Market Analysis – Virus, Riots & Trade Wars

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

Some people have been thinking that nothing can bring the stock market down, because it has been steadily chugging up despite all the negative news of virus, lockdowns, unemployment, trade wars, and now riots.

So can the market continue to climb up forever? What will it take to actually bring the market down?

Join our FREE Telegram channel for daily trading tips:

?? https://t.me/synapsetrading

Table of Contents

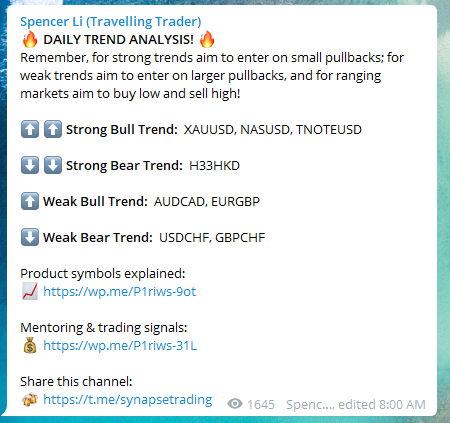

Market Overview

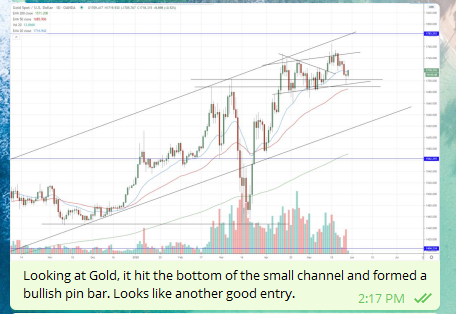

The strong bullish trending markets are Gold (XAU/USD), Nasdaq (NASUSD), and the US 10-year T-Note Futures (TNOTEUSD), which have been trending for quite a while, and our positions there have remained largely unchanged.

The most bearish market is the Hang Seng (H33HKD), which is not surprisingly since China is planning to enact more stringent national security laws, which will likely negatively impact Hong Kong’s financial markets.

Major Events

This has been a very eventful year so far, with the virus outbreaks, quarantines, job market crashing, and now the slow re-opening of the economy.

Amidst all that, the amazing thing is that the stock market is recovering much faster than the economy.

And now, tensions between US and China are stepping up, with China’s latest actions on HK and corresponding US retaliation, adding to the accusations of China covering up the virus at the start of the outbreak.

And in the US, we are seeing riots and looting, after a white cop killed a black guy in broad daylight during arrest.

US Stock Markets

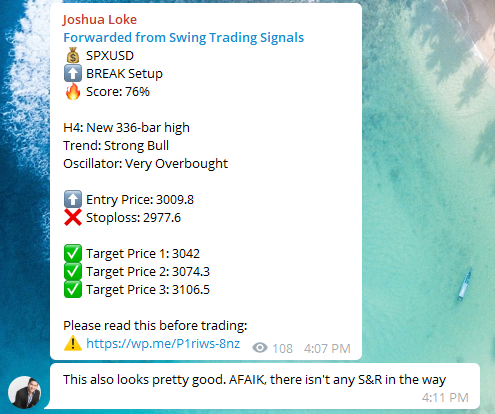

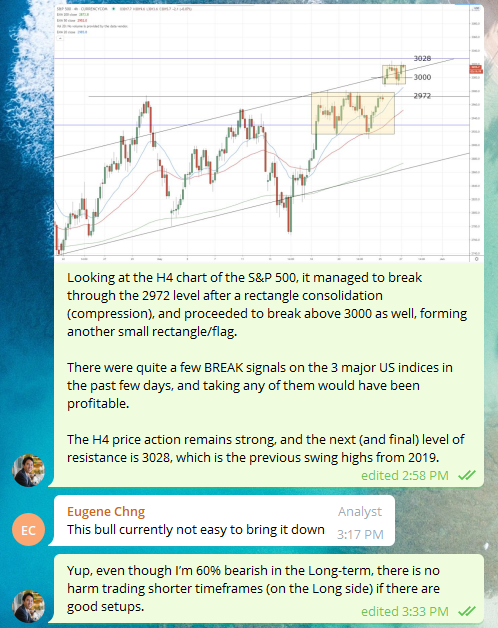

The US stock market, especially the NASDAQ, has been on steroids, thanks to the dominance of tech stocks.

In my private forum with my students, I shared a detailed analysis of the S&P 500.

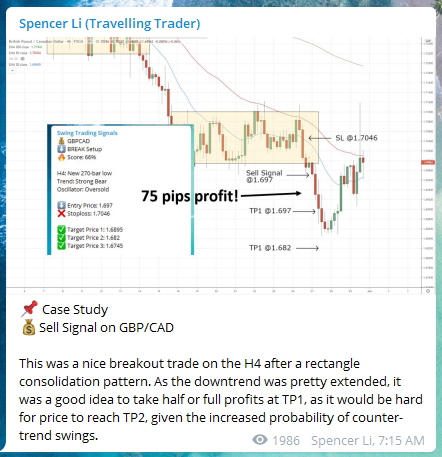

Trade Highlights

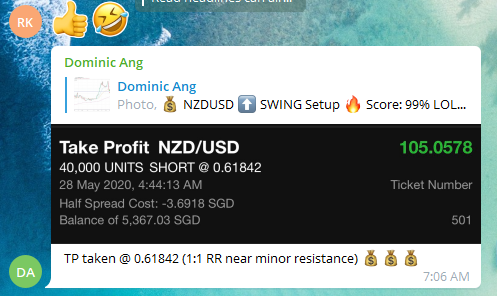

Here are some highlights and case studies of trades done on forex, commodities and CFD products, also taken from our private forum.

Join our Last & Final Skillsfuture Workshop!

Last weekend, we conducted another full-house Skillsfuture workshop, with 40 pax of new traders & investors, as well as some of my past students who sat in to help out.

So far, every intake has been a full house, which is why we expanded to 3 workshops instead of 1 originally planned, because of the overflow. But our license expires on 18 June, so this is the last and final workshop which we can hold.

This fully subsidised Skillsfuture workshop will give you the skills and roadmap to build a second source of income to plan for early financial freedom, by building an all-weather portfolio that can perform well in any market conditions, and also market timing skills to create additional cashflow from short/medium-term trades.

Date: 13 & 14 June 2020 (6pm to 10pm)

Click here to check availability:

? https://wp.me/P1riws-8OX

P.S. According to Skillsfuture regulations, the maximum intake is capped at 40 slots, so we will not be able to add new slots once all are filled up. Register early to avoid disappointment!

P.P.S. Your slot is only confirmed after you have completed payment, submitted your claims, and forwarded the confirmation screenshot to the organiser. If you did not complete the last step, your slot is still up for grabs to the next person who completes it.

? First-come, first-serve!

? See you soon! ?

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!