Weekly Market Wrap: Profits from Solana (SOL) Cross 167%!

New: Join our 3-hour live workshop with Spencer to learn the basics of trading and make your first live trade!

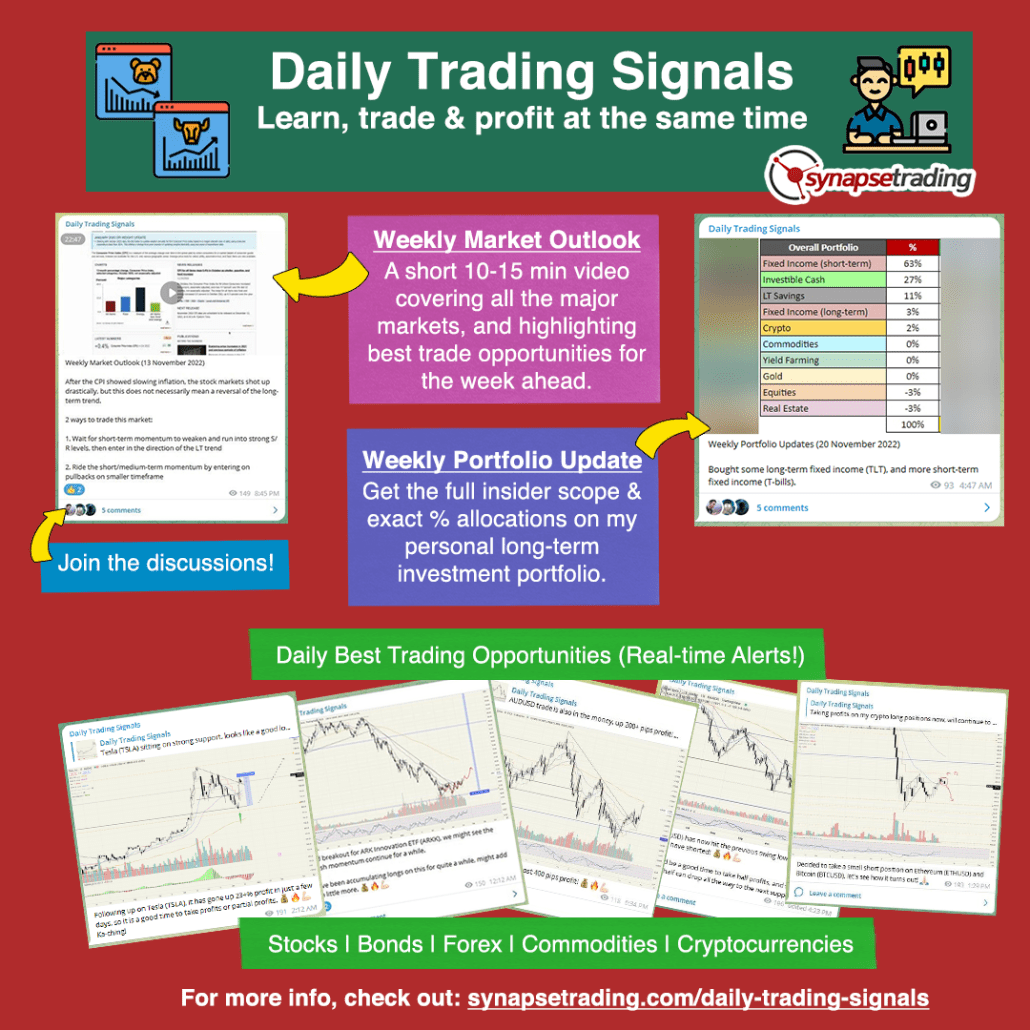

Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

Last week marked the one-year anniversary of the Silicon Valley Bank collapse, a pivotal moment that briefly ignited a banking crisis, unsettling the financial markets and leading to the downfall of several regional banks.

Reflecting on the tumultuous period, the contrast couldn’t be starker a year later; from the depths of a bear market and the worst year on record for bonds, the markets have rebounded into a robust bull rally reminiscent of the 1990s. This turnaround highlights the critical importance of maintaining a steady investment approach during periods of market panic.

The banking sector, which was at the heart of last year’s crisis, has seen significant improvements, with 2023’s challenges largely in the rearview mirror.

Interest rates have moderated, easing the unrealized losses in banks’ bond portfolios, and while the sector still navigates cyclical challenges like loan delinquencies, the systemic threats have subsided.

On the broader economic front, the resilience of the U.S. economy continues to shine through, defying the gravitational pull of prior rate hikes.

With the Fed shifting its stance towards potential rate cuts, the outlook for the banking system and the broader financial landscape appears markedly more stable than just a year ago, offering a steadier footing for continued growth and investment opportunities.

This week, attention is pivoted towards Federal Reserve Chair Jerome Powell’s remarks following the Fed’s interest rate decision on Wednesday, expected to hold steady, shaping market sentiment in the near term.

Additionally, the looming deadline on Friday for the passage of several crucial government spending bills poses the threat of a governmental shutdown, should legislative action falter.

On the corporate front, a slate of earnings reports is anticipated from key players across various sectors, including Micron Technology, General Mills, Nike, FedEx, and Xpeng. Meanwhile, Nvidia’s annual Global Processing Unit Technology Conference for AI developers, starting Monday with a keynote from CEO Jensen Huang, is set to spotlight innovations and possibly influence tech market dynamics.

Daily Trading Signals (Highlights)

Here is an example of our Solana trade which we started accumulating since $74 and rode it up to $200+, giving us a +176% profit to date!

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!