Weekly Market Wrap: Full Portfolio Updates & Strategy

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

With various financial markets in the decline, we are now in “risk-off” mode, and the key idea is to play defensive, not offensive.

In this week’s special edition, I have done a comprehensive comparative analysis of various asset classes, as well as various stock sectors, to see which are the leaders and laggards.

And most importantly, I have also shared my full current portfolio allocation, and my strategic reasons for such an approach.

So far, it has worked pretty well, giving me a YTD positive return, while most financial markets are in the red.

[Photo: Brod, Kosovo – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Portfolio Highlights

Currently, this is quite a defensive portfolio given the current market conditions, and had managed to stay positive even as most markets have crashed this year.

? Bulk of returns come from yield farming, which gives about 60% returns.

? About 44% is in cash, which is ready to be deployed once the crash is over and the dust has settled.

? Still bullish on crypto and commodities in the long term.

? Net short on stocks since they are currently in a downtrend. As stocks continue to fall, I will reduce the commodities allocation as well, because it will be the next in line to fall.

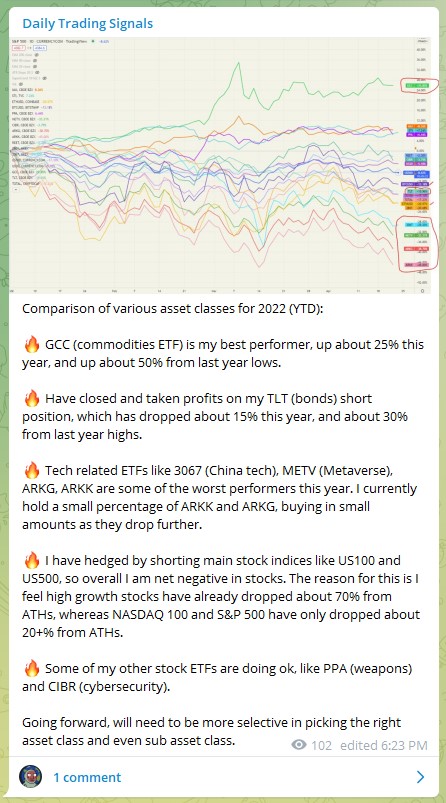

Comparison of various asset classes for 2022 (YTD):

? GCC (commodities ETF) is my best performer, up about 25% this year, and up about 50% from last year lows.

? Have closed and taken profits on my TLT (bonds) short position, which has dropped about 15% this year, and about 30% from last year highs.

? Tech related ETFs like 3067 (China tech), METV (Metaverse), ARKG, ARKK are some of the worst performers this year. I currently hold a small percentage of ARKK and ARKG, buying in small amounts as they drop further.

? I have hedged by shorting main stock indices like US100 and US500, so overall I am net negative in stocks. The reason for this is I feel high growth stocks have already dropped about 70% from ATHs, whereas NASDAQ 100 and S&P 500 have only dropped about 20+% from ATHs.

? Some of my other stock ETFs are doing ok, like PPA (weapons) and CIBR (cybersecurity).

Going forward, will need to be more selective in picking the right asset class and even sub asset class.

Forex Market Highlights

With stock markets crashing, it is now back to “risk-on” mode, where flight to safety to gold and USD occurs. (Correction: Should be “risk-off” mode.)

Commodities Market Highlights

Following up on GCC, it has broken out of the symmetrical triangle and started to head up.

Stock & Bond Market Highlights

Comparing the various stock sectors within the US stock market, from top to bottom:

XLE = energy (+37.81%)

XLU = utilities

XLP = consumer staples

XLB = materials

XLV = healthcare

XLRE = real estate

XLI = industrial

XLF = financial

US500 = S&P 500

XLY = consumer discretionary

XLK = technology

XLC = communication services

XBI = biotech (-29.70%)

Many stock counters have started making new lows, or are very close, such as:

– Adobe

– AMD

– Coinbase

– Disney

– Meta

– Google

– Microsoft

– Netflix

– Nvidia

– Roblox

– Sea

– Shopify

– Snap

– Snowflake

– Twilio

– Uber

– Zoom

Many of these would be good short trades, alternatively you can just short the stock indices.

On the other end, the strongest stocks on my list are:

– Apple

– Johnson & Johnson

– Coca Cola

– Mastercard

– Visa

– Tesla

Seems like the tech stocks are the ones getting slaughtered, whereas those more related to consumables or retail services are doing better.

Product: US Stock Index

Name: NASDAQ 100

Ticker: US100

Exchange: N/A

Analysis: Following up on the Nasdaq, prices have continued to fall as predicted, which is why I am currently net short on stocks.

I won’t be surprised if prices test the previous swing low or make new lows, so I won’t be going long until the strong bearish momentum comes to a stop.

EP: 14689, or on pullbacks

SL: 15311

TP: 13018+

Crypto Market Highlights

Following up on Ethereum (ETHUSD), it has pulled back to the $3000 level as predicted, and when it recently tried to break lower, price was immediately rejected and it closed back above $3000.

This is a bullish sign, and may be a good signal that the short-term trend is turning bullish, and ready to resume moving upwards.

Product: Cryptocurrency

Name: Ethereum

Ticker: ETHUSD

Exchange: N/A

Analysis: Following up, Ethereum is trading in a small range hovering around the $3000 support.

From here, I see 2 possible scenarios:

1. Break out from here and head up

2. Break down to test the $2800 level near the trendline support, before heading up.

At this point, I would still be net long, but reduce/hedge my positions slightly so that I can buy more should it dip down to $2800.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!