There are many different financial markets and financial products that are available for you to choose from, which sometimes can be too overwhelming.

Personally, I have traded or invested in almost all of them over the years.

In this post, I will give a brief introduction to each market and product, followed by my best picks for beginners.

Markets vs. Products

One major decision you have to make as a trader is to decide what markets and what financial products to trade, since there are many options available.

Do note the distinction between markets and products, as they are two very different things.

The market is where the transactions take place, while the products are what you will be buying and selling in the market.

Overview of Financial Markets

The major financial markets are those for stocks, bonds, commodities, forex, cryptocurrencies, and derivatives.

1. Stock Market

The stocks of each country are traded on their own centralised exchanges, so this means that prices should be the same across different brokers.

The stock exchange will also offer complementary products, such as ETFs (exchange-trade funds) and REITs (real estate investment trusts), which you can trade on the same exchange.

If you are an investor, stocks (or shares as some people call it), are basically ownership in a business/company, so when you buy a stock, you essentially own a small percentage of the company. So you will be hunting for the best businesses at good prices.

If you are a trader, you will be looking for stocks that are more actively traded, so there will be good liquidity and price movements for you to capture. Many traders prefer the US stock market, because it is the largest and has excellent liquidity and low transaction costs.

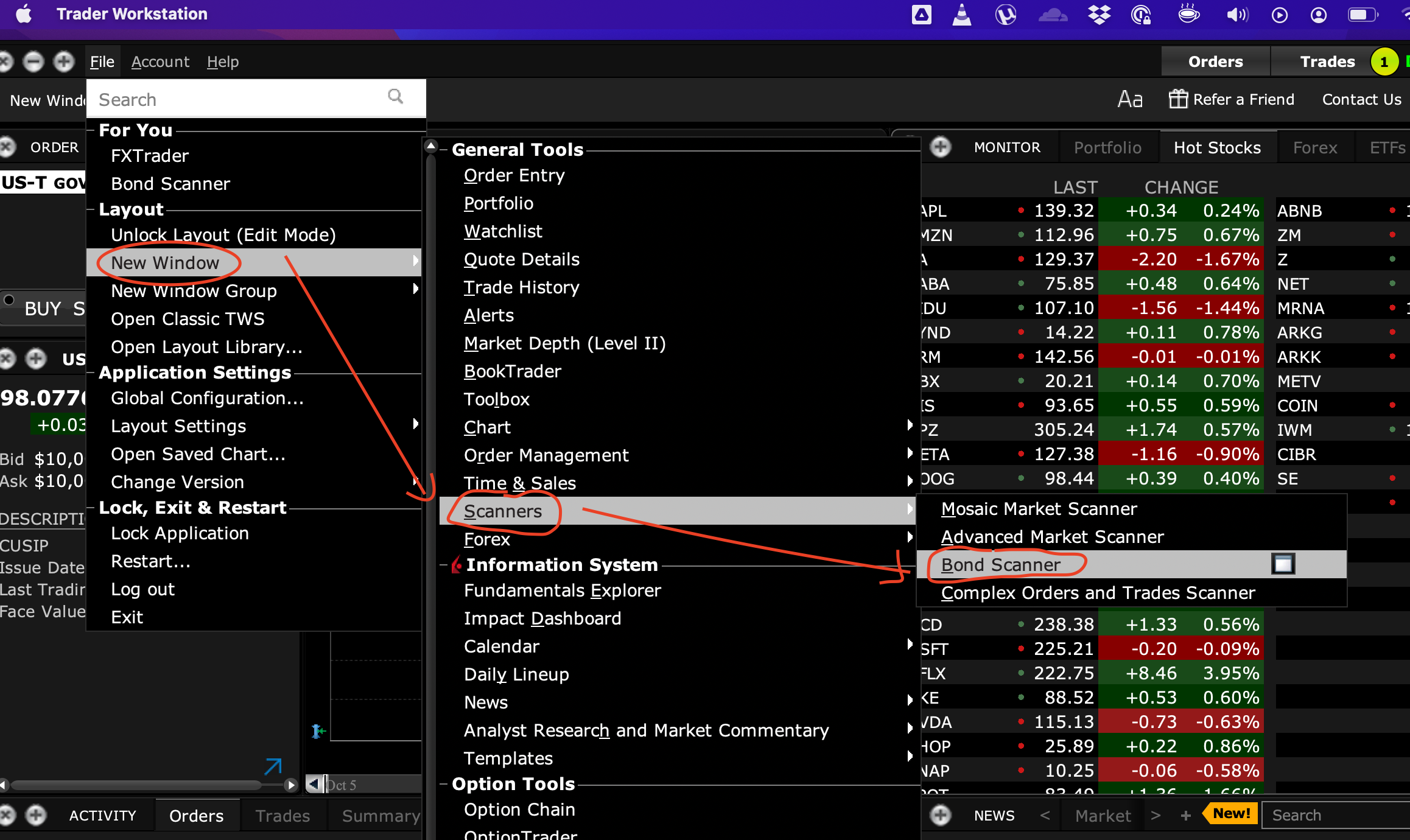

2. Bond Market

Bonds are loans that are made to businesses (corporate bonds) or to the government (government bonds), on which the lender is obliged to pay back the capital plus interest. As interest rates fluctuate, the prices of the bonds will also change.

Most of bond trading is done by financial institutions on the decentralised OTC (over the counter) market, with a small number of bonds like on exchanges.

Most retail participants buy bonds for investment or to provide stability to their portfolio, but not many people actually trade bonds actively, since price movements are small and hence large funds or large leverage is required.

3. Commodities Market

The commodities market includes metals (gold, silver, platinum), energy (crude oil, natural gas), food (sugar, coffee, cocoa), diamonds, etc.

Although it started out with physical trading, nowadays most transactions are based on financial derivatives.

These derivatives include forwards, futures, swaps, options, CFDs and in 2003, ETFs (exchange traded funds) and ETC (exchange traded commodities) were also added.

For retail traders, the most commonly traded derivative is probably CFDs, due it’s low starting capital requirements and low commissions.

4. Forex Market

Forex, or currencies, refers to the exchange rate between 2 different currencies. If you think that one currency (eg. EUR) is going to appreciate against another currency (eg. USD), you can buy a contract of EUR/USD, which is essentially the same as selling USD to buy EUR. This is no different from what you do when you go to the money changer before you embark on your vacation overseas, albeit in much larger quantities.

There is no centralised exchange for forex, so brokers and financial institutions tend to be market makers, meaning they take the opposite side of any trades that you wish to make. This also means that prices may vary slightly across different brokerages.

Forex is one of the most popular products for new traders, because the market has good liquidity, long trading hours, decent price movements, and low transaction costs even for very small accounts.

5. Crypto Market

Cryptocurrencies, or crypto for short, is a relatively new asset class which is meant to be a sort of global currency, but adoption is still not widespread, although it is growing steadily. From a market perspective, it is pretty much the same as foreign exchange, meaning you can trade it against normal currencies.

There are exchanges that allow you to trade between cryptocurrencies and fiat currencies, and other exchanges that allow you to trade between different cryptocurrencies. Some exchanges allow you to do both.

Due to its lower liquidity (besides Bitcoin, all other products do not have much volume) and quite often erratic price movements, this market is not that good for trading at the moment, although things might change in the future.

6. Derivatives Market

In addition to taking a direct position, there are also financial products that allow you to take an indirect position in the market. These products are pegged to prices of particular markets, and their prices are derived indirectly from these markets.

Hence, they are known as derivatives, and some examples include forward contracts, futures contracts, CFDs, options.

Forwards (or forward contracts) are agreements between a buyer and seller to trade an asset at a future date. The price of the asset is set when the contract is drawn up. Forward contracts have one settlement date—they all settle at the end of the contract.

Futures (or futures contracts) are similar to forward contracts, except that they are traded on an exchange and are settled on a daily basis until the end of the contract. Forward contracts are used primarily by hedgers who want to cut down the volatility of an asset’s price, while futures are preferred by speculators who bet on where the price will move.

CFDs (or contract for difference) are a way to profit from price movements without owning the underlying asset.

Options grant you the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

These products are quite versatile, so you might have combinations like stock options, Oil CFDs, Gold forwards, bond futures, etc.

What is the Best Product to Trade?

While it might seem confusing because there are too many choices, my advice to new traders is to pick one market and master it before deciding to explore other markets.

Here are some characteristics of good products:

- Has good liquidity so that you do not see erratic price spikes on the chart

- Has decent price movement so that you can actually make money from the price movements

- If you are intraday trading or swing trading, you do not want to pick a slow moving stock which only moves a few % each year

- If you are swing trading, you also won’t want to trade a penny stock which can fluctuate 10-20% in a day

- Low transaction costs, even for small accounts

- Has freely available price data for charting

- Has good coverage on news, blogs, etc, which will make learning easier

Most new traders will start off with the easiest products like forex, stocks, or CFDs.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.