Weekly Market Wrap: Cashing Out Before the Market Rebound!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, we saw a sharp rebound in all markets (stocks, bonds, crypto, REITs, etc), which was not unexpected given how oversold most markets were.

That is why we decided to cash out by closing all positions and taking profits. This includes my high 6-figure USD/SGD long positions.

The plan was to wait for the rebound to be over before entering all the same positions again, which happened in the later part of the week.

This week, we have already positioned ourselves for the market, and the major news of the week will be the CPI report coming out on 13 October.

No doubt September was one of our best trading months, with many traders making 10-15% profits on their portfolios, but if the market continues falling, I won’t be surprised if we exceed that record in the next 2 months.

If you want to join us in swing trading the market with 15 minutes a day, join our Daily Trading Signals Telegram channel. See you on the inside!

[Photo: Patungan, Cavite, Philippines – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

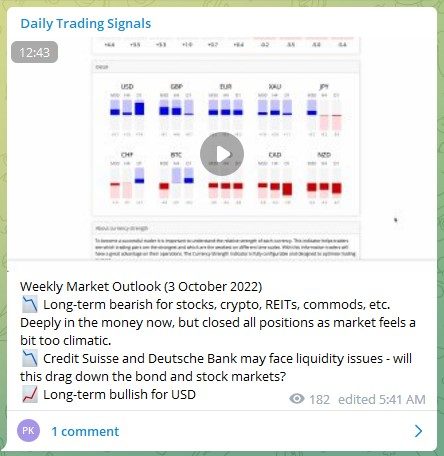

Weekly Market Outlook (3 October 2022)

? Long-term bearish for stocks, crypto, REITs, commods, etc. Deeply in the money now, but closed all positions as market feels a bit too climatic.

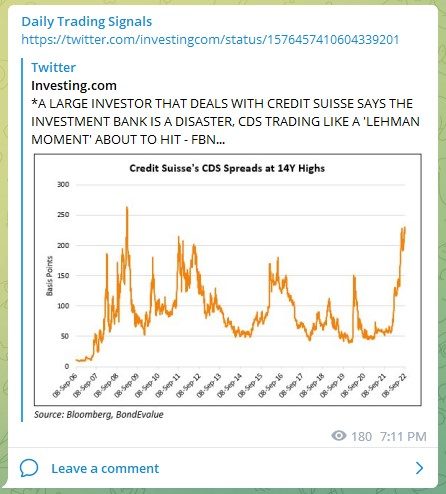

? Credit Suisse and Deutsche Bank may face liquidity issues – will this drag down the bond and stock markets?

? Long-term bullish for USD

Portfolio Highlights

Weekly Portfolio Update (3 October 2022)

Playing defensive this week, and waiting for better trading opportunities. Closed most positions and rotated all USD to SGD.

Forex & Commodities Market Highlights

1.000 parity level has now become a support-turned-resistance level for the EURUSD. Will be expecting it to continue falling when USD resumes the uptrend.

After cashing out on my USD near this cluster of pinbars, I am waiting for USDSGD to fall to the previous support level to re-enter.

I have placed some price alerts near the area, so we will know immediately when that happens. Stay tuned!

https://www.wsj.com/articles/britains-financial-disaster-is-a-warning-to-the-world-11664596851

Stock & Bond Market Highlights

*A LARGE INVESTOR THAT DEALS WITH CREDIT SUISSE SAYS THE INVESTMENT BANK IS A DISASTER, CDS TRADING LIKE A 'LEHMAN MOMENT' ABOUT TO HIT – FBN#CreditSuisse ???? pic.twitter.com/UiG0FzRucA

— Investing.com (@Investingcom) October 2, 2022

Why are markets so sensitive to data that would normally be regarded as merely an imprecise guide to the economy, to be taken in the context of other reports? Here are three theories:

https://www.wsj.com/articles/markets-are-stuck-in-overreaction-mode-11664894767

https://www.wsj.com/articles/battered-investors-now-find-thrills-in-t-bills-11664676704

After taking profit on our shorts near the exact bottom, the NASDAQ 100 (US100) is now having a dead cat bounce.

I am waiting for price action to turn bearish again so I can short. This might happen near the 50-EMA or the top of the bearish trendline.

I have placed price alerts at key levels, so we will know when the time is ripe. Stay tuned!

Crypto Market Highlights

Ethereum (ETHUSD) is still trading in a narrow range, but it is very near the neckline resistance and the 20-EMA.

Based on technicals alone, it is a bearish picture.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!