Weekly Market Wrap: Has the Stock Market Bottomed?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, we saw a continuation of the existing trends, but since these trends have been running for quite a while, it is likely we will have a short-term rebound, even if the longer-term trends remain intact.

We saw weakness in the USD, and strength in commodities like good, oil, agriculture, etc. This is in line with the inflationary pressures we have been observing.

The most interesting thing is the rebound in stock prices, but it is likely only temporary before the major downtrend continues.

Crypto markets are facing huge weakness after the Luna/UST saga, and have somewhat decoupled from stocks for the last week.

[Photo: Seljalandsfoss, Hvolsvöllur, Iceland – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Forex & Commodities Market Highlights

Currencies strength update

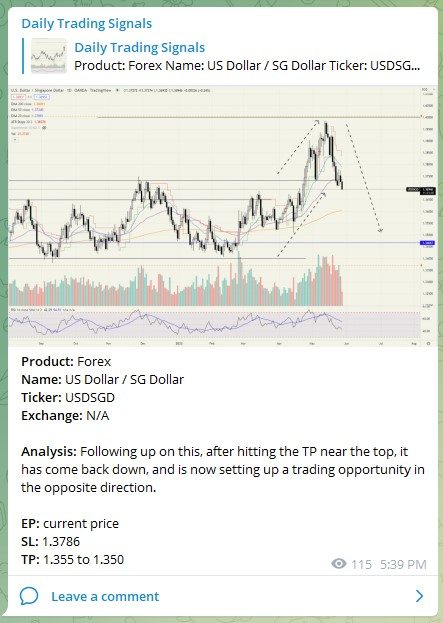

Product: Forex

Name: US Dollar / SG Dollar

Ticker: USDSGD

Exchange: N/A

Analysis: Following up on this, after hitting the TP near the top, it has come back down, and is now setting up a trading opportunity in the opposite direction.

EP: current price

SL: 1.3786

TP: 1.355 to 1.350

Product: Commodities

Name: Crude Oil

Ticker: WTIUSD

Exchange: N/A

Analysis: With the decrease in supply due to the Russian-Ukraine war, oil prices are steadily heading up after the initial spike. It is possible that it could test new highs.

EP: current price, or on pullbacks

SL: $110

TP: $130, or new highs!

Product: Commodities

Name: Gold (spot)

Ticker: XAUUSD

Exchange: N/A

Analysis: With the USD falling and markets facing uncertainty, this could be bullish for gold.

EP: current price

SL: $1835

TP: $1905, $1990, $2060

Stock & Bond Market Highlights

https://www.wsj.com/articles/investors-dare-to-dip-back-into-bonds-11653080577

“Here [in Davos] everybody’s pessimistic,” says Standard Chartered Chairman José Viñals. “But when I ask them how their business is doing, the picture is wonderful. It may be that the business reality catches up with the [very negative] macro-political reality.”

Product: US Stock Index

Name: NASDAQ 100

Ticker: US100

Exchange: N/A

Analysis: Updating the trade parameters since the previous TP has already been hit.

Prices are having a small rebound but there is still a higher chance of prices going down further after the rebound.

So far, NASDAQ has corrected 30% from ATHs while S&P 500 has corrected 20%. That is still very small compared to the run up for the past 10-20 years.

EP: Current price, or on pullbacks

SL: $12750

TP: $11540, $11000

Crypto Market Highlights

Product: Cryptocurrency

Name: Ethereum

Ticker: ETHUSD

Exchange: N/A

Analysis: Following up, Ethereum is now at the critical price level. Our trade call remains the same.

If prices break below this level, then it will be quite dangerous. The overall price pattern does not look that bullish.

On the other hand, when we look at the long-term weekly chart, we can see 8 consecutive weeks of price decline, which suggests at least a potential technical rebound.

The weekly 200-EMA also provides some potential support. The weekly RSI is also very near the oversold zone.

In short, the trend is uncertain but there is a high chance of a rebound in the short/medium-term.

EP: Current price

SL: $1650

TP: $2600+

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!