Weekly Market Wrap: Is Crypto Nearing the Bottom Soon?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last weekly, there was a lot of focus on the crypto markets, with a slew of bad news, such as the cascading effects of the TerraUSD and Luna crash, Celsius suspending withdrawals, and 3AC capital going under, etc.

These provided good trading opportunities to short crypto and make quick profits, but as the market reaches maximum fear, it could also be a buying opportunity for long-term investors, since crypto is down roughly 75% from all-time highs.

With the Fed aggressively raising interest rates, it has also caused bond and stock prices to continue trending downwards.

I am currently net short on stocks pretty heavily, and will be posting again when I close my shorts and start accumulating for the long run.

Stay tuned in the “Daily Trading Alerts” Telegram channel!

[Photo: Death Valley National Park, California, USA – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Forex & Commodities Market Highlights

Only thing positive is USD/SGD. That’s why I’m holding mostly cash in USD. ??

GBPCAD Crossing 1.59140

British Pound vs. Canadian Dollar

SL for short positions

Stock & Bond Market Highlights

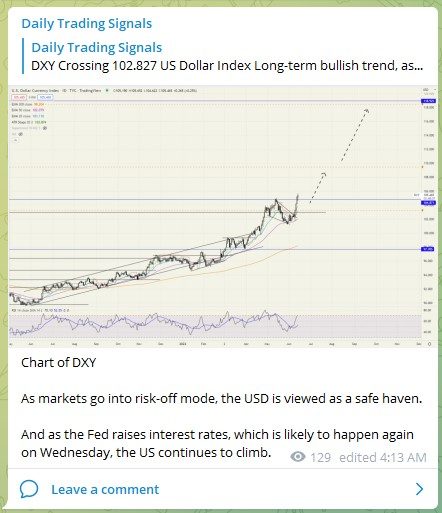

DXY Crossing 102.827

US Dollar Index

Long-term bullish trend, as US raises interest rates

SL: 103.265

TP1: 109.472

TP2: 118.474

As markets go into risk-off mode, the USD is viewed as a safe haven.

And as the Fed raises interest rates, which is likely to happen again on Wednesday, the US continues to climb.

US100 Crossing 11546.1

NASDAQ 100 Index

TP1 for short positions

TP1 hit for US100, waiting for TP2, but watch out for sharp counter-trend rallies!

PPA Crossing 67.03

Aerospace & Defense ETF

Break swing low

SL: 69.51

TP1: 64.34

TP2: 59.32

REET Crossing 23.50

iShares Global REIT ETF

TP for short positions

Congrats on hitting the TP, will wait for another pullback to short again! ????

US500 Crossing 3798.3

S&P 500 Index

Break swing low

SL: 3991.6

TP1: 3547.5

TP2: 3279.7

Product: Index (Measuring Fear)

Name: Volatility S&P 500 Index

Ticker: VIX

Exchange: N/A

Analysis: Historically, the market reaches a bottom once fear has reached a peak.

The VIX is a measure of fear, and as a rough estimate, the market tends to bottom once it reaches 45.

Only twice the fear was so intense that it reached over 80.

I have set alerts for these 2 levels so we will know when it happens.

Crypto Market Highlights

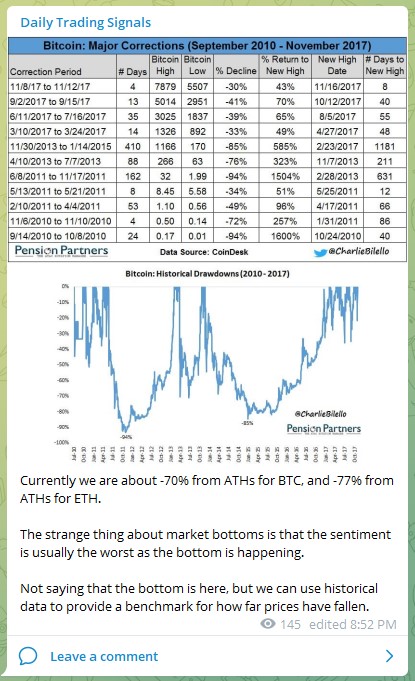

Currently we are about -70% from ATHs for BTC, and -77% from ATHs for ETH.

The strange thing about market bottoms is that the sentiment is usually the worst as the bottom is happening.

Not saying that the bottom is here, but we can use historical data to provide a benchmark for how far prices have fallen.

https://www.channelnewsasia.com/business/crypto-firm-celsius-pauses-all-transfers-withdrawals-markets-tumble-2743226

High volume sell-down on Ethereum (ETHUSD) today, trend is still bearish but high chance of a rebound based on observation of past instance of high volume spikes.

ETHUSD Crossing 1434.11

TP for short positions

A quick and clean short-term trade on ETHUSD! ????

Now it is most likely very oversold, so let’s watch for the rebound first.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!