Market Pandemonium – Stocks Rebound, Oil Plunges, Gold Surges

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

For the past few weeks, we have seen a strong rebound in stocks, but at the same time, we have also seen a plunge in Oil, crazy volatility in the USD, and a surge in Gold.

How can we make sense of this crazy market, when it seems like everything is moving in different directions? Does it mean it is risk-on for now, and is the market bottom already in?

Join our FREE Telegram channel for daily trading tips:

?? https://t.me/synapsetrading

Due to popular request, I will be doing a 1-hour Facebook Live session which is open to the public, where you will get the chance to ask me any questions you have about trading or investing, or the current market situation.

?? https://t.me/synapsetrading/1818

Table of Contents

Is the Stock Market Bottom In?

To be honest, no one really knows at this point.

After reading all the different articles, news, opinions and data, it seems the consensus is pretty split on this.

I also did a poll on Telegram, which seems to favour more downside.

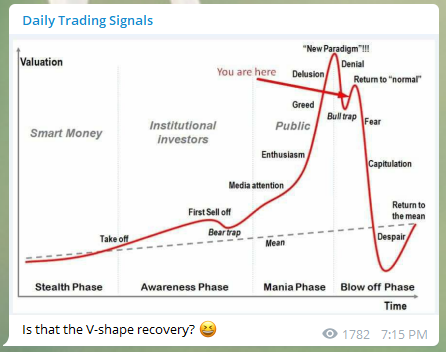

So is it possible that we are actually here?

Let’s take a look at the arguments for each side.

Bullish case:

- Slowing number of cases and hospitalisations after lockdown measures

- Possible that lockdown will end soon and economy returns to normal

- Unprecedented fiscal and monetary policies to boost economy

- Only certain industries are hit pretty bad, the rest of the economy is still ok

- It is a matter of time before a vaccine is found

- China is already “back to normal” after lifting their lockdown

Bearish case:

- Permanent damage to the economy – lost jobs, businesses shut down, loan defaults, etc

- Less future spending – change of habits, less discretionary spending

- Lockdown (full or partial) may last a really long time

- 2nd wave of infections after lockdown is lifted

- Domino effect of economy failure has yet to really kick in

- Fiscal & monetary policy is insufficient to save the economy

How to Swing Trade the Stock Market?

If I had to put a number on it, I would say I am 60% bearish, and 40% bullish.

Based on this opinion (and of course studying the price action), my general strategy is to do short/medium-term bullish swing trades, while at the same time looking for an opportunity to take a long-term bearish trade.

This will allow me to profit from the short/medium-term price rebound, based on the price action, but also not miss out from the potentially bigger long-term move down, should it happen.

From the chart, the strongest level of resistance is the gap around the 2900-3000 level, so if prices manage to close and stay above that, then I will reconsider my bearish hypothesis.

Tesla – Very Strong Price Rebound

After the sharp plunge when the stock price was almost hitting $1000, Tesla fell sharply to the $380 to $400 buying zone, which was the area I was planning to accumulate the stock.

It had an amazing rally after that, and as of today’s closing it is up almost 90% from my initial entry price. Congrats to those who took the trade with us!

Crude Oil – Double Whammy Selldown

Crude oil was very unfortunately to suffer a confluence of bad news, including price wars, and a huge decline in demand due to restriction of travel.

As price continues to drift down, we have seen the main exporters try to put together some deals and supply cuts, but the problem is that demand is too low, and even with a decrease in supply, there is still an increasing supply glut.

So unless we see lockdowns being lifted, and the economy going back to normal, we can expect crude oil to continue falling. This will get worse the longer the lockdown lasts.

Gold – The Hedge for USD

After seeing how the Fed (and almost every huge economy) is printing billions and trillions of dollars to save the economy, it is highly possible that we might see a devaluation of the US Dollar in the long-run.

For many traders and investors, they see Gold as a good way to hedge against the decline in value of the USD, which could explain the huge surge in Gold prices.

Thankfully, we managed to start buying in near the lows, and slowly accumulated on the way up.

As I mentioned in the post, I think this is a good medium/long-term trade, so for investors, you might want to add some of this in your investment portfolio as well.

Want to Start Your Trading Journey?

Here are some very practical trading tips which will be very useful, especially during such market conditions.

In trading, it is important to find the right mentor and the right community, because having the right support is very important if you want to succeed as a trader.

If you are interested to start your journey with our community, click on the link below: https://synapsetrading.com/the-synapse-program/

See you on the inside! ?

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!