Weekly Market Wrap: Upcoming Earnings Season & Inflation Data!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

The upcoming week will see the beginning of the earnings season, with reports from major banks and financial institutions, including JPMorgan Chase, Wells Fargo, Citigroup, BlackRock, and PNC Financial Services. Earnings for S&P 500 companies are projected to fall by 6.6%, marking the largest quarterly decline since Q2 2020.

The Federal Reserve will release meeting minutes from its most recent policy meeting on Wednesday, and markets will be watching closely on the tone and words used, to provide guidance for future rate policy direction.

Inflation reports for March will be released, with the Consumer Price Index (CPI) scheduled for Wednesday and the Producer Price Index (PPI) on Thursday. Prices are projected to have risen by 0.3% in March, while year-over-year CPI is expected to be up just over 5%. The PPI is anticipated to remain unchanged from last month, with an annual increase of 3.1%.

The U.S. Census Bureau will report on March retail sales on Friday, providing a key update on consumer spending. Sales are projected to have fallen by 0.4% last month and are expected to rise 4% to 6% this year.

The International Monetary Fund (IMF) and World Bank Spring 2023 annual meetings will begin on Monday in Washington D.C. These events will gather global leaders to discuss issues such as the world economic outlook, poverty eradication, economic development, and aid effectiveness.

[Photo: Zion National Park, USA – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (02 April 2023)

📌 Markets seem to be expecting Fed cutting rates in Q3 this year (4 months time)

📌 Stock markets are bullish in the short-run

📌 USD is weakening, while Gold & Crypto (ETH breakout) is gaining strength

📌 GPB is bullish while CAD is bearish

📌 Looking to accumulate long-term bonds (TLT) in my portfolio

📌 Bearish on Crude Oil and Commodities

Portfolio Highlights

Weekly Portfolio Updates (2 April 2023)

Even though stocks rallied slightly, bonds (TLT) rallied as well, providing a buffer against our short positions.

I also decided to add some commodity (DBC) short positions, since I don’t think this oil rally is sustainable if demand drops.

Forex & Commodities Market Highlights

AUDCAD – Finally the TP is hit, giving a whooping profit of 350+ pips! Congrats to all who took the trade! 💰🔥💪🏻

AUDNZD – Breaking down from range, in line with the downtrend. Probably heading to test prior lows.

CADCHF – Following up on this, it is the 2nd time pricing are testing the neckline.

EURCAD – Following up on this, and what I said in the video, the pullback after the breakout is a good low-risk entry.

GBPCAD – Great low-risk opportunity for a long trade.

Crude Oil (WTICOUSD) – Prices spiked up due to production cuts, but the overall trend is still down.

If prices close back down into the price channel, the downtrend is likely to continue.

I am looking for shorting opportunities on this, and commodity ETFs like DBC.

Stock & Bond Market Highlights

NASDAQ 100 (US100) – There might be enough momentum to push it to test the prior swing high, but don’t see much more bullish catalysts for it to break above that.

Also seeing some price divergence on the RSI.

3 months relative performance.

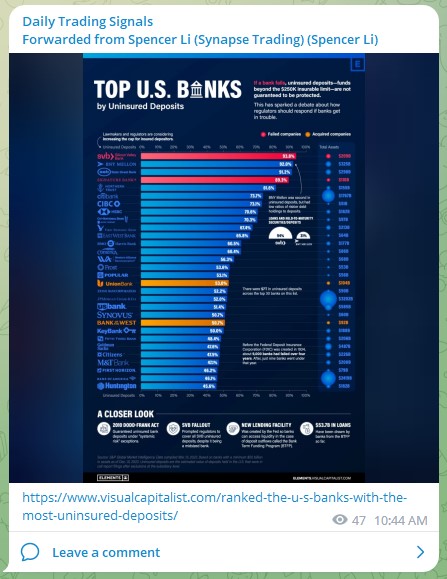

Top U.S. banks by uninsured deposits.

Crypto Market Highlights

Ethereum (ETHUSD) – Breakout of small ascending triangle, looking to gun for $2000. 🚀

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!