Before reading this guide, the first thing you will need to do is to open an Interactive Brokers (IBKR) account, before you can start trading.

How to Open an Interactive Brokers (IBKR) Account?

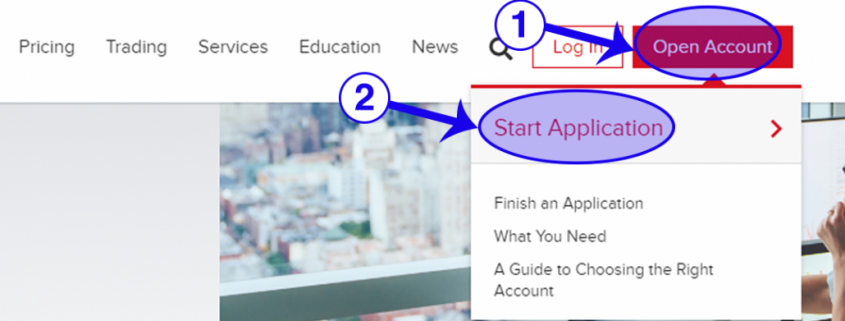

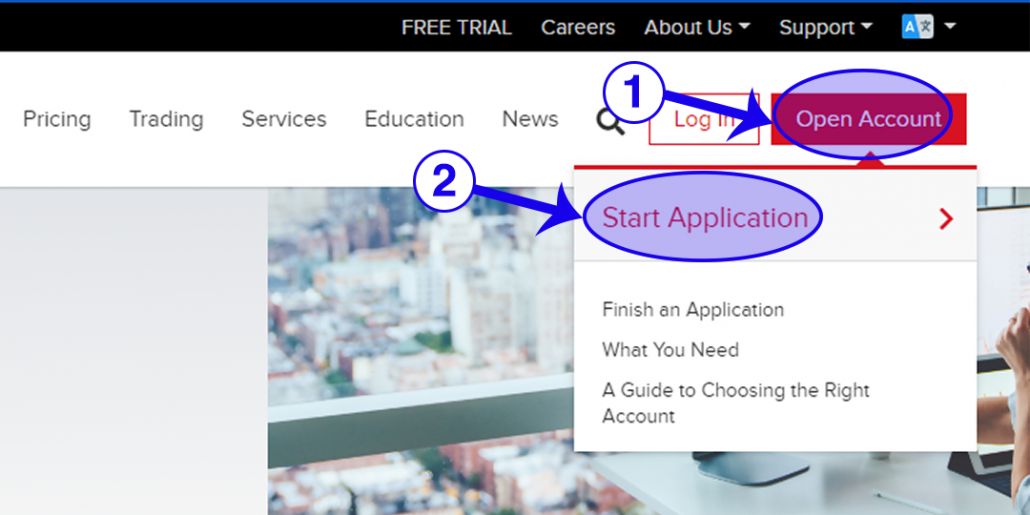

1. Click on “Open Account” button on top right of the screen.

2. Click on “Start Application” to being.

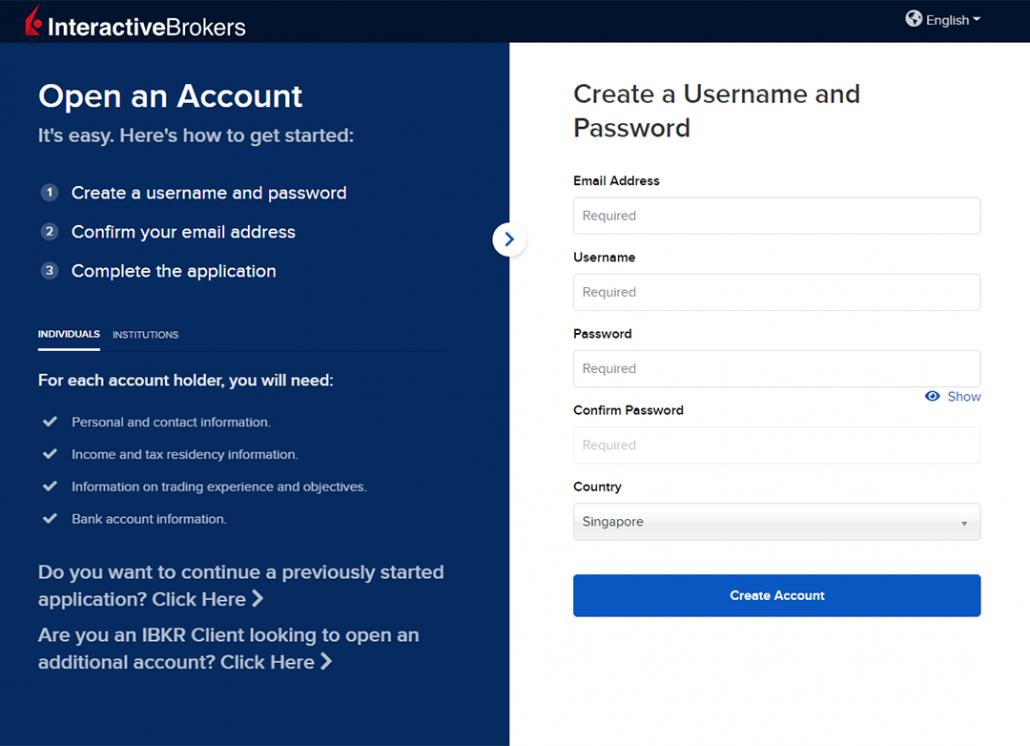

3. You are required to create an account. Fill in the relevant details.

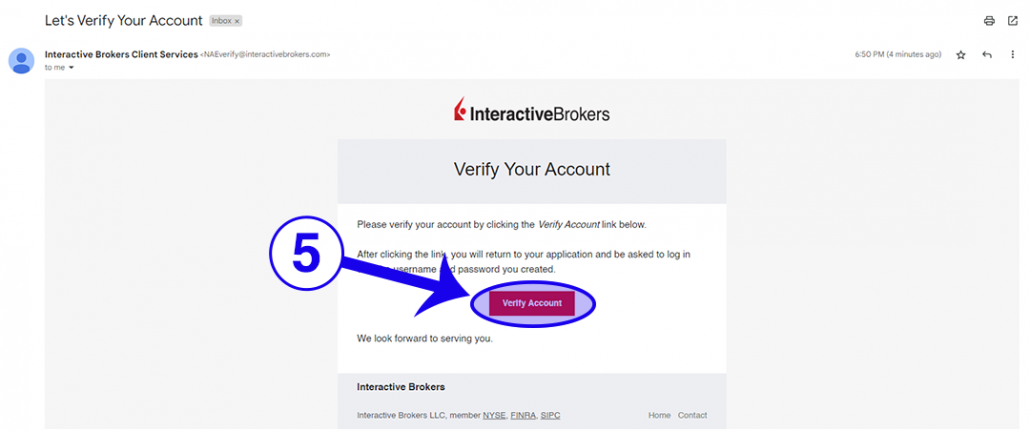

4. An account verification email will be sent to your email address upon creation of the account.

5. Log into your email and click on the link from IBKR.

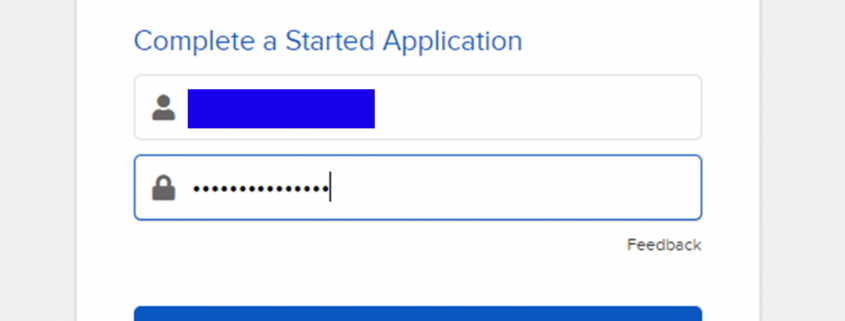

6. Log in to your IBKR account to begin the account opening.

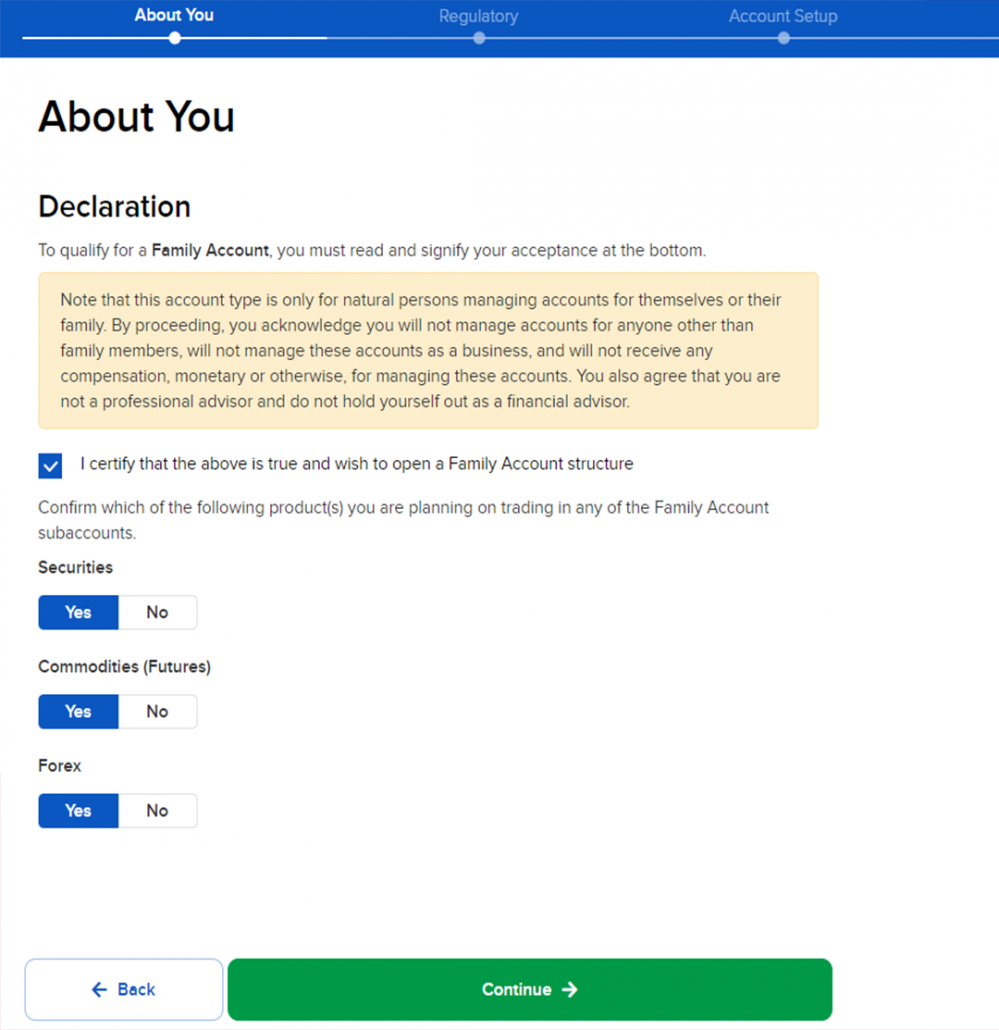

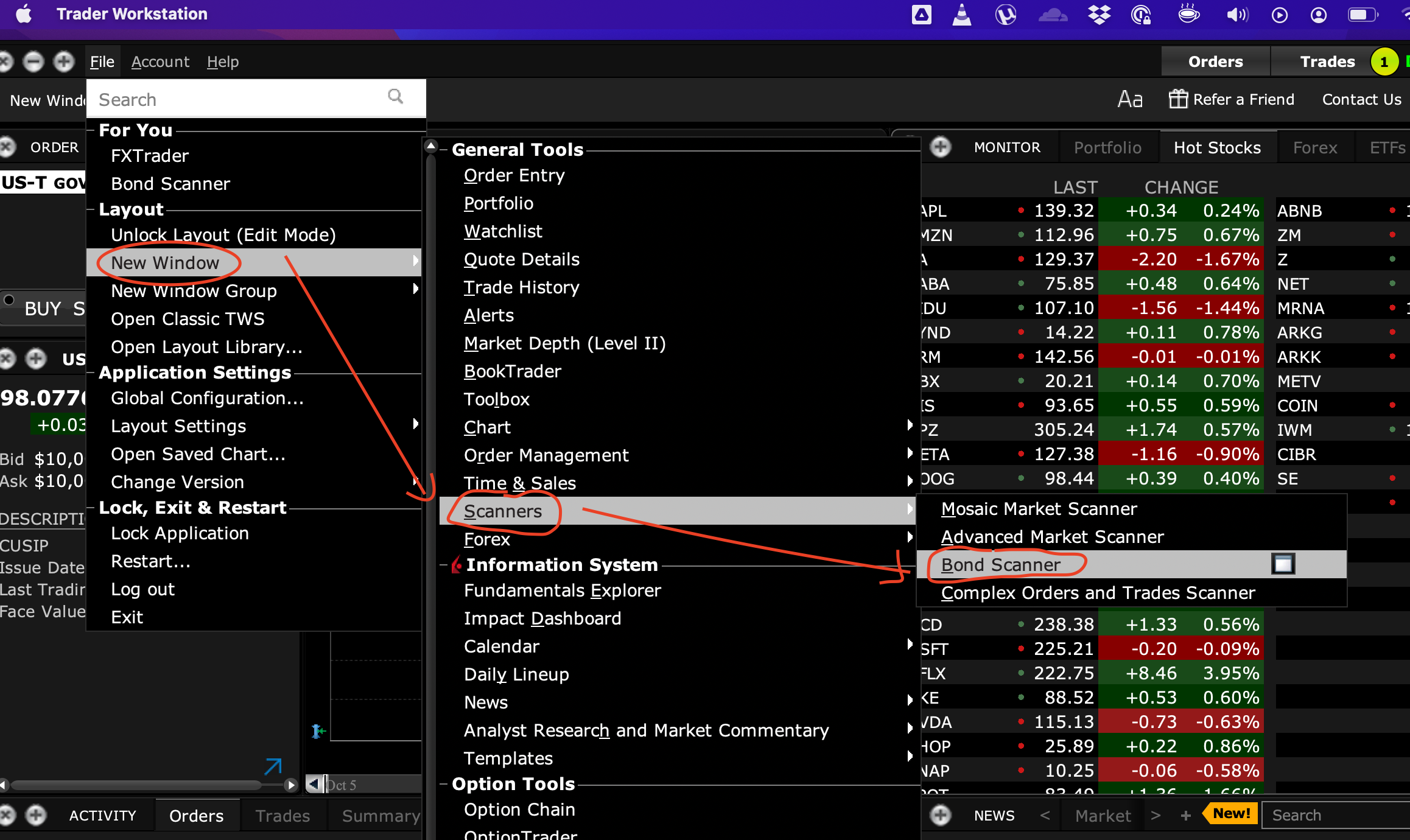

7. Select accordingly. Use the image below for assistance.

8. If you are a Singaporean, you can log into your Singpass. (If you do not have Singpass, you will have to manually fill in all the required information at Step 10 and 11.)

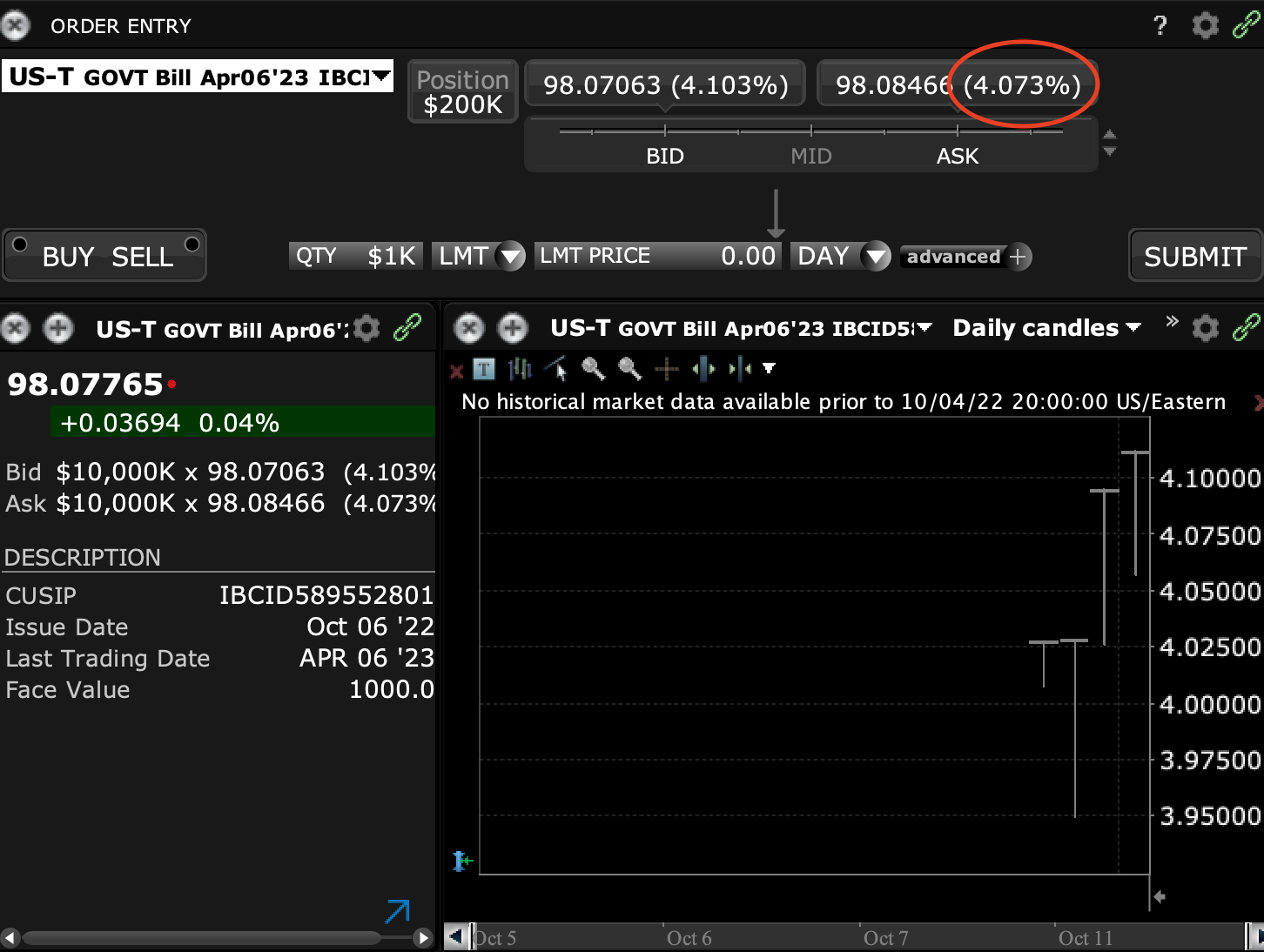

9. Select accordingly for your preferences. If you wish to dabble in stocks and bonds, choose “Securities”.

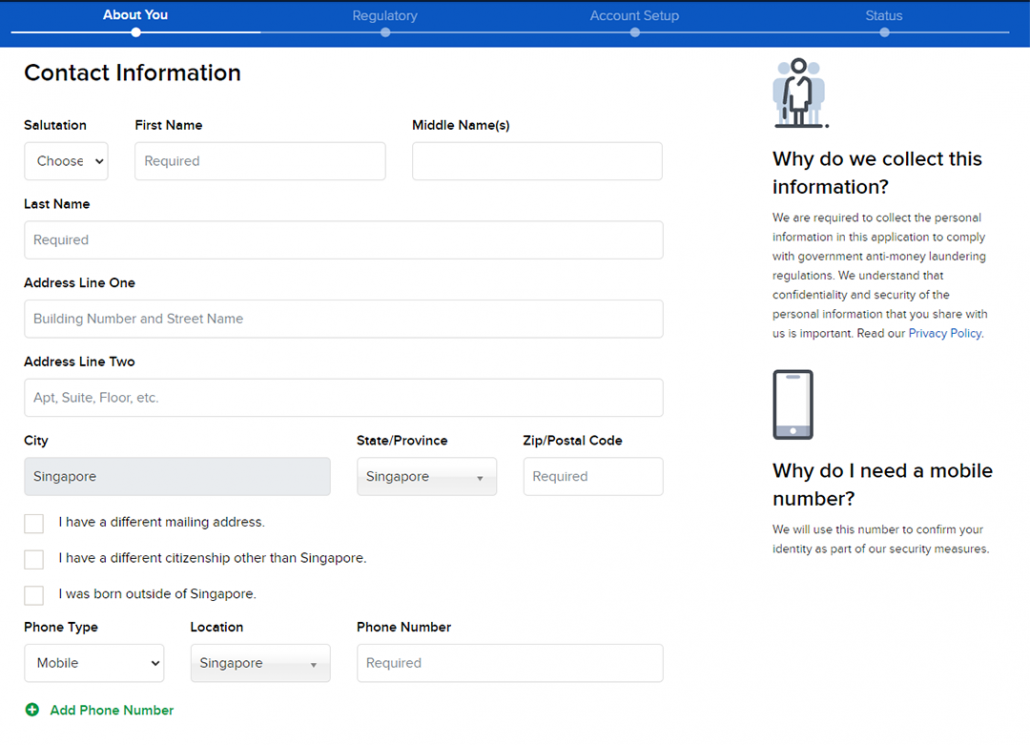

10. Fill in all the information.

11. Fill in all the information.

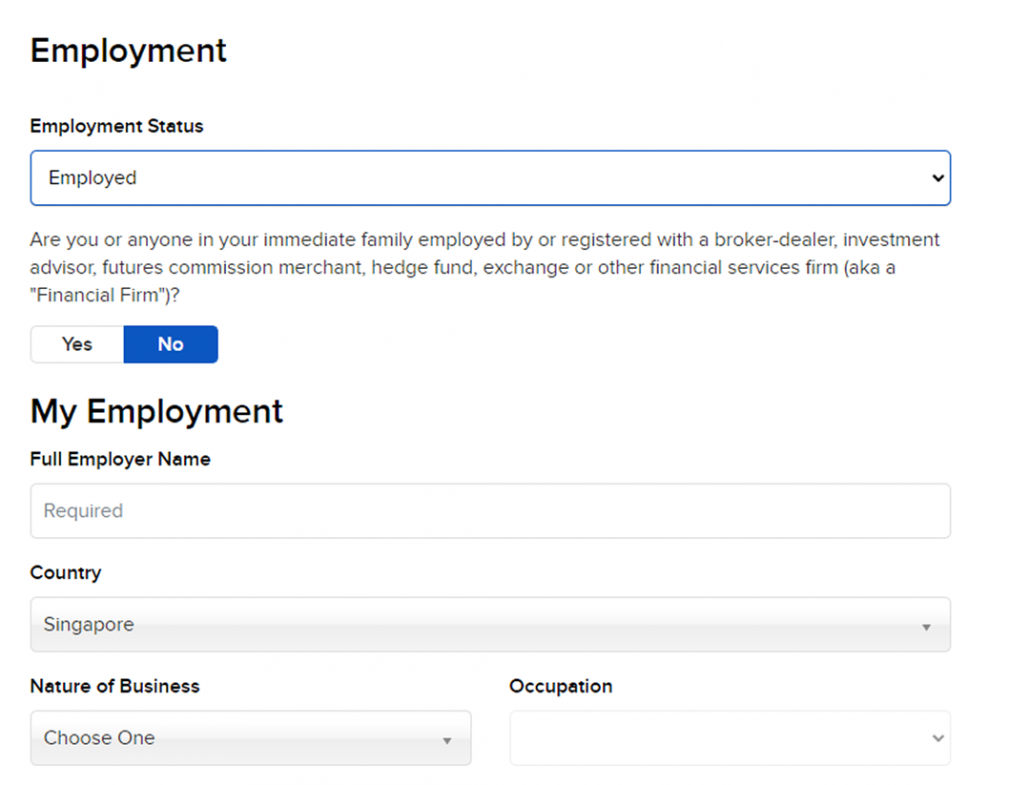

12. Key in your employment details.

13. Complete the “Source of Wealth” and the base currency. (You can change your base currency in the account settings after your account is approved.)

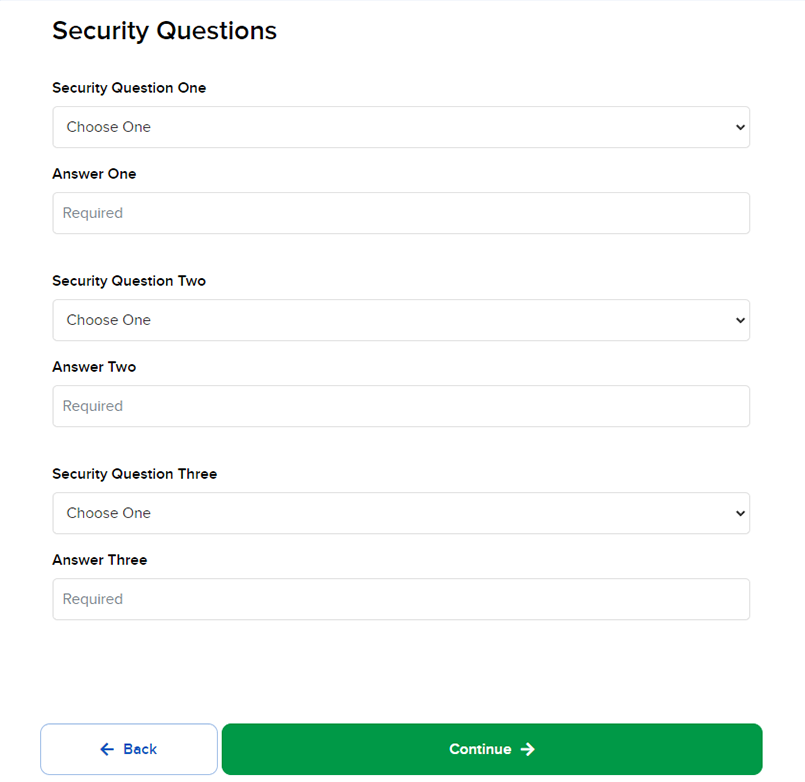

14. The 3 security questions are to protect your account if you ever lost your account password or for your verification in the future.

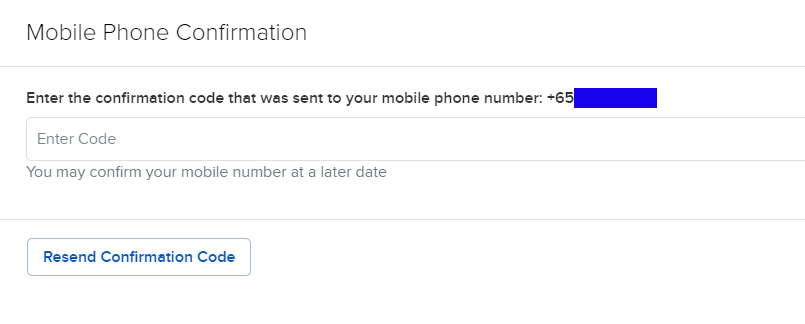

15. Confirm your mobile number (this step is optional)

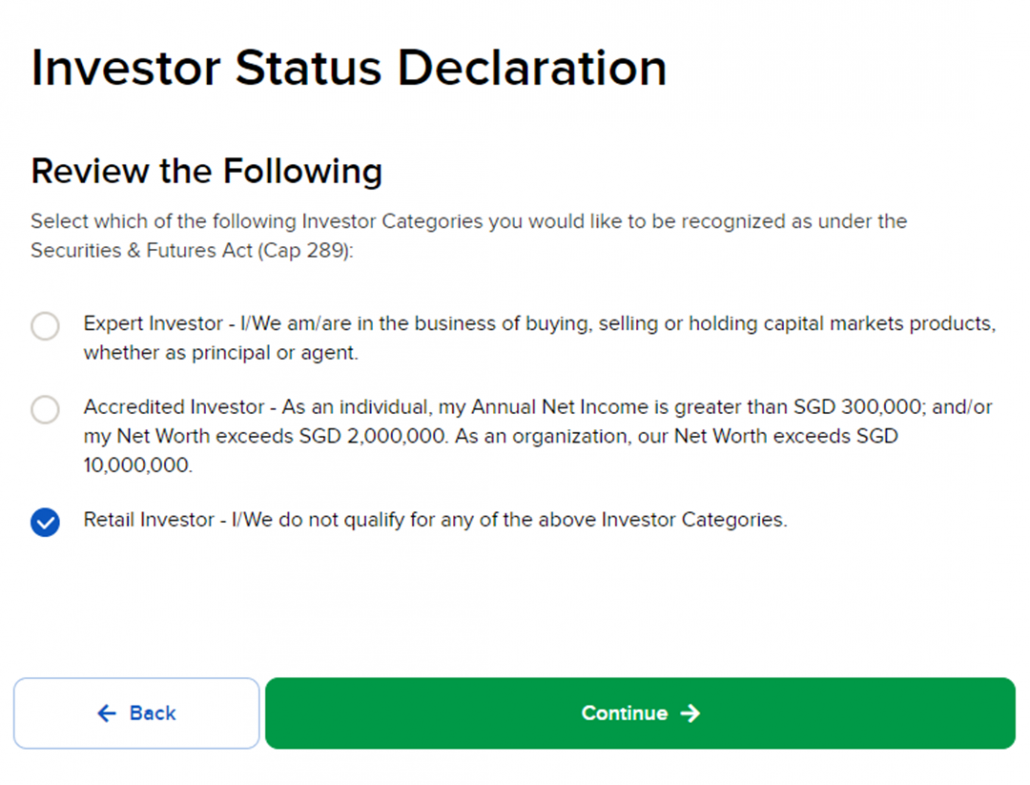

16. Select the relevant option that applies to you.

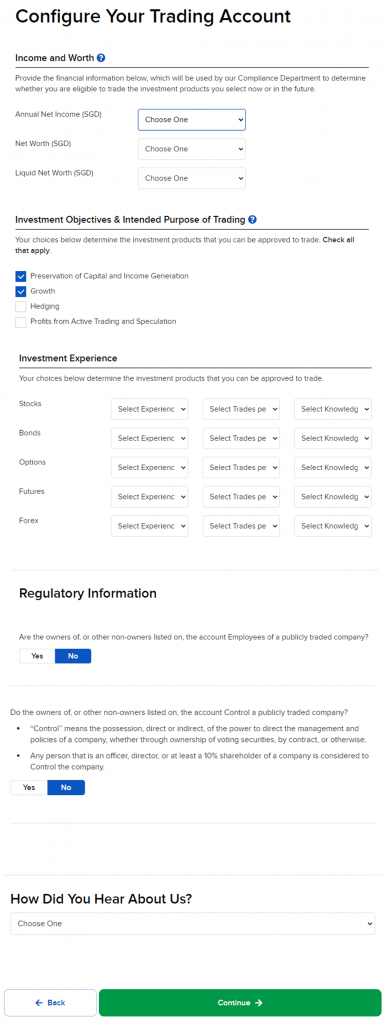

17. Fill up the relevant information. Take note of the investment experience that you will be declaring as some products will not be available to you if you declare that you have little to no experience.

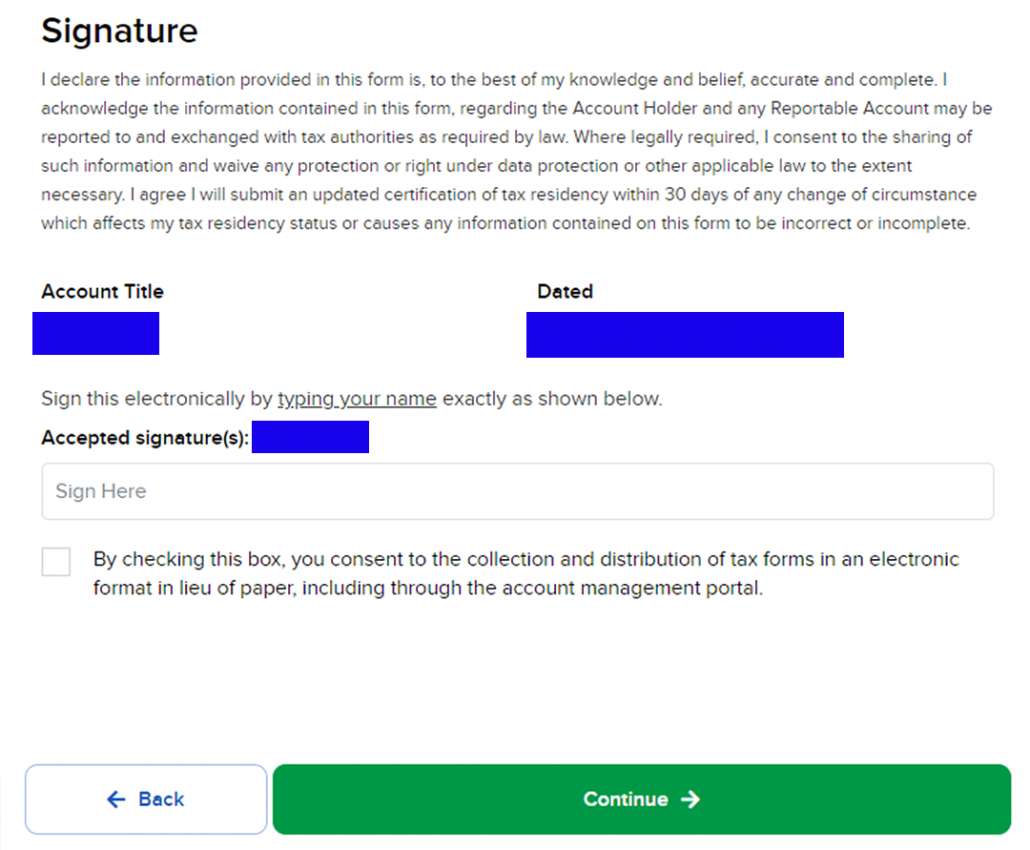

18. Review your tax residence information. Once you have finalize it, sign and click “Continue”.

19. Review the complete information as what you have filled from the earlier steps. Once you have finalized, sign and click “Continue”. The application is then processed.

20. You will then proceed to upload and submit your relevant documents online to IBKR.

21. Wait for IBKR to approve your application. In the meantime, IBKR will request certain documents from you if they are missing or incomplete.

22. Once your account is approved, you will receive an email from IBKR. Congratulations!

If you found this guide useful, you might also want to check out our full list of guides for Interactive Brokers!

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.