Weekly Market Wrap: Is a Ceasefire Coming Soon?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

As the war progresses into stalemate scenario (or rather a war of attrition), the challenge is to see who can hold out longer – the Russian economy against the sanctions or the Ukrainian military against the invaders.

With the drop of some commodities (after a long run-up), there is a possibility that the market is pricing in some form of ceasefire.

Even though stocks have recovered slightly, I do not see any bullish catalysts in the long run, since inflation is still climbing, and the interest rates have started rising.

[Photo: Old transport helicopter ? at The Stalin Line, Minsik, Belarus – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Forex Market Highlights

Safe haven assets

Following up on EURNZD, it looks like it might start heading down again.

The EURUSD continues heading down as predicted, and is already about 300 pips in the money. ????

I’m expecting it to continue heading lower.

This can be seen in the run-up of the USDCHF to the top of the channel.

The first TP for USDSGD has been hit, we will need to see if it can continue to break new highs.

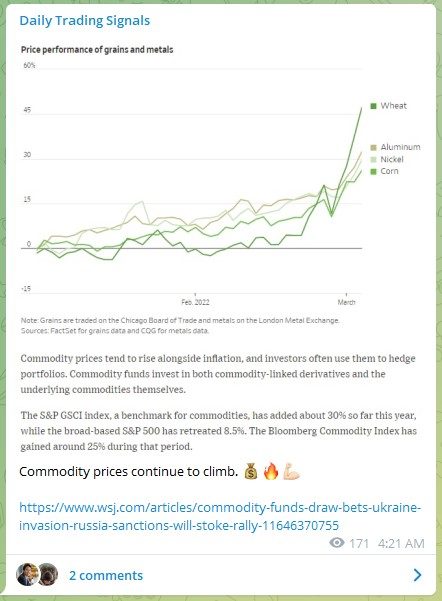

Commodities Market Highlights

Crude Oil surged up, then came back down 30%, could this be a sign that a ceasefire agreement is coming soon?

Commodity prices continue to climb. ????

Stock Market Highlights

Stocks have continued to fall as predicted, as can be seen on the NASDAQ 100 (US 100).

At the risk of sounding repetitive, I have been saying for the past few weeks to either stay out or be short on stocks.

So now we just need to ride the trend and add shorts on pullbacks for additional profit. ????

You can short by simply selling the QQQ, which is the ETF for the NASDAQ 100.

Strong movement on stocks today, as seen from the S&P 500 (US 500), but prices are at a crucial level, where all the key resistance levels and EMAs are right above it. I am still net bearish, until prices clear those resistances.

In times of crisis, the USD is perceived to be a safe haven, as seen from the strong uptrend in the US Dollar Index (DXY).

The stock is now 87% below its IPO price, leaving its two top shareholders — SoftBank and Uber — facing the potential for steep losses.

Crypto Market Highlights

After much sideways movement in cryptocurrencies, Ethereum (ETH) has managed to break out of its 3-month triangle consolidation.

If prices can hold above the breakout, and make new highs, there is a good chance of another crypto bull run.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!