Weekly Market Wrap: Is it Finally Time for the Next Crypto Bull Run?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

As the Russian war reaches the 1-month mark, Russian forces are starting to dig in while focusing attacks on a few key fronts, while Ukrainian forces counter-attack and try to gain back ground.

As markets start to stabilise, stocks had some recovery, while commodities get ready to make new highs.

Crypto which has been quietly ranging is preparing for the next big bull run.

[Photo: Former nuclear missile base in Ukraine – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

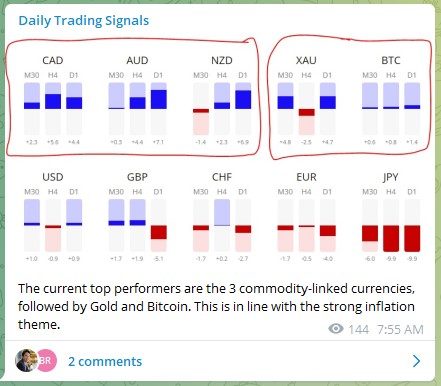

Forex Market Highlights

The current top performers are the 3 commodity-linked currencies, followed by Gold and Bitcoin. This is in line with the strong inflation theme.

Following up on CHFJPY, it has exceeded our targets! Congrats! ????

Following up on GBPAUD, it has hit our TP and clocked a whopping 1480 pips profit! ????

Looks like there is another leg of downside move too.

Following up on GBPUSD, it has hit our target to precision as well, at the bottom of the channel! ????

Now, it will most likely rebound to the opposite side of the channel.

Commodities Market Highlights

Good chance to buy into the commodity ETF (GCC) after a pullback to the 20-EMA. Even if the war ends, inflation is likely to persist, due to:

– Supply chain or production disruptions due to new Covid surge

– Russia is a major exporter of commodities

– Ukraine is also a major exporter of commodities, and it will take a long time before production resumes

Can also consider buying the Clean Energy ETF (ICLN), as more countries will now try to move away from relying on oil.

Stock & Bond Market Highlights

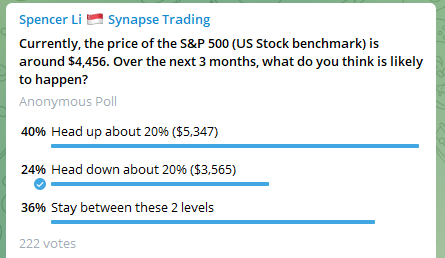

Did a market poll on stocks (S&P 500), seems like the majority is either bullish or sideways. Personally I am more on the bearish side, but will not take any drastic action until the charts confirm.

Looking at the long-term (weekly) chart of the China general stock market ETF (2801), it might have hit the bottom after dropping 55%, finding support at the mega long-term trendline.

With rising interest rates, it is no surprise that bond prices continue to fall (inversely correlated).

Following up from my last predictions, our short positions in the 20+ year treasury bond ETF (TLT) continue to make new lows! ????

Looking at the NASDAQ 100 (US100), the short-term momentum is very strong, it will most likely head up another 5% or so to test the previous swing high.

I would either take a short-term long position, or stay out till price reaches that level.

Crypto Market Highlights

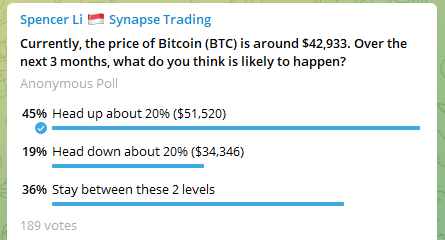

Market poll on Bitcoin (BTC), seems like the majority is either bullish or sideways.

Following up on the Crypto Total Market Cap, it has started to move up! ??

The key level to watch is the previous swing high (around $2T), which will confirm the start of the next bull run.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!