Weekly Market Wrap: Everything is on a Bull Run this Christmas!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

As 2023 comes to a close, the markets have seen a year marked by significant events and trends, shaping up to be a year of recovery and resilience.

The year started and ended with strong rallies, overshadowing the spring’s regional bank crisis and fall’s concerns about rising interest rates. The middle of the year witnessed a robust summer rally, driven by a surprisingly resilient economy.

This resulted in equities delivering double-digit gains and a remarkable comeback for bonds. As we look back, 2023 stands as a testament to the benefits of a disciplined investment strategy and the value of seizing opportunities during market lows.

In the stock market, the S&P 500 experienced an impressive eight-week winning streak, a rare occurrence in the past 50 years. This rebound, particularly remarkable after the fall’s pressures due to surging interest rates, highlights the market’s dynamic nature where rapid shifts from loss to gain can occur.

Despite expectations for a quiet holiday week, the market’s momentum might carry this winning streak further. However, a pause is likely as we transition into 2024, awaiting new economic and inflation data.

While this winning phase will eventually end, the broader bull market’s end doesn’t seem imminent, reinforcing the importance of long-term strategy in investment.

This week, despite being shortened by the Christmas holiday, could still offer significant market movements. Investors are anticipating a potential “Santa Claus rally” to end the year on a strong note.

The bond markets will wrap up early at 2 p.m. on Friday, December 29.

Key economic data releases are few but noteworthy, focusing on the U.S. housing market. The S&P Case-Shiller Home Price Index and the National Association of Realtors’ pending home sales data are due, along with weekly initial jobless claims, inventory, and trade balance information.

Additionally, the holiday sales season continues, with retailers expected to offer substantial discounts to clear inventories.

Housing market data will be a focal point with the S&P Case-Shiller Home Price Index set for release, potentially shedding light on housing affordability trends.

Thursday’s pending home sales data from NAR is also anticipated, following an increase in existing home sales in November.

These reports come amidst growing homebuilder confidence. Meanwhile, the possibility of a “Santa Claus rally” looms, a phenomenon where the S&P 500 historically gains during the final days of the year and the start of the new year.

This trend, though not guaranteed, is often attributed to factors like holiday shopping, seasonal optimism, and institutional investors balancing their books.

Daily Trading Signals (Highlights)

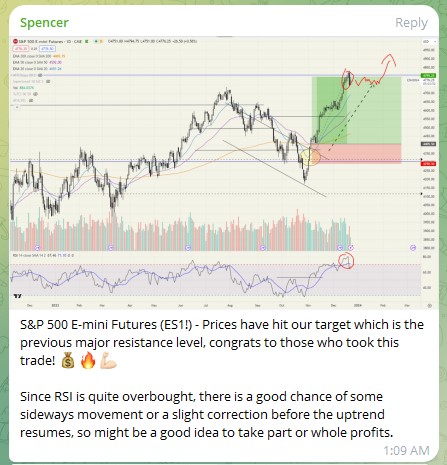

S&P 500 E-mini Futures (ES1!) – Prices have hit our target which is the previous major resistance level, congrats to those who took this trade! 👏🔥📈

Since RSI is quite overbought, there is a good chance of some sideways movement or a slight correction before the uptrend resumes, so might be a good idea to take part or whole profits.

US 20+ yr Treasury Bond ETF (TLT) – Following up on this, prices have gone up an impressive 21.94% since the October bottom just 2+ months ago.

Congrats to those who took this position! 😎🔥💪

Going forward, since rate cuts are expected to start in 2024, I foresee some consolidation (now overbought on RSI) before breaking past $100 and to $105.

Solana (SOL) – Did not expect Solana to hit my target so fast, already up +50% profit from our buy price! 😎🔥💪

Revised the target upwards because it looks like the early stages of a bull trend.

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!