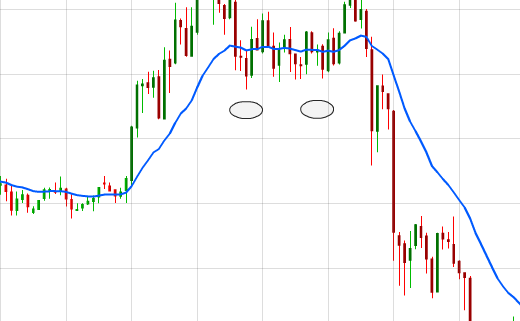

After the inverted H&S breakout, the EUR/USD has trended up strongly, going past my original first target of 1.26, and even reaching 1.28. From here, I am bullish in the medium-term, and will continue to trail my stops to maximise my profits. Prices may head down to test the head of of the inverted H&S before heading to make new highs, or it may just pullback to the area of the EMA. Either way, I am expecting bullishness.

https://synapsetrading.com/eurusd-holding-longs/

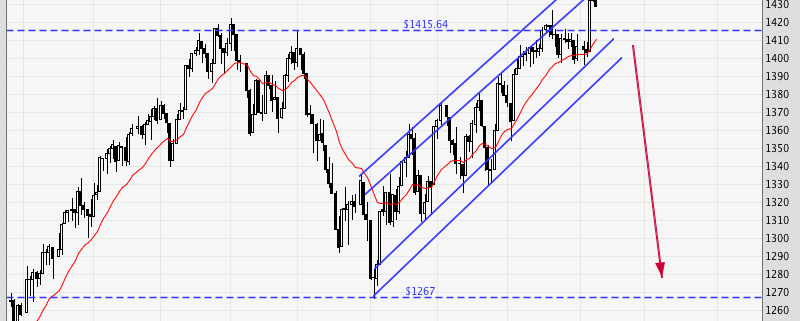

Looking at the 2 key US indices, they have remained largely unchanged since 2 weeks ago when I last looked at them. Interestingly, the S&P 500 has broke slightly above its previous swing high, but the Dow Jones is still unable to break up. Overall, I am still bearish, and I am looking for a setup to go short. Aggressive players would have already started accumulating shorts, since the R/R is very favourable.

Markets are likely to remain flat till the next major news catalyst, which is likely to be the next FOMC meeting later this month. (http://www.federalreserve.gov/monetarypolicy/fomccalendars.htm). Since the US elections are going to be held in November this year, it is likely that the govt will find ways to prop up the market till then, either through promises of QE3, or by playing up positive economic data.

Yesterday, I attended the Shares Investment Conference, and here are some insights I got from the talks, as well as from chatting up the speakers during the private VVIP lunch session.

Insights from Jim Rogers

Jim Rogers is a very charismatic speaker, sharing not only market wisdom, but also wisdom on living life to the fullest. He had tons of interesting travel stories to share (especially since he travelled around the world).

He is bearish on the US and European markets, for obvious reasons, at least throughout 2013 and 2014. He also talked about a possible bond bubble in the forming, especially in the longer term.

For his portfolio, he is short on US stocks, and has large holdings in Singapore stocks. He is also buying up china stocks (during a crash), expecting a long-term bull for China, at the same time also accumulating the RMB. Other up-and-coming investments include Myanmar and N. Korea, which are starting to show some signs of opening up.

His most bullish sentiments lie in the commodities sector, especially in the area of agriculture. He spoke of cycles of supply and demand for these markets, such as natural resources, land, and commodities. Hence this new cycle is expected to usher in a new era of prosperity for farmers. If one is interested to invest in US real estate, he recommends areas like Iowa and Texas.

On a non market-related note, Jim says that the most important thing is to find your passion in life and do it, then you will never have to work a single day in your life. Trust your heart, and don’t let others discourage you. He ends off by suggesting that investors study philosophy and history, the former to teach us how to think, and the latter to help us draw from the past to cope in a world that is ever-changing.

Insights from Mike Bellafiore

Mike is a famous proprietary trader in New York, and the trading firm he started, SMB Capital, is now one of the top trading firms in New York. He was featured in the famous TV series, Wallstreet Warriors.

Mike started off the talk by stating upfront that there is no need to predict the market in order to make money. He said that many professional when asked will not be able to give a view on the market, simply because it is not necessary to have a view on the market to make money.

When training his new traders, he tells them not to dwell on a losing trade, and instead focus more on the winning trades. One should not celebrate a trade simply because one has made money on it. One should be asking “could I have made more on this trade? Did I manage the trade well such that I got the most out of it?”

When asked about his views on high-frequency trading (HFT), he said that it resulted in more whipsaws, and stops getting taken out more frequently, but the way to go around that was to be ready to re-enter a position upon getting stopped out, and using a time filter to aid in this decision-making.

Someone in the audience asked him what parameters he used for his indicators, to which he replied that he preferred not to use indicators at all. This got me sitting up in my seat, because I had been telling my students the same thing. He said that newbies tended to get bogged down by indicators, but professional prefer to use a blank chart to read the psychology of the market. In fact, the messier one’s chart is, the more likely he has no idea what he is doing.

Over lunch, he shared with me some useful tips on starting a trading firm, and I am very grateful that he is willing to share his experience so generously. Overall, I had a great time at this conference, and I would like to thank the speakers and organisers for the great insights and excellent lunch!

Tomorrow, I will be going starting my ICT (army reservist) as part of the advance party, hence I will be going in on Friday morning and will then spend the next 2 weeks there as well.

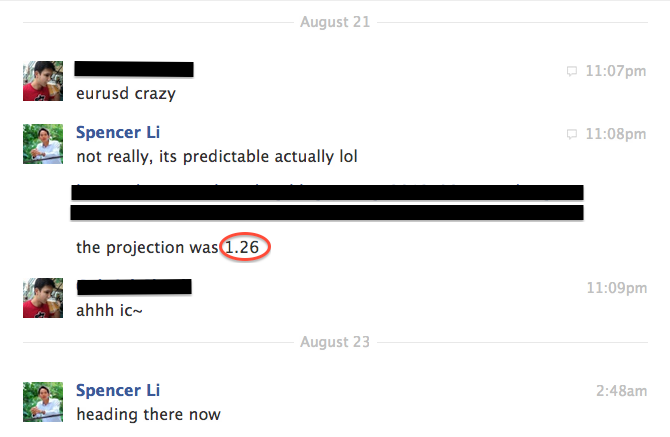

I have liquidated all my stock holdings, and I am only holding on to my EUR/USD longs, which I have been accumulating since it was 1.24. I am expecting a minimum target of 1.26, based on a rough pattern projection.

It could go much higher than that, I’ll see when I get back.

I’m not kidding, there really is such a pattern.

The Batman pattern, or Batman’s cowl, is aptly named after the shape of the helmet donned by the said superhero. Some say that it is a variant of the double top pattern, and can be traded the same way.

On a sidenote, this dark knight did stage a strong rise later in the US session, retracing the drop during the Europe session and heading to test the previous swing high.

Latest Blog Posts

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm

Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

Contact Us

Synapse Trading Pte Ltd

Registration No. 201316168H

FB Messenger: synapsetrading

Telegram: @iamrecneps

Email: info@synapsetrading.com

Disclaimer

Privacy policy

Terms & Conditions

Contact us (main)

Partnerships