The January Barometer: An Accurate Predictor of Stocks for 2017?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

There are many speculations about leading indicators in the market, and one of the most popular ones is the January Barometer. In this post, we will explore this phenomenon, and see if it holds up to the test, and whether it will provide any useful insights going forward.

Table of Contents

WHAT IS THE JANUARY BAROMETER?

“As January goes, so will the market go for the year.” – Wall Street Folklore

The January barometer is a tool used to determine if the year will be bullish on the equity space. If January sees a winning month, the year would be a winning year.

January can be said to be an indicator to whether the year would be bullish or not.

This idea first emerged in the 1972 edition of Yale Hirsch’s Stock Trader’s Almanac. Here’s what was published:

“We doubt that any technique or indicator ever devised has been so remarkably accurate as the January Barometer. The barometer, which indicates that as January goes, so will the market go for the total year, has proven correct in 20 of the last 24 years…. Very few stock market indicators show such an 83.3 percent accuracy for even short spans of time.”

https://www.instagram.com/p/BPuVVnxj8Yt/?taken-by=iamrecneps

PREVIOUSLY… INVESTIGATING THE SANTA CLAUS RALLY

A couple of months back, I collected statistics for a simple ‘buy in January, sell in February’ portfolio. How it works is simple: I would purchase the stock index on 1 January, and sell it on 1 February and see the results.

Buy in January, Sell in February Statistics

2011: 4.34%

2012: 1.28%

2013: 4.55%

2014: 5.62%

2015: -0.08% — Total returns for 5 years = +15.71%!!!

Over the last 5 years, it has indeed been a great run for the ‘buy in January, sell in February’ portfolio.

This got me excited, but I decided to look further back in history…

Breaking up the time periods into 5-year chucks, here are the statistics:

5-year “Buy in January, Sell in February” Statistics

2011-2015: +15.71%

2006-2010: -8.7%

2001-2005: +0.88%

1996-2000: -6.38%

The santa claus rally didn’t really exist as claimed by most sensationalists.

This time, we want to look at whether January tells us if the year would be a winning year.

JANUARY BULL RUN = WHOLE YEAR BULL RUN?

Quantpedia has a good summary of this, and the strategy is simple: Invest in equity market in each January. Stay invested in equity markets (via ETF, fund or futures) only if January return is positive otherwise switch investments to T-Bills.

To put it more simply, there are two scenarios:

Scenario 1: January positive –> Stay invested in equities

Scenario 2: January negative –> Exit equities

The results are shocking. Quoting from a research paper titled: “What’s the Best Way to Trade Using the January Barometer?” (M. J. Cooper, J. J. McConnell, A. V. Ovtchinnikov, 2009)

“We investigated the power of the January market return to predict returns for the next 11 months using 147 years of U.S. stock market returns.

Using 147 years of U.S market data, this was the result:

We found that, on average, the 11-month holding period return following positive Januarys was significantly higher, by a wide margin, (-7.76%) than the 11-month holding period return following negative Januarys.”

This meant that on average, a year with a positive January outperformed a year with negative January by 7.76%. This is a very significant difference.

https://www.instagram.com/p/BOquPBmjdbj/?taken-by=iamrecneps

5 TRADING STRATEGIES THAT WERE RESEARCHED

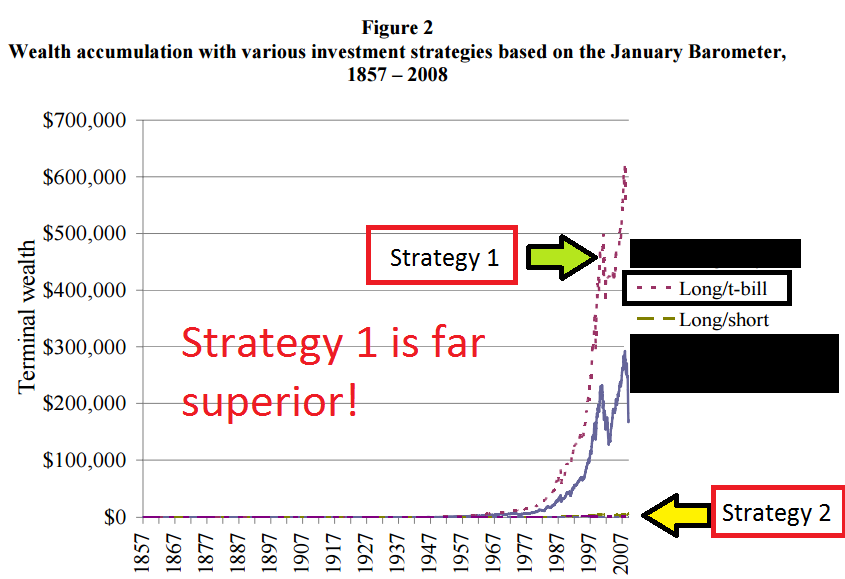

In the research paper that I mentioned above (you can read the whole paper by downloading it in the link at the bottom of this article), here are 2 strategies that can be taken knowing that January is a good predictor of the market for the rest of the 11 months:

(1) LONG/T-BILL STRATEGY

Long in Jan, continue being long if Jan is positive, but exit and go long on bonds if Jan is negative.

(2) LONG/SHORT STRATEGY

Long in Jan, continue being long if January is positive, but go short if Jan is negative.

The results for 1857 – 2008 are highlighted below:

Strategy 1 ( completely outperformed strategy 2.

Strategy 1 ( completely outperformed strategy 2.

Source: Page 21 of “What’s the Best Way to Trade Using the January Barometer?” (M. J. Cooper, J. J. McConnell, A. V. Ovtchinnikov, 2009)

In the research paper, 5 strategies were outlined, but I only cover the 2 that are relevant to our discussion.

It seems that this would be a very profitable strategy:

Firstly, buy stocks in January.

If January is positive, remain long on stocks from February to December.

If January is negative, exit stocks and go long on bonds from February to December.

In addition, the research paper also published returns for the years 1940 – 2008:

Strategy 1 completely outperformed strategy 2, even in the recent 70 years.

Source: Page 23 of “What’s the Best Way to Trade Using the January Barometer?” (M. J. Cooper, J. J. McConnell, A. V. Ovtchinnikov, 2009)

https://www.instagram.com/p/BOZFaacjNwq/?taken-by=iamrecneps

WHAT HAPPENED THIS YEAR?

The STI is up 5.5% for the month of January 2017. Going by the strategy outlined above, if you are a buy-and-hold investor, it would be wise to hold the STI until the end of 2017.

The STI is up 5.5% for the month of January 2017. Going by the strategy outlined above, if you are a buy-and-hold investor, it would be wise to hold the STI until the end of 2017.

On the contrary, for the Dow, we’ve only seen a +0.4% increase in Jan 2017. At the time of writing this (2:00am Singapore Time, 1 Feb), it still makes sense to hold the U.S stock index until the end of 2017 (if you’re a buy-and-hold investor). That being said, it’s wise to employ price action strategies and focus on a precision entry/exit if you are already long.

On the contrary, for the Dow, we’ve only seen a +0.4% increase in Jan 2017. At the time of writing this (2:00am Singapore Time, 1 Feb), it still makes sense to hold the U.S stock index until the end of 2017 (if you’re a buy-and-hold investor). That being said, it’s wise to employ price action strategies and focus on a precision entry/exit if you are already long.

While the January barometer is good information to know, it’s largely a super long-term strategy (10-20 years) and investors will position themselves well if they have strong price action fundamentals in a generally bullish market.

Going forward, I expect the stock market in both Singapore and U.S to be bullish. This is a probabilistic approach; I would still be making trades based on solid price action strategies, and make portfolio adjustments where necessary.

All the best for 2017, and happy trading! I hope that this article has shed some light for those who hate reading research papers 🙂

RESEARCH SOURCES & REFERENCES

investopedia.com/terms/j/januarybarometer.asp

cnbc.com/2014/01/30/uld-totally-ignore-the-january-barometer.html

quantpedia.com/screener/Details/113

papers.ssrn.com/sol3/papers.cfm?abstract_id=1436516

fullertreacymoney.com/content/2010-03-02/Januaryeffrct.pdf

Cover Image: wallpapercave.com

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!