The random walk theory, which started off from academic offshoots, put forth the idea that one should give up trying to predict or beat the markets because it was impossible to do so. In theory, this theory sounds plausible, but in practice, financial history has proven otherwise, with both investors and traders consistently beating the markets.

The random walk theory states that price history is not a reliable indicator of future price direction because price changes are “serially independent”. In other words, there is no definable relationship between the direction of price movement from one day to the next. This does not mean that prices meander aimlessly or irrationally, but it means that prices have no patterns of order within the chaos.

We know that prices are determined by a balance between supply and demand. Random walk theory asserts that prices reach that equilibrium level in an unpredictable manner, moving in an irregular response to the latest information or news release. New information, being unpredictable in content, timing and importance, is therefore random in nature. Consequently, the theory puts forth that price changes themselves are random.

Try this interesting optical illusion:

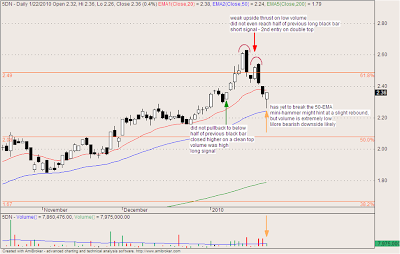

While price changes might seem random in nature, the trend of prices themselves are not. In reality, price movements contain well-known components of trend, seasonality and cycles which are not random in nature. Although these are mostly clear when prices are considered over the long-term, if one observes prices very closely in the short-run, price trends or patterns are also readily recognisable.

Technical analysis and chart-reading analyses the impact and action of market participants in response to the latest news or information. As a result, it is possible to understand what the different market participants are doing, and which way the market is likely to trend next. Besides, the market is not perfectly efficient, and reading the actions of the smart money will often alert traders to what is happening in the markets.

“The illusion of randomness gradually disappears as the skill in chart reading improves.” – John Murphy