Weekly Market Wrap: Cashing in on Short Positions!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Click here to receive all these signals in real-time for only $67 a month! You will get several signals a day, and even taking just 1 trade the whole month can easily cover the fee, so what are you waiting for?

Forex Market Highlights

Following up on USDSGD, it has fallen to the bottom of the channel as predicted, so this would be a good time to take profits on the short positions. ????

Can start looking for a pullback opportunity to go long instead.

Following up on AUDCAD, it has reached the bottom of the range, hitting our TP for +200 pips profit! ????

Following up on Crude Oil, since our first buy call, we are now up more than +25% in profits! ????

Can consider taking some profits, since prices are very near ATHs.

Product: Forex

Name: Euro / British Pound

Ticker: EURGBP

Exchange: N/A

Analysis: Strong downtrend, look to short on pullbacks till next support level.

EP: 0.8315 to 0.8360

SL: 0.8400

TP: 0.8200 to 0.8100

Product: Forex

Name: NZ Dollar / Swiss Franc

Ticker: NZDCHF

Exchange: N/A

Analysis: Potential small rectangle breakout, can look for low-risk pullbacks.

EP: 0.6170 to 0.6215

SL: 0.6250

TP: 0.6000 to 0.6050

Stock Market Highlights

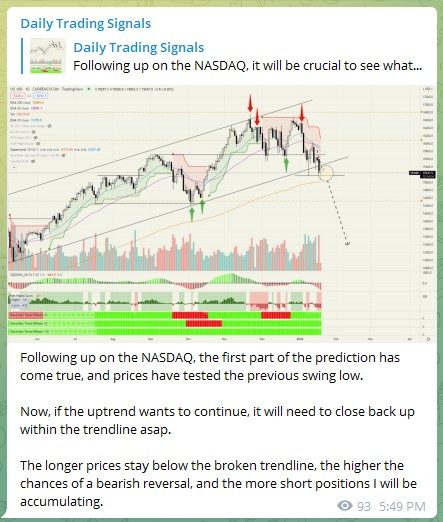

Following up on the NASDAQ, the first part of the prediction has come true, and prices have tested the previous swing low.

Now, if the uptrend wants to continue, it will need to close back up within the trendline asap.

The longer prices stay below the broken trendline, the higher the chances of a bearish reversal, and the more short positions I will be accumulating.

NASDAQ (US100) moving as planned, and my short positions are deeply in the money now. ????

Following up on Shopify (SHOP), it has dropped quite a bit, and looks to be heading lower. Congrats to those who followed took the trade! ????

Following up on Ford Motors (FORD), this stock has gone up a whooping 25% while the rest of the market was bearish!

Congrats to those who followed! ????

Following up on Netflix (NFLX), we got a windfall profit of 33.33% over 2 weeks! ????

Product: US Stock

Name: Crocs

Ticker: CROX

Exchange: NASDAQ

Analysis: Bearish trend after breaking neckline. Look to short on pullbacks.

EP: $110 to $130

SL: $140

TP: $80 to $90

Crypto Market Highlights

After a small rebound from support, Ethereum (ETH) is now at a precarious zone near the confluence of EMAs acting as resistance.

At this point, I would recommend either staying out or taking a small short position.

Following up on Ethereum (ETH) and most of the crypto market, prices have started falling and I have been slowly adding more short positions. There is a good chance of it breaking the previous swing low.

Congrats to those who shorted crypto with us this weekend. Looking at the chart of Ethereum (ETH), I have taken half profits, and I’m waiting for a pullback to short again, or a reversal to switch to long.

Following up on Solana (SOL), it is still hovering around the resistance level, unable to make new highs. Not looking good.

Not looking good for Axie Infinity (AXS).

Off to a great start this weekend with all our short positions, congrats to those who have been following my crypto analysis! ???? Will be posting some charts later on.

Click here to receive all these signals in real-time for only $67 a month! You will get several signals a day, and even taking just 1 trade the whole month can easily cover the fee, so what are you waiting for?

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!