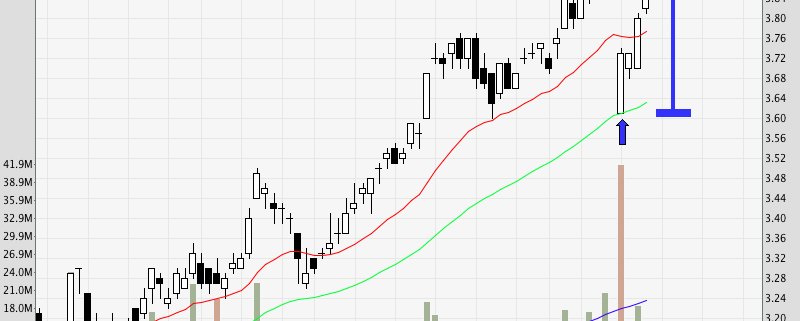

Last Saturday, I conducted a market outlook seminar for 2013, sharing how to read charts using behavioral analysis and how to identify the 4 major behavior patterns. This was done on-the-spot using real examples, and without using any indicators or special software.

Due to space constraints, we were only able to accomodate 50 people, so I will try to organise another session as soon as possible for those who missed out. For those who already went for this seminar, please do not sign up for the next one and give others a chance.

For those keen on the next seminar, kindly sign-up for our mailing list and reply quickly once you receive the invitation (usually sent about a week before the event). The seats for this seminar were filled within a few hours, so it is best to reserve early.

Feedback

“Articulated insights on trading, my key takeaways are the 4 major patterns of market behaviour, and the distribution/accumulation phases which appear as low price volatility on price charts. I think it’s great – no use of jargons at all! The speaker is soft-spoken and not “showy” as compared to other speakers.”

– Howard

“Very comprehensive, covers a lot of ground. There is a lot more focus on behavioral analysis and price action then other courses. Now, I have a lot more awareness of how price may reflect behaviour of big players.”

– GH (Student, 3 years experience)

“This workshop is informative and updated, and the speaker is good, friendly and open.”

– Valerie (Student, NTU, <1 year experience)

“Very informative and sincere, focused on trading psychology. Now I see markets as a form of psychological warfare.”

– Adrian Tan (Student, NTU, <1 year)

“Spencer is very keen to teach and is sincere in what he wants to do. This course is different because it uses less charts, and more psychology & behaviour of buyers and sellers. It is less technical, and more interesting & suits my cup of tea.”

– Maween (4 years experience)

“This a clear presentation by the speaker, with heavy focus on the behavioral side. Spencer is modest and willing to share. Very modest in marketing his program.”

– Yap BT (IT Sector)

“This workshop is different because it combines TA & mind analysis. I learnt how to ride the trend to maximise profit. ”

– Darren

“Provides a concise overview of a broad sample of markets. This changed the way I see the markets. My key take-away is the concept of market behaviour.”

– Daniel (Sales, 3 years experience)

“The workshop is informative and provides a good overview of the market. This speaker sounds genuine.”

– Helmy Hamzar (3 years experience)

“The workshop is informative, structured, concise and realistic.”

– Gary Koh (7 years experience)

“Insightful and factual interaction.”

– Bennie Yeo (HR)

“The thing I liked best about this workshop is the real examples. The main difference is that there are no indicators, and simple to understand. My key take-away is that behavioral/psychology is key. The speaker is experienced.”

– Ng Guang Jie (Student, <1 year experience)

“This changes the way I see markets by giving me some more insight to the market play. Very good for beginners.”

– Ng Chin Huat (Exxon Mobil, 1 year experience)

“This method is practical, simple and clear. My key take-away is the 4 major price behavior patterns – BSBT. The speaker is knowledgeable and experience. Looking forward to mor seminars in the future.”

– MiKuan (Clerk, 5 years of experience)

“Wide coverage, speaker is humble and articulate. This method is different from those out there as it covers behavioral analysis. One key take-away is that markets could potentially be at their last leg.”

– Tang Poh Sheng (Optimal online marketing Pte Ltd)