Forex Intraday Trading | EUR/USD – The Daily 35 Pips Challenge

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

After the trading workshop yesterday, I gave everyone the forex daily 35 pips challenge, and today I traded with some of my students to show them it can be done. On every trading day, a major pair like the EUR/USD typically has a conservative trading range of roughly 70 pips, so the challenge is to make 35 pips a day consistently. While this might seem insignificant when people try to punt/gamble for once-off big gains, the power of consistency must not be underestimated.

A trader who starts off trading a measly 0.5 standard lots will be making 0.5 x 35 x US$10 = US$175 a day, which adds up to roughly US$3,500 a month, comparable to most full-time jobs. Not bad for a few trades a day! A trader who progress to 3 standard lots will be making 3 x 35 x US$10 = US$1,050 a day, which adds up to roughly US$20,000 a month, comparable to a high-end job in the financial sector. If a trader then progresses to trading 10 standard lots,… well I leave you to work out the math.

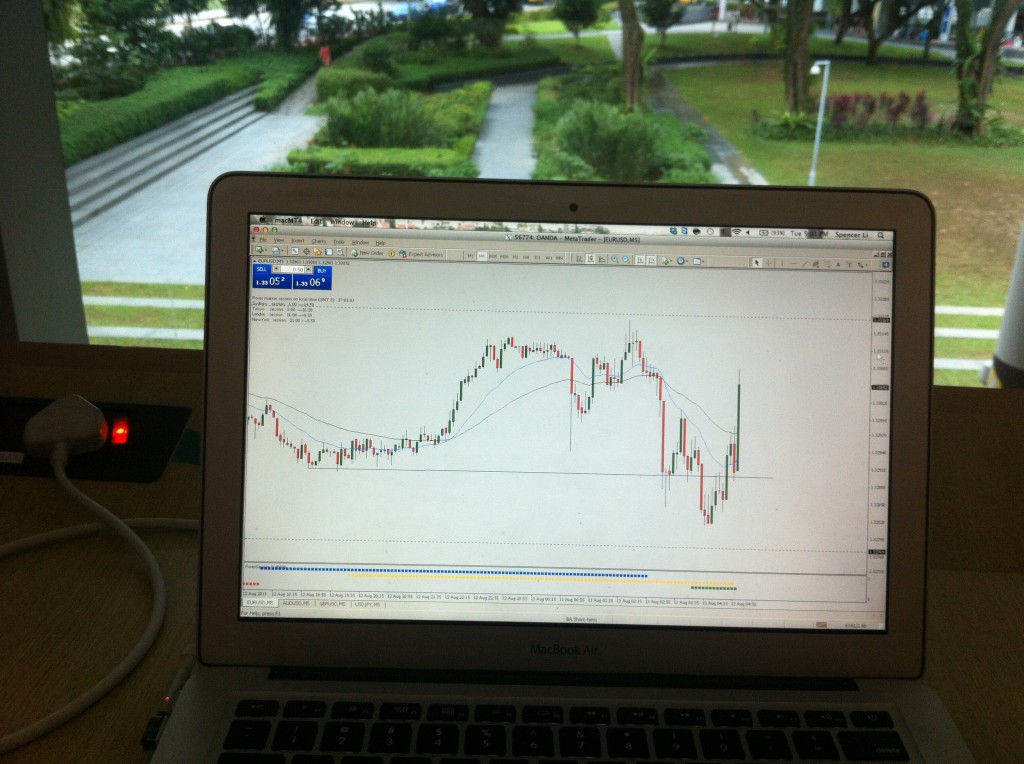

For today, the trading range was 83 pips, and I managed to catch 68 pips, and trailed my stops for a small portion of my profits. This was done in just ONE GOOD TRADE, well-timed with precision and accuracy. I have highlighted the sequence of steps from trade entry to exit, as well as how I managed my risk and trailed my stops. Of course, my students were following me live as I made these trades.

For those who are interested to hear me share more about how I always make such accurate entries by reading blank charts, I will be revealing how intraday trading can be done at a relaxed pace. https://www.eventbrite.sg/event/7760228051?ref=ecal

Forex trading strategies – Waiting patiently for a good setup

Forex trading strategies – Waiting patiently for a good setup

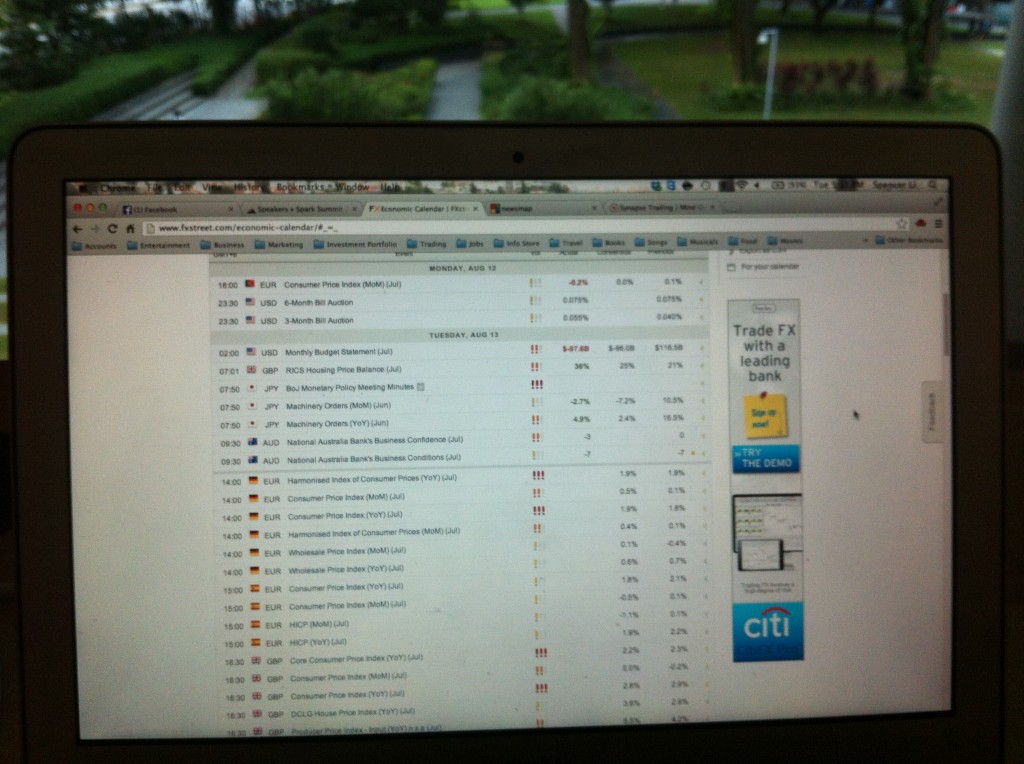

Checking the economic calendar for major forex news

Checking the economic calendar for major forex news

Pin-point entry using one of our price action forex trading strategies – No technical analysis or indicators required

Pin-point entry using one of our price action forex trading strategies – No technical analysis or indicators required

Price action goes in our favour very quickly

Price action goes in our favour very quickly

EUR/USD – Price spike down on news release!

EUR/USD – Price spike down on news release!

Managing our risk by shifting stoploss to lock in profits

Managing our risk by shifting stoploss to lock in profits

1st TP is hit for 40+ pips! Taking half profits.

1st TP is hit for 40+ pips! Taking half profits.

2nd TP was hit at 1.3235, a few pips off the low of the day. Simply uncanny how accurate these price projections can be. Trailing a small position overnight to gun for 100+ pips overnight.

A big thanks to one of my students who insisted on using some of the profits he made today to buy me some sweet treats. With the daily effort put in, I am pretty sure it is only a matter of time before he will be trading a huge account of his own. Keep up the good work!

Spencer Li – The Wealth Coach – Stocks Investing – Forex Trading

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

What is the risk per trade of target 35 pips?

Is it an intraday trade?

How many trades are done per day?

@John Thanks for your questions.

The initial risk was about 10 pips for this trade, and the TP was calculated way further than 35 pips, so the R/R was definitely >3.

Yes, this is an intraday trade, but I held a small position overnight after trailing my stops to lock in the bulk of my profits.

Trades done depend on the market conditions and the setups. We only trade when there is a good setup. For example, this day I only did one trade, but it was good enough to net 68 pips. Number of trades can range anywhere from 1 to 20, depending on level of risk appetite.

So does that mean this challenge is more for full time traders?

How about part time traders? Can part time achieve this feat as well?

And what will be the trade frequency for part time traders?

Will there be a lot of monitoring?

@John

It is possible for part-time traders, but it will be more challenging. It depends on the schedule of your work, for example will you be able to take 10-15 mins during major news annoucements, etc

For part-time traders, if you are unable to watch the market much, it might be better to take longer-term positions like overnight trades. The position size will be smaller, but the moves you catch will be larger.

For full-time traders, just 2-3 trades a day are good enough. For part-time traders, it might be 2-3 trades a week.