Weekly Market Wrap: Debt Ceiling Fears vs. AI Hype?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technicals, economics, and portfolio management:

Click here for last week’s market report (22 May 2023)

Click here to subscribe for the latest market report (29 May 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Last week, Nvidia’s Q1 fiscal 2023 earnings report exceeded market predictions, resulting in a significant surge in the company’s shares. The strong performance is mainly attributed to Nvidia’s leading position in the production of artificial intelligence chips and a significant increase in demand for its data center products.

As a result, Nvidia’s net income saw an increase from the previous year. Meanwhile, Wall Street was preparing for a potential U.S. default, following Treasury Secretary Janet Yellen’s announcement about the U.S. potentially running out of cash for bill payments. This led to contingency plans to maintain the financial market operations in case of a default.

Furthermore, Treasury yields and mortgage rates reached new multi-year highs, indicating the bond market’s expectation for further rate hikes. The rise in the six-month yield suggests traders are pricing in another rate hike in the coming months. Unlike the previous rate-hike cycle in 2018-2019, which aimed to normalize monetary policy amid relatively lower inflation, the recent rate hikes respond to higher inflation rates. The six-month yield’s highest point in 22 years implies a shift in the market’s perception of the Federal Reserve’s policy direction.

As we head into a holiday-shortened trading week, investors should closely monitor the strength and weaknesses of the various currencies and the stock market. With a strong rebound in the USD, continuous weakness in the Aussie and New Zealand dollars, and strong pound, these shifts in the forex market can significantly influence financial strategies. In addition, the general weakness observed in the stock market last week may continue to affect portfolios.

Moreover, the potential resolution of the debt ceiling in the US could trigger significant market moves. Especially if it isn’t resolved, the surprise could lead to large market movements, so staying alert to this development is crucial.

In addition, investors should keep an eye on key economic indicators and corporate earnings. With the release of reports like the Case-Shiller National Home Price Index, FHFA House Price Index (HPI), the Job Openings and Labor Turnover Survey (JOLTS), and the Labor Department’s nonfarm payrolls report, understanding the current state of the housing and labor markets in the US is essential. Furthermore, updates on inflation and unemployment rates in the eurozone will give valuable insights into its economic health.

Lastly, earnings reports from Salesforce, HP, Broadcom, Dollar General, Lululemon Athletica, Macy’s, and Dell Technologies will provide key insights into the performance of these companies and, by extension, the sectors they operate in.

Daily Trading Signals (Highlights)

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

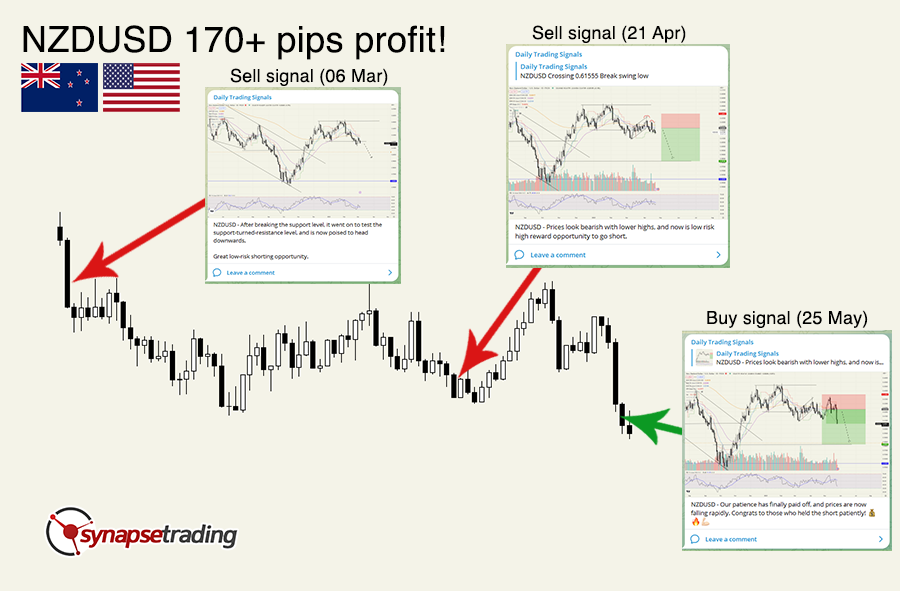

NZDUSD – Our patience has finally paid off, and prices are now falling rapidly. Congrats to those who held the short patiently! 💰🔥💪🏻

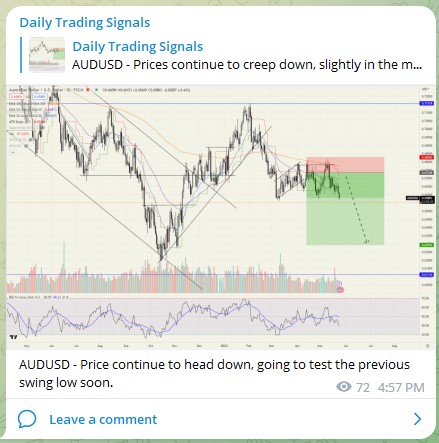

AUDUSD – Price continue to head down, going to test the previous swing low soon.

USDJPY – After breaking above the neckline of the double bottom, the RR ratio is good for a long trade.

NZDJPY – A range-trading opportunity, can wait for prices to pull back higher for a better entry.

China tech stocks (3067) – Looks like the rally has stalled, we will need to see if the final support level of around $7.25 holds.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!