Weekly Market Wrap: Time to Buy Bonds?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, the stock market continued to fall, so we continued to hold onto our short positions. I am not sure how much more it will fall, so I will just use a trailing stoploss to lock in profits as it continues to fall.

We also decided to add some long-term bond positions, since bond prices have dropped significantly, and we profited from our shorts on the way down.

Crypto remains a wild card, so I am holding a small position (with lots of cash on the side to add more later on), while waiting for a clearer bullish sign to appear.

Overall, we are thankful our portfolio is positive for this year, given the many wild fluctuations in various markets. This is the importance of diversified portfolio allocation, and not putting all your eggs into one basket (one asset class).

[Photo: Tugela Falls, South Africa – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Portfolio Highlights

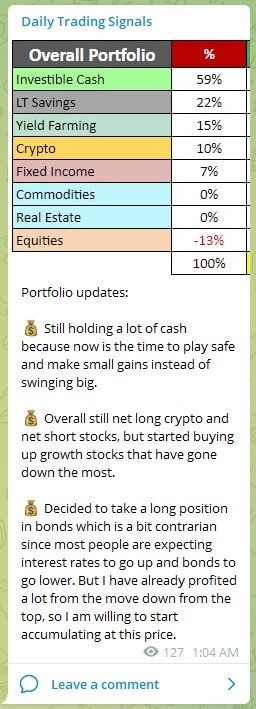

Portfolio updates:

? Still holding a lot of cash because now is the time to play safe and make small gains instead of swinging big.

? Overall still net long crypto and net short stocks, but started buying up growth stocks that have gone down the most.

? Decided to take a long position in bonds which is a bit contrarian since most people are expecting interest rates to go up and bonds to go lower. But I have already profited a lot from the move down from the top, so I am willing to start accumulating at this price.

Forex & Commodities Market Highlights

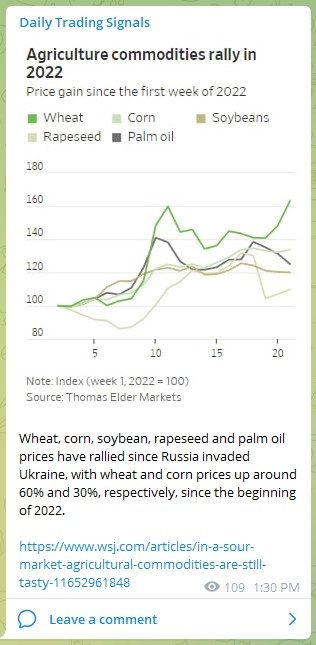

Wheat, corn, soybean, rapeseed and palm oil prices have rallied since Russia invaded Ukraine, with wheat and corn prices up around 60% and 30%, respectively, since the beginning of 2022.

https://www.wsj.com/articles/in-a-sour-market-agricultural-commodities-are-still-tasty-11652961848

Product: Commodity Index Fund

Name: Teucrium Wheat Fund

Ticker: WEAT

Exchange: NYSE

“The Fund is an actively managed, long only, diversified agricultural ETF that provides futures price exposure to corn, wheat, soybean, and sugar markets.”

Analysis: Looking at the long-term weekly charts, the ongoing war and inflation has driven prices up.

EP: $11 to $13

SL: $10

TP: $17+

Stock & Bond Market Highlights

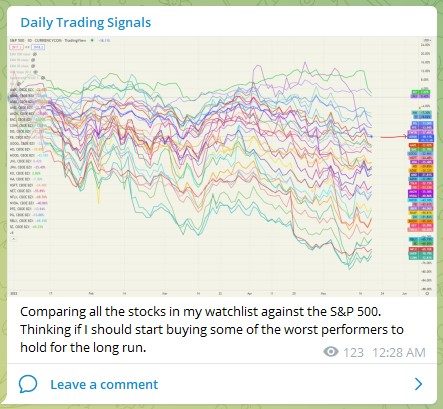

Comparing all the stocks in my watchlist against the S&P 500. Thinking if I should start buying some of the worst performers to hold for the long run.

Comparing the various stock sectors within the US stock market, from top to bottom:

XLE = energy (+47.53%)

XLU = utilities

XLP = consumer staples

XLB = materials

XLV = healthcare

XLI = industrial

XLF = financial

US500 = S&P 500 (-18.13%)

XLRE = real estate

XLK = technology

XLC = communication services

XLY = consumer discretionary

XBI = biotech (-38.94%)

Eight companies are to blame for nearly half the stock market’s decline this year—and the pain doesn’t end there.

https://www.wsj.com/articles/stock-market-is-top-heavy-but-carnage-is-widespread-11652935180

Product: Bond ETF

Name: ishares 20+ Year Treasury Bond ETF

Ticker: TLT

Exchange: NASDAQ

Analysis: Looking at the long-term weekly charts, it has dipped into the oversold area on the RSI, which suggests at least a medium-term rebound.

Further interest rate increases are generally bearish for bonds, but it is hard to say how much “predicted increase” has already been priced in.

EP: Current price

SL: $112

TP: $145+

Product: US Stock

Name: Twitter

Ticker: TWTR

Exchange: NYSE

Analysis: Keeping an eye on this to see if the deal goes through.

Price is in a downward sloping channel.

The original offer price was $54.20, making the current price about a 30% discount. (if the deal does go through and at the original price.)

Crypto Market Highlights

Best yields in the crypto bear market

https://newsletter.banklesshq.com/p/best-yields-in-the-crypto-bear-market

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!