For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

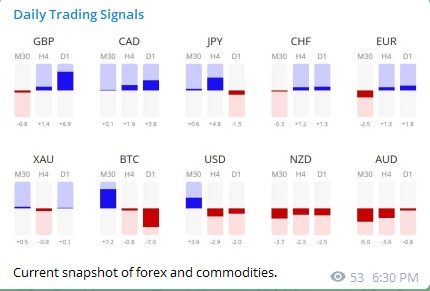

Forex Market Highlights

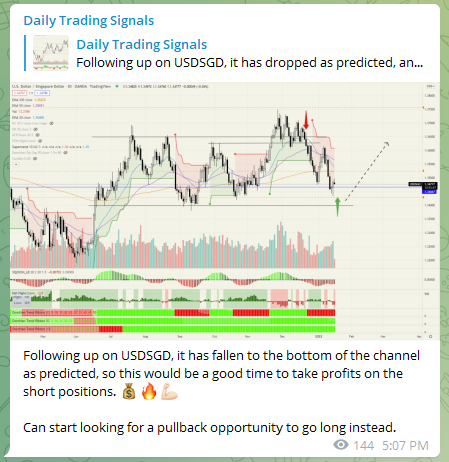

Following up on USDSGD, it has fallen to the bottom of the channel as predicted, so this would be a good time to take profits on the short positions. ????

Can start looking for a pullback opportunity to go long instead.

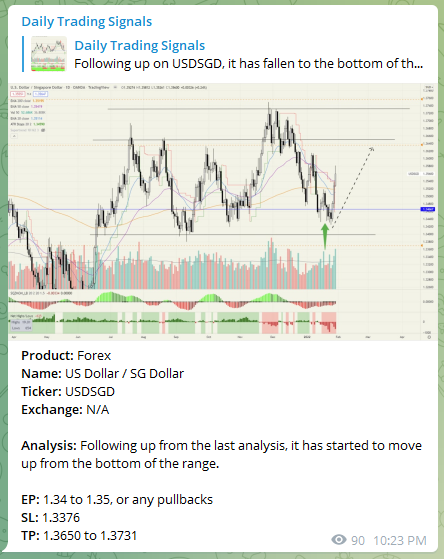

Product: Forex

Name: US Dollar / SG Dollar

Ticker: USDSGD

Exchange: N/A

Analysis: Following up from the last analysis, it has started to move up from the bottom of the range.

EP: 1.34 to 1.35, or any pullbacks

SL: 1.3376

TP: 1.3650 to 1.3731

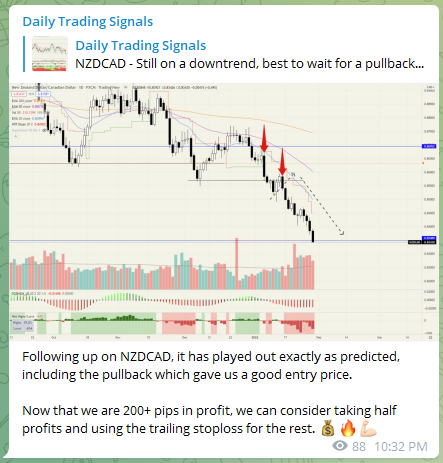

Following up on NZDCAD, it has played out exactly as predicted, including the pullback which gave us a good entry price.

Now that we are 200+ pips in profit, we can consider taking half profits and using the trailing stoploss for the rest. ????

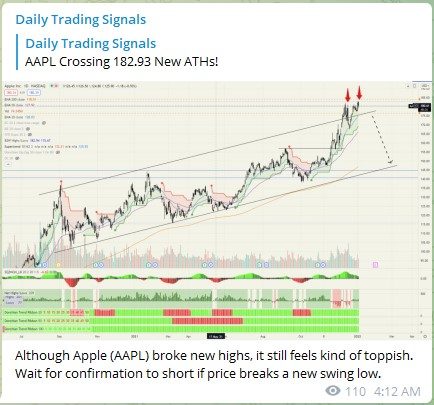

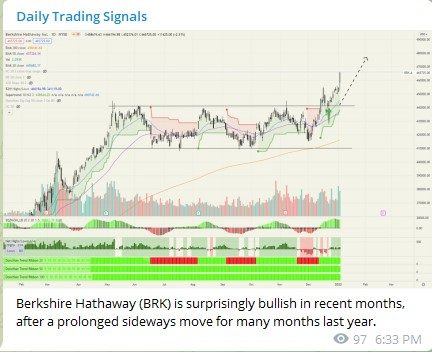

Stock Market Highlights

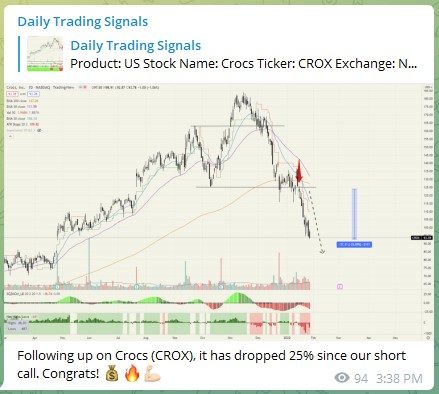

Following up on Crocs (CROX), it has dropped 25% since our short call. Congrats! ????

Following up on Advanced Micro Devices (AMD), it has dropped 22% and hit our TP zone. Congrats! ????

Product: US Stock ETF

Name: ARK Genomic Revolution ETF

Ticker: ARKG

Exchange: NYSE

Analysis: This is a long-term investment idea, to accumulate cheap assets that have fallen a lot. Be prepared to hold for years.

EP: $33 to $44

SL: N/A

TP: $60+++

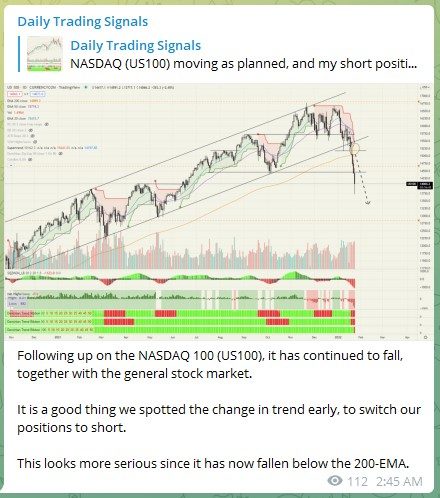

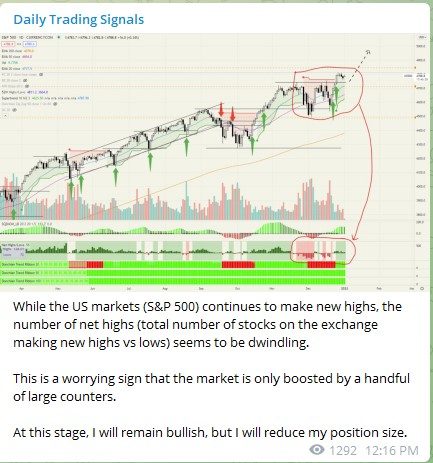

Following up on the NASDAQ 100 (US100), it has continued to fall, together with the general stock market.

It is a good thing we spotted the change in trend early, to switch our positions to short.

This looks more serious since it has now fallen below the 200-EMA.

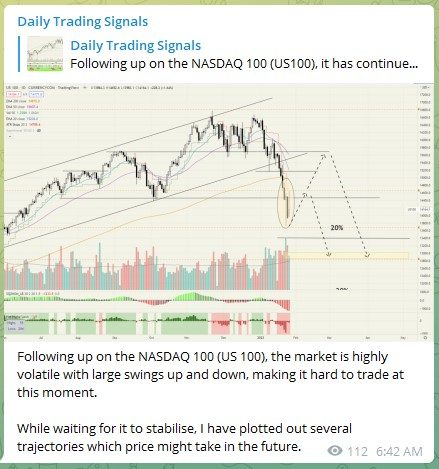

Following up on the NASDAQ 100 (US 100), the market is highly volatile with large swings up and down, making it hard to trade at this moment.

While waiting for it to stabilise, I have plotted out several trajectories which price might take in the future.

Following up on Nvidia (NVDA), it has clocked about +25% profit since our entry, so this might be a good place to take profits and wait for a pullback. ????

Following up on Snap (SNAP), it has plunged an incredible 41% since our short call. Ka-ching! ????

With the recent crash of the stock market, especially high growth tech stocks, it is possible that high growth tech might be oversold relative to the rest of the market. I have started to accumulated some for my long-term portfolio, while shorting the NASDAQ 100 to act as a hedge.

The key is to look for good stocks that have fallen by 60-70%, if you plan to buy them for investment, or keep an eye on those which are still falling.

Here are some counters I am monitoring, and I will be posting individual charts/analysis of them when the time is right. Some I have already highlighted a few times, such as … and … .

For individual counters, we can look at … .

Crypto Market Highlights

Following up on Axie Infinity (AXS), it is down about 46% since our short call. Congrats! ????

Product: Cryptocurrency

Name: Ethereum

Ticker: ETHUSD

Exchange: N/A

Analysis: After correcting more than 50% from its ATHs, we can try to do a bit of bottom-picking. This is somewhat of a higher risk trade, so take a smaller position size. Also suitable for people looking to accumulate some for long-term investment.

EP: 2000 to 2300

SL: 1900

TP: 4000+

Product: Cryptocurrency

Name: Bitcoin

Ticker: BTCUSD

Exchange: N/A

Analysis: The past few days have seen muted price action, with small bars and long shadows, signifying uncertainty.

Since the trend is currently bearish, if there are no positive catalysts, price much continue to fall again.

Prices are near the top of the trend channel, so this might be a good low-risk shorting opportunity.

EP: $37288 to $39158

SL: $39820

TP: $33977 to $30275

Good luck, and may next week bring more excellent profits!

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.