Personal Checklist: The Top 5 Habits of Singaporean Self-Made Millionaires

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Just last week, I came across this interesting article, talking about some of the prominent millionaires in Singapore, and how they created their wealth.

Source: Vulcan Post

Source: Vulcan Post

As I read it through, I couldn’t help but think about what they did to make, keep, and grow their wealth. Sure, some of them inherited their wealth, but it takes a different kind of education in order to preserve and grow the inherited wealth.

It is definitely not chance that these people have achieved phenomenal success. There were, in fact, common patterns of behaviour that keep them successful.

The difference lies in just 5 actions they take consistently:

Table of Contents

1. THEY CREATE MULTIPLE INCOME STREAMS

The average person lives from paycheck to paycheck, while the average wealthy person receives cash from various sources, so that even if one source were to be temporarily cut off, they can still enjoy the same standard of living they currently have. Here are just some of the commonly known income streams that they have:

Earned Income: working for money

Interest Earned: earning money by lending it

Dividend Income: earning money by share ownership

Profit: Selling something you make or own

Capital Gains: Selling something higher than what you bought it for

Rental Incomes: Money gotten from owning real estate

Royalty Incomes: Money from selling intellectual property or franchise systems

Having multiple streams of income is like having many waterfalls flowing into the same ocean. The more streams you have, the more reliable the flow.

Which do you currently have? The average person struggles to survive because he only has one stream. Personally, I like trading and portfolio management. The great thing about portfolio management is that you can enjoy interest earned, dividend income, and capital gains.

2. THEY TREASURE EVERY SECOND OF THEIR TIME

Let’s be honest with ourselves; how many hours a day do you do things that do not contribute to your financial success? Most people would rather procrastinate or spend time on enjoyment rather than on what really matters.

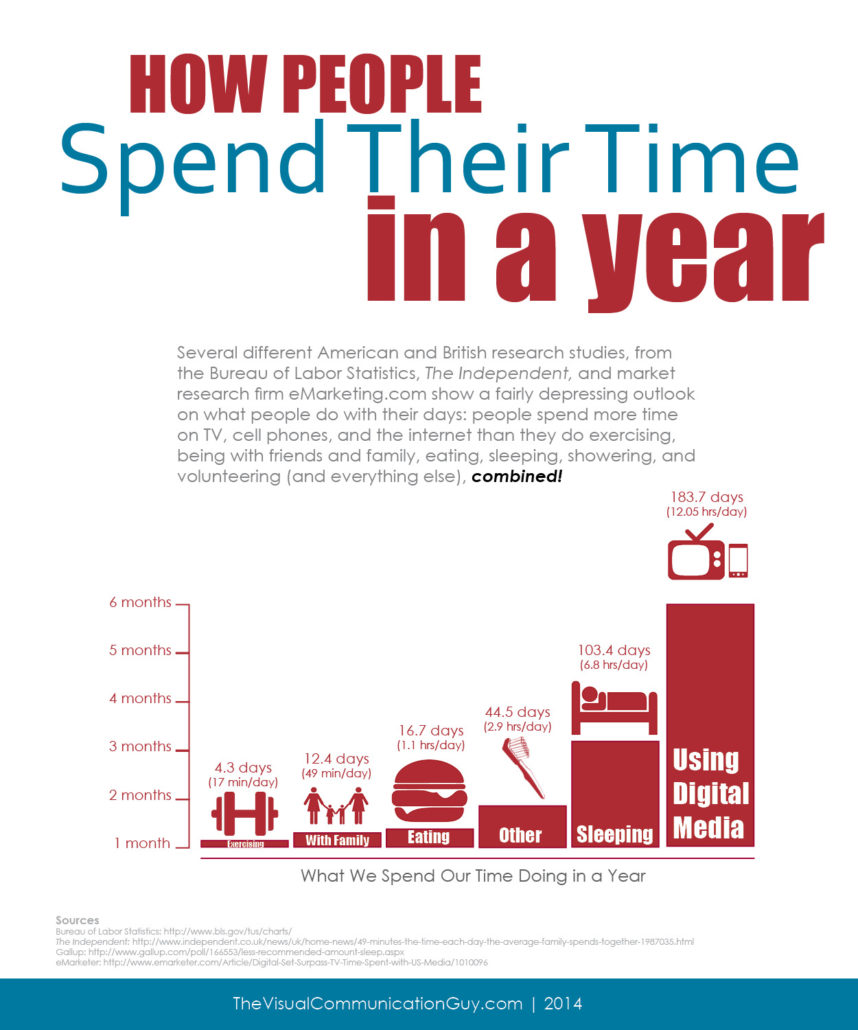

I found this really interesting image of how most people spend their time in a year:

Source: The Visual Communication Guy

Source: The Visual Communication Guy

It’s amazing; out of 365 days a year, 183.7 days are spent on media! If we were honest with ourselves, perhaps what we need is to rethink the way we live. Perhaps if we all take some time away from Media and reallocate it to self-improvement, learning, investing, and growing as a person, we could be living a very different life indeed.

How would your life look if you re-arranged your priorities?

Robert Kiyosaki once made a quip about what he noticed of rich and poor dads; he said that poor dad would sit on the couch and watch TV every night, while rich dad would review his investments and upgrade his skills every night. Poor dad would spend the weekends wasting time, while rich dad would build a business during the weekends.

Many of you would know that I read more than 200 books before I embarked on my trading journey. Even now, I make it a point to read at least 3 books a week, because I feel that it is important to never stop learning and upgrading oneself. Here are some key pointers:

- Don’t waste time. Find out what you need to do, and do it.

- Re-prioritize. Find out which areas of your life you can do away with, and cut them out quickly.

- Learn. Just because you have graduated doesn’t mean you should stop learning. Successful people get where they are because they have an attitude of lifelong-learning.

3. HAVING A MENTOR MAKES A BIG DIFFERENCE

Mentors are looking for people who are humble, hungry, and hard-pressed for success. No matter where you are in your career or life, it helps to have successful people to reach out to and learn from. They’ll be able to quickly point you in the right direction if you are going off-track.

When I started my trading career at a professional fund, I had wonderful, experienced mentors to guide me in the right direction. I quickly picked up on what worked and what did not. I learnt their habits, their lifestyle, and the difficulties that they went through to get where they were.

Where can you look for mentors if you have no one at the moment? This is what many people ask me from time to time.

- Build connections: Networks are not built overnight. As you expand your social circle to include successful people, you will start to find people who could potentially guide you to where you want to go.

- Be inquisitive: People will only want to mentor someone who has the attitude for success. While at the beginning you might lack aptitude, the right mentality and motivation would attract the right people to you.

- Keep learning: As you learn more, you discover you will have the vocabulary to connect with people. With greater proficiency, you would be able to speak at the same level as industry practitioners, asking smart questions, being able to understand jargon, and make an impression.

4. THEY VISUALIZE THEIR DREAMS IN DETAIL

Goals without dreams are dead; they become mere tasks rather than the exciting outcome that you hope for. It helps to have an idea of what you want; most people want to be wealthy but don’t know what it would look like.

What does a wealthy life look like for you? For YOU personally?

For some, it could mean having to work only 2-3 days a week. Financial goals differ from person to person, and it’s not just the monetary goal, but also the lifestyle goal. For me, I knew I wanted to have the luxury of making passive income even when I am travelling. This may not be everyone’s goal.

“How much money do you want to make exactly, and what would that lifestyle look like exactly?”

Many people want to lose weight. Losing weight isn’t a definite enough goal; Losing 12 kg by the end of 6 months is a definite goal. Many people fail to achieve their goals because they don’t even define their goals!

It’s also important to visualize yourself doing what you hope to be doing. Having a lot of money is pointless if all you are going to do is sit aroud with the cash; it is accomplishing the goals you have, those bucket lists, that make life worthwhile.

So what is it for you?

Grab a piece of paper and start getting your hands dirty. It doesn’t matter if you are old or young, experienced or inadequate; what matters is a willing heart and dilligent hands, and of course, a big enough dream that will knock you off your sofa and get you started.

- Be specific about your goals. General goals generally don’t work. Specific goals help you to move toward exactly what you want.

- Keep track of your progress. You never know if you are on the right path if you don’t take stock regularly. Even better, get a mentor to help you evaluate where you are.

- Focus on the dream with its details. Keep reminding yourself of where you eventually want to be. Otherwise, you’ll just lose steam and burn out, bum around, and end up not getting where you were heading toward.

5. THEY DO NOT GIVE UP OR QUIT

If you’ve got your foot into the investing arena, you would be familiar with financial losses. It is at this point where your mettle is truly tested; is this what you want? Are you willing to sit through heartache and tough lessons to get where you want? Is the life you left behind really worth going back to? Do you still believe in the dream you have?

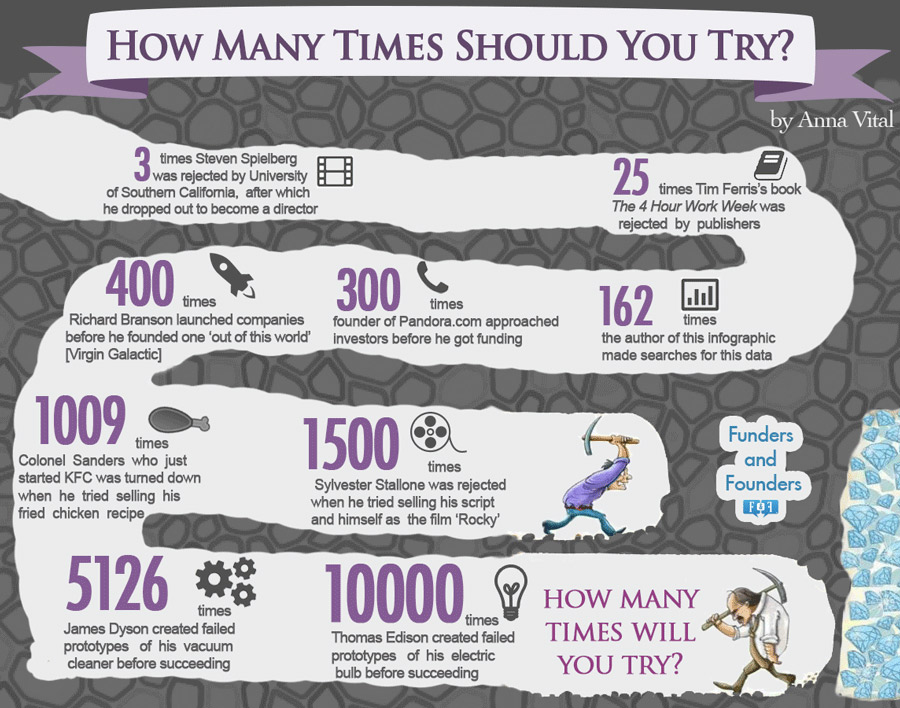

When that business fails, would you stand up again and start all over? When you family doubts you and the pressure to provide hits you, will you continue to stand by your dream? People want the glory without the trials and training. Just take a look at the infographic below that I found:

Source: Anna Vital (Founders & Founders)

Source: Anna Vital (Founders & Founders)

I also came across this interesting quote, which I thought was very useful in clarifying what we really value. Millionaires invest their money and make investing a priority, while poor people spend their money first and make spending a priority.

Always, always seek to make investing your primary objective. Invest your time, invest your money, invest in your team if you are running a business. Invest, invest and invest.

Is investing your primary objective, or is spending your primary objective? Would you be willing to delay gratification, in order to enjoy a lot more in the future, far more than you can ever imagine?

- Do not quit. Ensure that you have made a commitment. Tell your friends, and engage people to keep you on this path.

- Invest your money, your time, and in your team. Investing is what multiplies your returns in the long-run. Keep at it!

- Prioritize learning, rather than earning. It pays to be more proficient at what you want to do. When you are starting out, make learning a priority, and the profits will come eventually.

Don’t give up on your dreams!

Feel free to share this with people you know who are working hard toward their dreams, and striving to build their first pot of Gold. And with these 5 actionable steps, you’ll be one step closer to your first million! 😀

Bonus: Download free ebook: The 7 Best-Kept Secrets of Professional Traders

RESEARCH SOURCES & REFERENCES

vulcanpost.com/593788/in-forbes-2016-asias-richest-families-list-we-see-some-prominent-singaporean-names

businessinsider.sg/habits-of-self-made-millionaires-2016-3/#rJDS8hCPPhHm5qpK.97

fastcompany.com/3052770/how-to-be-a-success-at-everything/7-habits-of-self-made-millionaires

allbusiness.com/slideshow/9-smart-habits-of-real-millionaire-entrepreneurs-16769866-1.html

huffingtonpost.com/timothy-sykes/top-30-millionaire-habits_b_8260134.html

If you are excited to get more life hacks, also check out: “Beyond Financial Freedom: An Unofficial Guide to Living Your Best Life”

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!