor market, with several key reports scheduled for release. The week will kick off with data on job openings, providing insights into the current employment landscape.

This will be followed by the ADP private payroll report on Wednesday, which is often viewed as a precursor to the broader employment situation. Thursday brings the weekly initial jobless claims, a timely indicator of short-term employment trends.

The culmination of labor market reports will be the U.S. unemployment report on Friday, which is pivotal for understanding the overall health of the labor market and could influence market sentiments significantly.

In addition to labor market data, investors will be keenly awaiting other economic updates throughout the week. These include the latest figures on factory orders and revisions to U.S. third-quarter productivity, which offer a glimpse into the industrial sector’s performance and overall economic efficiency.

On the consumer front, the Federal Reserve’s report on consumer credit and the preliminary December results from the Michigan Consumer Sentiment Index will shed light on consumer financial health and confidence levels.

In the tech sector, a notable event is the launch of Advanced Micro Devices’ (AMD) new MI300 data center GPU chip on Wednesday, highlighting the ongoing advancements in AI-focused chip designs. Additionally, tech giants Microsoft (MSFT) and Cisco Systems (CSCO) will be conducting their annual shareholder meetings, potentially impacting their respective stock movements and broader market trends.

Daily Trading Signals (Highlights)

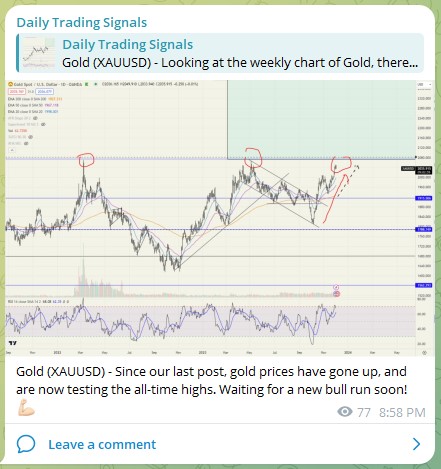

Gold (XAUUSD) – Since our last post, gold prices have gone up, and are now testing the all-time highs. Waiting for a new bull run soon! 💪🏻

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!