Weekly Market Wrap: Taking Profit for Euro Pair Short Trades!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week we saw a pullback in the crypto market, which is expected since some counters like Ethereum have run up close to 65% since the start of the year, so even if the bull-trend is to continue, we cannot expected it to go straight up without some zig-zags along the way.

Following up from some of the Euro short trades we shared a few weeks ago, we expected weakness in the EUR relative to many other currencies, and these trades have yielded between 400 to 900 pips profits per trade! Simply awesome!

The stock markets have also started turning down after hitting our predicted major resistance levels, so we expect the week ahead to be bearish or sideways. Still not seeing any major bullish catalysts for the stock markets.

[Photo: Bratislava, Slovakia – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Forex Market Highlights

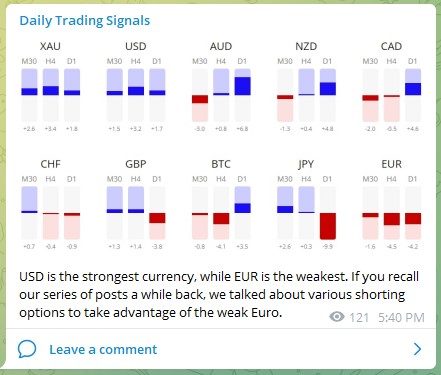

USD is the strongest currency, while EUR is the weakest. If you recall our series of posts a while back, we talked about various shorting options to take advantage of the weak Euro.

Product: Forex

Name: Aussie Dollar vs Canadian Dollar

Ticker: AUDCAD

Exchange: N/A

Analysis: Small rising wedge (bearish) after running into major resistance at the top of the wide range.

EP: 0.938

SL: 0.953

TP: 0.918, 0.900

Product: Forex

Name: Euro vs Aussie Dollar

Ticker: EURAUD

Exchange: N/A

Analysis: Following up from the last post, this pair has hit our profit target, with about 900+ pips profit! ????

Product: Forex

Name: Euro / NZ Dollar

Ticker: EURNZD

Exchange: N/A

Analysis: Following up from the last post, this has also hit our TP, netting us another 600+ pips profit! ????

Product: Forex

Name: Euro vs US Dollar

Ticker: EURUSD

Exchange: N/A

Analysis: Following up from the last post, we are currently about 400+ pips in the money.

EP: 1.13 to 1.15, or on pullbacks

SL: 1.16

TP: 1.055, 0.920

Product: Forex

Name: New Zealand Dollar vs US Dollar

Ticker: NZDUSD

Exchange: N/A

Analysis: Bearish price action (pin bar) near the top of a trend channel, plus major resistance (blue line).

EP: 0.687 to 0.690

SL: 0.700

TP: 0.665

Commodities Market Highlights

Product: Commodity Index Fund

Name: iShares S&P Global Clean Energy Index Fund

Ticker: ICLN

Exchange: NASDAQ

Analysis: Following up, the ICLN has broken out of the bullish wedge, and might be started a major run up.

EP: 21 to 22, or on pullbacks

SL: 20

TP: 25 to 33

Stock & Bond Market Highlights

Product: US Stock Index

Name: NASDAQ 100

Ticker: US 100

Exchange: N/A

Analysis: Prices have run into resistance as expected, will we see a test of prior lows?

EP: 14689, or on pullbacks

SL: 15311

TP: 13018+

Crypto Market Highlights

Product: Cryptocurrency

Name: Ethereum

Ticker: ETHUSD

Exchange: N/A

Analysis: Following up, Ethereum is up 65% from its lows, and continuing to head towards the highs. Will continue to buy on pullbacks.

EP: 2000 to 2300

SL: 1900

TP: 4800+++

Product: Cryptocurrency

Name: Terra

Ticker: LUNAUSD

Exchange: N/A

Analysis: The breakout has taken place, so now we just need to hold on to our positions and wait!

EP: 97 to 100, or on pullbacks

SL: 87

TP: 150+

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!