Macroeconomic Indicators and Central Bank Policy

The U.S. Federal Reserve entered November on pause but firmly tilted toward easing. With key data releases disrupted by a federal funding shutdown (the longest in history at 43 days), Fed officials increasingly signaled a readiness to cut rates. By late month, markets were pricing in roughly 85 percent odds of a 25 bps Fed rate cut in December.

New York Fed President John Williams hinted that the time for policy easing was nearing, helping convince forecasters like J.P. Morgan to pull forward their cut expectations from 2026 into December 2025. The shutdown’s impact was evident: October’s jobs and inflation reports were canceled or delayed, leaving policymakers flying blind on recent data.

When government offices reopened mid-November, a backlog of reports showed a mixed picture. For instance, consumer confidence for November plunged to 88.7, a post-pandemic low, and retail sales in September (finally reported in late November) rose just 0.2 percent, undershooting forecasts.

On the inflation front, producer prices were tame (0.3 percent in September, with core PPI only 0.1 percent), and the absence of an official CPI release suggested price pressures remained contained. Meanwhile, labor market signals weakened slightly: a private ADP report indicated U.S. employers shed jobs through late October, and weekly jobless claims crept up – subtle signs that the once-hot job market is cooling.

Treasury yields responded dramatically to the shifting outlook: the 10-year yield, which had been above 5 percent earlier in the fall, fell to around 4.0 percent by late November, reflecting investors’ expectations of imminent Fed easing. In fact, the entire yield curve eased and started to re-steepen (the 2-year yield slid under 3.6 percent while longer yields held around 4.0 to 4.6 percent), a bullish signal for future growth. The prospect of the Fed pivoting to rate cuts, combined with the restoration of government operations, helped brighten market sentiment in the latter half of the month.

Other major central banks also positioned themselves more dovishly as inflation showed signs of peaking. The European Central Bank (ECB) held interest rates unchanged again at its late-October meeting, keeping the deposit rate at 2 percent. ECB President Christine Lagarde stated policy is in a good place with the euro-zone economy proving resilient despite past rate hikes. Indeed, euro-area Q3 GDP grew a modest 0.2 percent, better than expected, and headline inflation continued to ease toward the 2 percent target.

With risks to growth abating helped by improved trade relations and a calmer geopolitical backdrop, officials saw no urgency to cut rates immediately. However, with internal forecasts likely to show sub-target inflation in coming years, discussion of future rate cuts is expected to heat up at the December ECB meeting. Financial markets are already pricing in at least one ECB rate reduction by mid-2026, reflecting confidence that the tightening cycle is over.

Over in the UK, the Bank of England (BoE) similarly stood pat but with greater debate. At its early November meeting, the BoE voted 5 to 4 to keep Bank Rate at 4.00 percent, as four MPC members dissented in favor of an immediate 25 bps cut. This razor-thin decision underscores that British monetary policy may have reached a turning point: inflation in the UK is finally trending down (CPI about 3.8 percent by autumn) and prior rate hikes have cooled wage growth.

The BoE noted that underlying inflation is easing amid subdued economic growth and slackening labor markets. Having already begun a gentle cutting cycle (the BoE has reduced rates five times since mid-2024), officials indicated that further cuts will depend on continued disinflation progress. In short, the BoE’s stance has shifted toward cautiously easing, provided inflation stays on track to hit 2 percent in the medium term.

In Asia, policymakers faced a somewhat different backdrop. The Bank of Japan (BOJ) which had finally exited its ultra-loose stance earlier in 2025 moved closer to raising rates again. Japan’s core CPI in Tokyo rose 2.8 percent YoY in November, holding well above the BOJ’s 2 percent goal. Price pressures in Japan have proven more durable than expected, driven by surging food costs and a tight labor market, and inflation excluding food and energy is running around 3 percent.

BOJ officials, including Governor Ueda, signaled that if these trends persist, a rate hike could come as soon as December. The benchmark policy rate has been at 0.50 percent since January (when the BOJ hiked for the first time in 17 years), and many on the Board believe conditions now merit another increase.

A major concern is the yen’s weakness – the yen slid to around 155 per USD, a 9 to 10 month low, during November. This yen slump, partly a result of U.S.–Japan rate differentials, is pushing up import costs and stoking inflation further. Japanese authorities ramped up verbal warnings about possible FX intervention if yen declines continue.

The government in Tokyo is also grappling with softer economic momentum; Japan’s economy shrank in Q3 2025, and consumer spending remains lukewarm. This puts the BOJ in a bind: raise rates to support the yen and rein in prices, or hold to support growth. As of late November, the consensus is that a near-term BOJ rate hike is likely – if only to reinforce the message that the era of zero rates and yield-curve control is truly over.

In China, by contrast, the central bank (PBoC) maintained an accommodative bias. China’s one-year Loan Prime Rate stayed at 3.45 percent for the fifth consecutive month in November, and policymakers hinted at potential RRR or rate cuts in early 2026 if needed. China’s economy is sending mixed signals: manufacturing PMIs remain under 50 (contractionary), and services growth slipped to a 5-month low in November, pointing to an uneven post-pandemic recovery.

With inflation near zero and credit growth sluggish, Chinese authorities have rolled out targeted support measures (such as modest fiscal stimulus and property market easing) rather than broad rate cuts. Still, markets anticipate the PBoC could resume easing in coming months to spur demand, especially if global conditions worsen.

Crucially, global bond yields retreated in November on the evolving monetary policy outlook. The U.S. 10-year Treasury yield fell under 4.1 percent, down from around 5 percent just a month prior, as investors priced in the Fed’s impending rate cuts. German 10-year Bund yields similarly declined (to around 2.2 percent) as euro-area inflation waned and the ECB struck a neutral tone. In the UK, gilt yields oscillated around 4.3 percent, off their highs, amid the BoE’s divided decision.

Notably, yield curves began steepening in several markets: the U.S. 2 to 10 year spread became less inverted as short rates dropped on Fed pivot bets. Lower yields and the prospect of cheaper credit ahead provided a tailwind to equities and other risk assets (particularly benefiting rate-sensitive sectors like housing and utilities). Even corporate credit spreads tightened to historically low levels, reflecting investors’ comfort with the economic outlook and search for yield.

In currency markets, the U.S. dollar index drifted weaker, falling below 100 for the first time in over a year. The dollar lost ground against the euro (EUR/USD up to about 1.16) as the Fed pivot narrative gained traction. However, the dollar strengthened versus the yen given expectations of only a minor BOJ hike (USD/JPY hit 154 to 155 before month-end). Overall, November saw a macro regime shift: investors began looking past the most aggressive tightening cycle in decades and embracing the dawn of rate cuts, underpinning a broad improvement in financial conditions.

Major Political and Geopolitical Developments

U.S. Fiscal Policy and Government: The month began under the cloud of a U.S. government shutdown, which had started in early October and dragged on for 43 days, the longest federal shutdown on record. This funding lapse furloughed hundreds of thousands of workers and halted key economic reports, injecting uncertainty into markets. By mid-November, however, Congress passed legislation to reopen the government, bringing a sigh of relief to investors and businesses. The resolution (a stopgap spending bill brokered in the House and Senate) ended the standoff and restored normal federal operations.

One quirk of the prolonged shutdown was that several data releases (including the October employment report and CPI) were omitted entirely, which was confirmed by the White House – those data might never be released officially. The shutdown’s end meant delayed figures (like retail sales and producer prices) were finally published, and agencies like the BLS and BEA resumed work. The market impact of the shutdown proved limited in the end; while it did shave some GDP growth due to lost government output, the primary effect was to muddle the economic picture for a time. Once resolved, attention turned back to fundamentals, and the removal of this political overhang provided a modest boost to market sentiment.

In Washington, monetary politics also made headlines. With Fed Chair Jerome Powell’s term ending in early 2026, President Donald Trump began vetting candidates to lead the central bank. Treasury Secretary Scott Bessent indicated an announcement of the next Fed Chair is likely before Christmas 2025. Markets widely expect Trump to not reappoint Powell, but instead choose a more dovish figure aligned with his growth-friendly, low-rate preferences. This comes amid Trump’s ongoing public pressure on the Fed – he has repeatedly urged deeper rate cuts and even mused about restarting quantitative easing.

One Fed official already in focus is Atlanta Fed President Raphael Bostic, who announced he will retire in February 2026. Bostic has been a relatively hawkish voice concerned about inflation, so his departure and eventual replacement by a Trump nominee is seen as potentially tilting the Fed more dovish. These political developments – an incumbent president actively trying to reshape the Fed – are unusual and added a layer of uncertainty. However, for now investors reacted positively, assuming a Trump-picked Fed leadership in 2026 would likely mean earlier rate cuts or easier policy than otherwise, reinforcing the Fed pivot narrative.

Trade and International Relations: On the global stage, November actually brought some easing of tensions in critical areas. Notably, the U.S. and China made incremental progress on trade issues. In late October, President Trump and President Xi Jinping reached an agreement to trim tariffs on each other’s goods. This marked a significant de-escalation in the trade war that has simmered since 2018. Details of the deal suggested that both sides would roll back certain tariffs implemented in recent years, a move which Lagarde cited as having mitigated downside risks to growth in Europe and globally. Indeed, the prospect of lower U.S.–China tariffs improved business confidence, especially in export-focused economies like Germany and South Korea.

Furthermore, the U.S. and EU finalized the outlines of a trade deal of their own, heading off a threatened new round of U.S. auto tariffs on European cars (which had loomed for late 2025). The Trump administration postponed those tariffs indefinitely as talks yielded a framework on other trade issues. Combined, these developments suggest a pivot from protectionism to negotiation, reassuring markets that trade frictions were easing at the margin.

That said, some sticking points remain – for example, the U.S. continued enforcing high-tech export controls on China (especially around semiconductors and AI technology), and China’s economy is still contending with weak external demand partly due to prior tariff regimes. But on balance, November’s news on trade was the most encouraging in years, and stocks in sectors like industrials and materials (sensitive to trade) got a boost from this détente.

Geopolitical events saw mixed turns, with one major conflict entering a quieter phase. In the Middle East, the war between Israel and Hamas (which had erupted in Gaza in late 2024) saw a ceasefire agreement take hold in November. This ceasefire – brokered by international mediators – paused hostilities long enough for humanitarian aid to flow and hostage negotiations to progress. The respite calmed fears of a broader regional escalation that might disrupt oil supplies. In fact, the de-escalation in Gaza, alongside diplomatic efforts with other regional players, contributed to a sharp drop in oil prices.

Another positive note was struck in Eastern Europe: rumors swirled of potential peace talks in the Ukraine war, as both Russia and Ukraine faced war fatigue by late 2025. While no formal peace had been achieved, even the hint of a roadmap (such as a temporary truce or negotiations around the new year) was enough to spur peace hopes in markets. These hopes helped strengthen the euro and lift European investor sentiment, given Europe’s heavy stake in an end to the conflict. It’s worth noting that gold prices – often a geopolitical risk barometer – initially surged to record highs in early November, but then pulled back slightly as some of these international risks abated.

On the other hand, political risks did not vanish entirely. In the U.S., partisan divides over government spending and debt remain unresolved – the November funding bill was a temporary measure, meaning a potential return of shutdown threats in 2026. Additionally, the approaching presidential election year is expected to bring policy uncertainty (though at this point, markets are assuming a continuation of Trump’s pro-business, tax-cutting stance).

In global politics, U.S.–China strategic rivalry persisted despite the trade truce. A notable flare-up came when President Trump signed a Taiwan relations act in early December, bolstering U.S. support for Taiwan. China’s government angrily condemned this move, and while it did not derail the trade agreement, it underscored ongoing geopolitical tension between the two superpowers. Meanwhile, Japan found itself under U.S. trade pressure earlier in the year (with tariffs on Japanese goods impacting its exports), and those issues remained only partly resolved. Japanese officials in November raised concerns about higher U.S. tariffs on certain goods and their drag on Japan’s industrial output. This indicates that while the U.S. eased up on China and Europe, it has taken a harder line on trade with some allies, an unconventional approach that could have longer-term repercussions.

Lastly, domestic unrest in China (stemming from a property sector crisis and youth unemployment) and in some emerging markets (over high food prices) remained under the radar but could resurface as flashpoints. None of these reached a boiling point in November, but investors are keeping an eye on them as latent risks.

Overall, November saw a reduction in acute political threats to markets. The U.S. government shutdown ended without major damage, trade winds turned more favorable, and even geopolitical conflicts saw tentative improvements (a Gaza ceasefire, hints at Ukraine talks). These developments, collectively, removed some of the tail-risk that had weighed on sentiment earlier in the autumn. They also complemented the macro narrative of lower inflation and easier central banks, giving investors a double dose of relief.

It is telling that the VIX volatility index fell to multi-month lows in late November, and global risk premia compressed – a sign that markets perceived the geopolitical and fiscal backdrop to be improving. Still, as noted, new challenges could emerge (from U.S. election politics to unresolved trade issues), so the landscape remains fluid. But heading into year-end 2025, the major political headwinds were significantly calmed compared to just a month or two prior.

Equity Markets Performance

U.S. equities managed to extend their gains in November, though the advance was minor and marked by significant internal rotation. The S&P 500 index finished the month essentially flat, up roughly 0.1 percent. This tepid result masked a bifurcated market: high-flying technology stocks stumbled after months of outperformance, while previously lagging sectors like financials and industrials took the lead. Indeed, the tech-heavy Nasdaq Composite posted a small loss in November (around minus 0.5 to 1 percent), its first down month since early 2025, as the AI-driven rally in mega-cap tech stocks paused.

In contrast, the Dow Jones Industrial Average, which is weighted more toward cyclical and value stocks, climbed about 1 percent and notched new record highs during the month. On November 12, the Dow closed above 48,250 (a record) even as the Nasdaq slipped, highlighting this divergence. Investors essentially rotated out of richly valued tech and into other areas of the market that stood to benefit from lower interest rates and economic reopening. The S&P 500 Value Index gained 0.4 percent in November, outperforming the Growth Index, which fell 0.2 percent.

Sector-wise, Information Technology was the clear laggard, dropping roughly 4 percent for the month, its worst monthly showing since March 2025. After an extraordinary year-to-date run, tech stocks were hit by a wave of profit-taking and a few stock-specific disappointments. For instance, some of the high momentum AI trade names saw sharp pullbacks: Nvidia shares, despite stellar earnings, seesawed and ended November below their peak; Palantir (an AI software favorite) tumbled more than 15 percent from its highs; and the broader Philadelphia Semiconductor Index fell about 5 percent in November.

This AI wobble in early November was a stark reminder of the market’s heavy reliance on tech. At one point, the S&P 500 and Nasdaq suffered their largest one-day drops in months due to a sharp tech sell-off. As Reuters noted, technology’s weight in the S&P 500 had swelled to approximately 36 percent – higher than even during the dot-com bubble – leaving the index vulnerable to negative developments in that sector. Thus, when tech faltered in November, it restrained the entire market’s advance.

On the flip side, more cyclical sectors rallied. Financials were strong, with bank stocks surging as Treasury yields fell, improving the outlook for interest margins. The S&P 500 Banks index jumped about 6 percent for the month, and heavyweight bank JPMorgan Chase hit a 52-week high. Industrials and transportation stocks also outperformed: the Dow Jones Transportation Average rose 0.8 percent in one mid-month session to its best level in over a year, boosted by airline and railroad shares. Companies like Delta Air Lines and Union Pacific benefited from hopes that, with the government shutdown resolved, operations such as air traffic control staffing would normalize and travel demand would remain robust. Energy stocks were mixed – oil prices plunged, which hurt oil producers’ stocks but helped industries for whom oil is an input, like airlines and chemicals. Utilities and Real Estate sectors got a belated lift from the decline in long-term interest rates, as investors sought high dividend payers once yields on bonds fell.

Market leadership broadened in November: instead of just a handful of tech giants driving index gains (as was the case much of 2025), other groups like small-caps and international stocks saw renewed investor interest. The Russell 2000 (small cap) index, for example, rose about 3 percent for the month, outpacing the S&P, as easier financial conditions tend to aid smaller companies. This rotation is a healthy sign, indicating improving breadth in the equity rally even as the marquee tech names take a breather.

European equity markets had an upbeat November, with many indices climbing to all-time highs. The overall MSCI Europe index (which covers developed European markets) was up 1.49 percent in November and an impressive 31 percent year-to-date through November, outperforming the U.S. market’s YTD gains. Investor sentiment in Europe benefited from the same themes as in the U.S.: declining inflation and the prospect of stable or lower interest rates. Additionally, the reduction in transatlantic trade tensions (with the U.S. delaying auto tariffs and an improving U.S.–China trade climate) buoyed Europe’s export-heavy industries.

Germany’s DAX index and France’s CAC 40 both reached record territory during the month, reflecting optimism that the euro-zone might avoid a severe downturn. In the UK, the FTSE 100 index lagged somewhat (UK stocks were flat to slightly down in November), hampered by a strong pound and weakness in commodity-linked shares. But even there, domestically focused mid-cap stocks rose on hopes that BoE rate cuts in 2026 would revive the British economy.

Asian markets were a tale of two regions. Japan’s Nikkei 225 index continued to climb and at one point breached the 50,000 level, nearing its highest values since the early 1990s. In fact, the Nikkei touched an intra-month peak above 52,000 – marking a new multi-decade record. Japanese equities have been buoyed by robust corporate profits, ongoing share buybacks, and the yen’s weakness, which boosts exporters’ earnings. Automakers like Toyota and tech firms like Sony saw stock gains on anticipation that a modest BOJ rate hike (if it happens) would not derail growth. However, toward the very end of November, the Nikkei did pull back slightly as yen strengthened off its lows on those BOJ hike rumors.

Elsewhere in Asia, emerging market stocks faced headwinds. The MSCI Emerging Markets Asia index fell about 3.2 percent in November, underperforming global markets. A big drag was South Korea, where the KOSPI index dropped 7.9 percent in the month. Korean markets are heavily weighted to semiconductor and electronics names (for example Samsung, SK Hynix), which slumped in tandem with U.S. tech and on concerns of peaking chip demand. Taiwan’s market was similarly down (5.0 percent in November), as its dominant semiconductor firms saw profit-taking after strong runs.

In China, equity performance was mixed. Mainland Chinese indexes (Shanghai and Shenzhen) were roughly flat amid ongoing worries about the property sector and mediocre economic data. However, Hong Kong’s Hang Seng Index managed to rise about 2.5 percent in November, aided by a late-month rally. Hong Kong and China-exposed stocks got a lift from some better news on China’s economy – for example, Chinese GDP growth for Q3 came in a bit above forecasts thanks to government stimulus, and November saw rumors of further policy support for real estate developers. Additionally, the U.S.–China tariff rollback news in late October helped sentiment for Chinese export-oriented companies.

Volatility stayed low; the VIX averaged in the low teens. One notable milestone: the Dow Jones Industrial Average entered December having gained for eight consecutive weeks, its longest weekly winning streak in over four years. This underscores how steadily bullish the late-2025 environment became after the autumn pullback. Still, some caution signs flashed: market breadth, while better than early 2025, was not extremely strong – a handful of megacaps still accounted for an outsized share of YTD gains. And valuations remained elevated, with the S&P 500 forward P/E around 22 to 23x, well above its 10-year average of about 18.8x. Even after the November dip, the tech sector’s forward P/E, approximately 32x, was lofty, prompting some analysts to warn of potential correction if earnings growth doesn’t materialize.

Indeed, strategists from major banks cautioned during the month that U.S. equities might be due for a drawdown, citing those stretched valuations and the market’s heavy reliance on one sector. Thus, while November ended on a broadly positive note for stocks, investors remained mindful of risks from AI bubble concerns to uncertain 2026 economic growth that could introduce volatility down the line.

Notable Corporate Earnings and Stock Moves

U.S. Mega-Cap Tech Earnings: November saw the tail end of the Q3 earnings season, with several mega-cap tech companies reporting results that significantly moved their stocks. Apple, the world’s largest company, announced its fiscal Q4 (September quarter) earnings on October 30. Apple delivered record revenue of 102.5 billion dollars, up 8 percent year-over-year, driven by strong iPhone 17 sales, and quarterly EPS of 1.85 dollars, up 13 percent year-over-year.

These better-than-expected results (especially the iPhone revenue record) propelled Apple’s stock to new all-time highs in early November. Apple briefly traded above 250 dollars, reflecting investors’ enthusiasm for the company’s resilient demand and expanding services business. Apple’s report showed that consumer spending on premium smartphones and wearables remained robust despite a soft macro environment. The company did issue cautious guidance, noting some impact from foreign exchange and the late launch of certain new products, but the market largely looked through it.

In a rare corporate move, Apple also announced layoffs of a few hundred sales staff in November to streamline operations. While any layoffs at Apple are notable (given it had avoided job cuts earlier when peers were downsizing), the affected roles were limited and related to government and enterprise sales teams, some of whom were constrained during the shutdown. This minor cost-cutting was taken as a positive sign of discipline. Overall, Apple’s earnings underscored the strength of its ecosystem, and its stock finished November with roughly a 5 percent gain for the month, adding to its impressive year-to-date rise.

Perhaps the most anticipated report was from Nvidia, the poster child of the 2023 to 2025 AI boom. Nvidia announced blowout Q3 FY2026 earnings on November 19, smashing expectations yet again. Revenue came in at 57.0 billion dollars for the quarter, up 62 percent year-over-year, a new record, with data center sales (AI chips) surging to 51.2 billion dollars. Both revenue and EPS handily beat analyst estimates, and the company raised guidance for the next quarter, projecting an unheard-of 65 billion dollars in Q4 revenue. These numbers illustrated extraordinary demand for Nvidia’s AI accelerators (Blackwell GPU chips), which CEO Jensen Huang said are sold out as compute needs keep accelerating and compounding in the AI era.

Upon the earnings release, Nvidia’s stock initially spiked around 5 percent in after-hours and the following morning, briefly pushing Nvidia’s market cap near 1.7 trillion dollars. This upbeat reaction buoyed the tech sector broadly for a short time. However, in the days after the report, Nvidia’s stock surrendered those gains and turned negative, as some traders took profits and worried that even fantastic results might not propel the stock much higher given its rich valuation. Furthermore, a separate development weighed on Nvidia and its peers: reports emerged that Meta (Facebook) was considering sourcing some AI chips from Alphabet’s Google, which has started designing its own AI semiconductors. This news on November 25 sent Nvidia’s shares down about 2.6 percent and hit other chipmakers like AMD, which dropped 4.1 percent that day, as investors mulled rising competition in the AI hardware space.

In any case, Nvidia’s year-to-date stock gain remained enormous (well over 200 percent), and it continued to be the top-performing S&P 500 component of 2025. But November showed that even Nvidia is not immune to profit-taking and that expectations have risen incredibly high – any hint of a plateau in its AI dominance could jolt its stock and the market.

Alphabet (Google’s parent company) had an eventful month as well. While Google’s Q3 earnings (released in late October) were solid – driven by a rebound in advertising and steady cloud growth – the bigger buzz came from its advancements in Artificial Intelligence. On November 18, Google launched Gemini 3, its latest AI model, and notably integrated it directly into Google Search from day one. CEO Sundar Pichai touted Gemini 3 as Google’s most intelligent model yet, capable of handling text, images, and complex reasoning tasks. The immediate embedding of this AI into core products like Search and Gmail signaled Google’s aggressive push to compete with OpenAI’s ChatGPT and Microsoft’s AI offerings.

Alphabet’s stock jumped over 6 percent in the two days around the Gemini 3 announcement. In fact, on November 24, Google shares rose 6.3 percent – their biggest one-day gain in years – after the company demoed Gemini’s capabilities and some Wall Street analysts upgraded the stock. Google’s rally made it one of November’s best-performing megacaps and briefly lifted its market cap above 2 trillion dollars again. The AI war is clearly heating up: Google’s moves put pressure on OpenAI and Microsoft, and as noted, Meta and others are seeking alternate AI chip suppliers to reduce reliance on Nvidia. This dynamic introduced new competitive threads in the tech industry that investors are now parsing. For example, could Google’s Tensor Processing Units challenge Nvidia’s GPUs in the long run? Will Amazon or others follow suit in chip design? So far, it’s early stages, but Google’s strong execution in AI in November reassured investors that it remains a formidable player in the space.

Other U.S. tech giants mostly reported in late October, but their stock moves carried into November. Microsoft delivered better-than-expected earnings, with Azure cloud growth re-accelerating to around 29 percent, and issued optimistic guidance on AI services demand. Its stock hovered near record highs around 400 dollars through most of November, though it dipped slightly when the tech sector sold off mid-month. Meta Platforms had surged in October after an earnings beat (driven by a rebound in ad spending and promising VR and AI developments), but Meta shares gave back some gains in November, down approximately 4 percent, amid the broader tech pullback and the aforementioned news that its data center strategy might involve third-party AI chips, potentially favoring Google over Nvidia.

Amazon surprised the street with a big revenue beat and margin improvement in Q3, announced in late October, propelling its stock up around 10 percent. In November, Amazon largely held those gains, trading strong on the back of record-setting holiday shopping forecasts. Early reports suggested Black Friday and Cyber Monday sales were robust, and AWS cloud continued to grow. Toward month-end, Amazon did face an EU antitrust complaint related to marketplace practices, but this had limited stock impact.

Tesla was relatively quiet news-wise in November, but its stock rebounded about 5 percent during the month after a steep drop earlier in the fall. Investors weighed Tesla’s challenges – declining profit margins due to price cuts and rising EV competition globally – against upcoming catalysts. The long-awaited Cybertruck delivery event took place in late November, with Elon Musk handing over the first few Cybertrucks to customers. Reception of the Cybertruck was mixed, but it kept Tesla in headlines. Additionally, speculation grew that Tesla might announce a share buyback or other shareholder-friendly moves as its cash pile grows – another factor that lent support to the stock. Still, Tesla remained roughly 25 percent below its 2025 highs, showing that not all big-cap stocks have been market darlings equally.

Stepping outside the mega-cap universe, corporate earnings in other sectors produced some eye-popping stock moves in November, reflecting a very selective environment for winners versus losers.

Consumer and Retail: Several mid-sized retail companies delivered huge surprises that sent their stocks soaring. Department store chain Kohl’s reported Q3 earnings on November 21 that smashed expectations – notably, Kohl’s showed growth in sales and improved its profitability outlook as new marketing initiatives paid off. The result: Kohl’s stock exploded 42 percent in one day after earnings, one of its largest single-day gains ever. Similarly, apparel retailer Abercrombie and Fitch astonished the market with a massive earnings beat and raised guidance, fueled by a successful brand turnaround and inventory management. ANF shares surged 37 percent on November 21, reaching their highest level in over a decade. These dramatic jumps underscore that pockets of consumer spending (especially among younger shoppers, in ANF’s case) are strong, and that some retailers have navigated the post-pandemic shifts adeptly.

On the other hand, not all was well in retail. Discount chain Burlington Stores issued a weak report and cautious holiday outlook, causing its stock to plunge 12 percent. Burlington struggled with tightening consumer budgets at the low end and inventory snafus, reminding investors that the retail landscape is bifurcated. Macy’s and Foot Locker also fell on lackluster results. Meanwhile, big-box leaders Walmart and Target (which reported earlier) showed diverging trends – Walmart had strong grocery sales and lifted forecasts, whereas Target cited soft discretionary spending. These outcomes collectively hint at a U.S. consumer that is becoming more value-conscious, with strength in essentials and selective splurges but weakness in more discretionary or lower-end segments.

Transportation and Travel: The easing of the shutdown and generally solid travel demand aided names like Delta, American Airlines, and Southwest, which all saw their stocks up high-single-digit percentages in November. There was some turbulence mid-month when a few airlines guided that Q4 revenue might be at the lower end of estimates, citing higher fuel costs earlier and Middle East conflict impacting certain routes. But by end-month, with oil prices collapsing, airline stocks were rallying on the improved profit margin outlook. The Dow Transports index reaching new highs was largely thanks to airlines bouncing off their autumn lows and FedEx continuing to execute cost cuts.

In autos, aside from Tesla, the traditional Big Three automakers (GM, Ford, Stellantis) finally resolved the UAW labor strikes by early November, resulting in new contracts with significant wage increases. Initially, those higher labor costs sparked concern, but auto stocks actually rose in November as investors were relieved that production could normalize and because sales remained healthy. Ford stock gained approximately 10 percent in November, helped also by reports it’s reaccelerating EV development with Chinese partnerships.

Financials: Big banks (JPMorgan, Bank of America, Citi) generally drifted higher as mentioned, benefiting from the yield curve steepening. On the investment banking side, Goldman Sachs and Morgan Stanley got a lift late in the month when deal activity showed signs of life. November saw a few large IPO filings and M&A deals. Additionally, there was speculation that with the Fed cutting soon, capital markets and trading revenues would pick up. One noteworthy development: Berkshire Hathaway disclosed significant stock buybacks and new investments in its Q3 report, which investors read as a bullish signal on value stocks. Berkshire’s stock hit all-time highs, contributing to the financial sector’s strength.

Energy and Industrials: The energy sector was a mixed bag. Despite the plunge in oil prices, many refiners and petrochemical firms saw margin improvement due to cheaper crude feedstock, so names like Valero and Dow Inc. rose. However, pure E and P (exploration and production) companies fell with oil. In industrials, defense contractors like Lockheed and Northrop had been rallying due to global tensions, but the Gaza ceasefire and talk of Ukraine peace led to some cooling off in defense stocks in late November. Instead, infrastructure and construction plays like Caterpillar, which gained around 8 percent, took the baton, as investors bet on U.S. fiscal spending on infrastructure and the housing sector stabilizing with lower rates.

Healthcare: Pharma giants Merck and Pfizer underperformed as they grapple with patent cliffs and, in Pfizer’s case, declining COVID vaccine sales. But biotech staged a small comeback in November after a brutal year, aided by a couple of positive drug trial results at the American Heart Association conference. One example was a new cholesterol-lowering drug. CVS Health jumped after announcing a CEO change and cost cuts. Healthcare was overall not a focus in November’s market narrative, as its defensive nature was less in demand during a risk-on, rate-cut-anticipation phase.

Notable Tech and Media Moves: One standout gainer was Zoom Video. The pandemic-era videoconferencing star reported earnings that beat estimates, with stable user trends and improved profitability as it upsells enterprise products. Its stock popped nearly 10 percent post-earnings, a welcome rebound for a stock that had been heavily sold off earlier in the year. This suggests some of the stay-at-home tech names have found a bottom and can grow again from a smaller base.

In media, Netflix traded volatilely. Early in the month it surged on speculation of strong viewership for new content and rumors of an acquisition (later debunked) of a legacy studio. But by month-end Netflix gave back gains as some hit shows were delayed by the Hollywood actors’ strike, which finally ended around Thanksgiving.

One common theme in Q3 earnings was better-than-feared results. According to FactSet, S&P 500 aggregate earnings grew modestly in Q3, ending the earnings recession of the past year. Profit margins showed resilience even as revenue growth was meager. Many companies cited cost efficiencies and still-solid demand. As a result, about 80 percent of S&P companies beat EPS expectations, a higher share than usual. However, guidance for Q4 was often cautious – firms mentioned macro uncertainties, the delayed impact of high rates, and in some cases, higher labor costs (post union deals) as reasons to be conservative.

Still, the market’s reaction function in November was clear: reward the positive surprises generously, as seen with Kohl’s and Abercrombie, and punish any disappointments swiftly, such as Burlington. This led to outsized single-day moves, reflecting the currently liquid and momentum-driven trading environment.

Overall, the corporate earnings picture in November added fuel to the market by confirming that many companies are navigating the high-rate environment well. Top-line growth has slowed in many industries, but margins are not cratering – indicating resilience. Moreover, sectors that were under pressure like retail and industrials showed that with the right strategy, strong results are achievable. With the Fed expected to ease, many companies also struck a more optimistic tone about 2026.

That said, the stark contrast between winners and losers grew more pronounced: investors have little patience for underperformance when ample alternatives exist, so dispersion in stock returns is high. The months ahead will test whether the market’s lofty valuations for the winners (especially in tech) are justified by continued growth, or whether a broader re-rating might occur if the economy slows.

For now, November’s takeaway was that earnings are good enough to keep the bull case intact, especially if interest rates indeed head lower soon.

Bitcoin and Ethereum

The cryptocurrency market extended its remarkable resurgence in November, led by record-shattering moves in the two largest digital assets, Bitcoin and Ethereum. Bitcoin in particular had a milestone month: prices exploded to new all-time highs, driven by a potent mix of favorable market momentum and growing institutional acceptance. After consolidating around 70,000 dollars in October, Bitcoin surged rapidly in early November.

It blew past its previous peak (around 69,000 dollars from late 2021) and kept climbing, reaching approximately 89,000 dollars at one point. Around Thanksgiving, BTC was trading in the high 80,000s, representing about a 30 percent gain in November alone. By month-end it settled near 87,000 dollars, still up significantly from the start of the month. This rally solidified Bitcoin’s status as one of 2025’s top-performing assets, up over 130 percent year-to-date.

Several factors fueled the run. First, the anticipation and subsequent arrival of spot Bitcoin ETFs unleashed a wave of institutional demand. U.S. regulators had approved the first spot BTC ETFs earlier in 2025, and by November, those funds were accumulating coins. The very existence of easily accessible Bitcoin ETFs increased mainstream legitimacy for crypto. Second, the macro backdrop of falling real interest rates and a peaking U.S. dollar provided a favorable environment for alternative assets like gold and Bitcoin. Indeed, Bitcoin’s rally coincided with gold’s surge, both seen as hedges in a world of abundant liquidity and geopolitical uncertainty.

Third, crypto-specific dynamics, such as the upcoming Bitcoin halving (expected in spring 2026, which will halve BTC’s mining issuance rate), historically tend to boost prices in anticipation. And finally, a general risk-on mood in markets and FOMO likely played a part – as BTC broke to new highs, more buyers piled in, including retail investors, leading to a parabolic move.

That said, November wasn’t entirely one-way traffic: toward month-end, volatility spiked, with Bitcoin briefly dipping from about 89,000 dollars to 80,000 dollars before rebounding, demonstrating its continued price swings. News of regulatory actions or large whale sales occasionally caused sharp intraday moves. For example, when some early Bitcoin ETF filings showed smaller-than-expected initial inflows, BTC had a quick pullback. Nonetheless, the overarching trend remained bullish.

Ethereum, the second-largest crypto, also rallied in November, though it lagged Bitcoin in magnitude. Ether began the month around the mid 2,000s and climbed steadily, crossing the 3,000 dollar threshold by late November. It touched highs around 3,100 dollars during the month, which is the highest level Ether had seen since early 2024. By November 30, ETH was hovering near 3,000 to 3,050 dollars, up roughly 20 percent for November.

Unlike Bitcoin, Ethereum did not break its all-time high (which was around 4,950 dollars in November 2021), but the trajectory was positive and investors are optimistic about upcoming catalysts. A major one is the Ethereum Fusaka network upgrade scheduled for December 2025, which is expected to improve the network’s throughput and efficiency. Anticipation of this upgrade has coincided with increased accumulation by large Ether holders (whales), signaling confidence in Ethereum’s technical roadmap.

Additionally, speculation grew that the SEC could approve a spot Ethereum ETF in 2026, following on the heels of the Bitcoin ETF approvals. Such an ETF would open ETH to a wave of institutional capital. For now, institutional participation in Ethereum is seen via futures ETFs and trusts, but a spot product would be a game-changer.

Like Bitcoin, Ethereum benefited from the macro tailwind of potential Fed easing – lower yields make non-yielding assets like crypto relatively more attractive. Ethereum’s fundamentals also showed strength: network activity in terms of fees generated and transactions picked up in November, partly thanks to a boom in tokenized real-world assets and continued interest in DeFi protocols.

The broader crypto ecosystem reflected these gains. The total cryptocurrency market cap surpassed 3.2 trillion dollars in November, nearing its all-time high. Other altcoins rallied, though with significant variance. Bitcoin’s market dominance rose above 55 percent, as BTC drew disproportionate interest, a typical pattern during the early stages of a crypto bull market. Some popular altcoins like Solana and Ripple saw double-digit percentage gains in November, buoyed by positive project developments and, in Solana’s case, a resurgence of developer activity.

Regulatory news was mixed but did not derail the rally. In the U.S., the SEC delayed some decisions on smaller crypto ETFs, but a U.S. judge also dismissed a high-profile lawsuit against a crypto exchange, which the market took as a legal victory. In Europe, new MiCA regulations (Markets in Crypto-Assets) were being finalized, which actually created more clarity for crypto firms operating in the EU. These regulatory steps, while increasing compliance costs, ultimately legitimize the crypto industry and were thus welcomed by many investors.

One cannot mention crypto in late 2025 without noting gold’s performance in parallel. Gold prices hit fresh records above 4,100 dollars per ounce in November, which is striking as gold and Bitcoin often draw comparisons as alternative stores of value. In November they both rose strongly – a sign that investors were hedging fiat currency debasement and geopolitical risks through multiple avenues. However, gold’s climb was more about real-world uncertainties and perhaps central banks buying gold at record pace, whereas Bitcoin’s surge had a heavier speculative fervor element.

There were moments when Bitcoin’s rapid ascent showed signs of excess – for example, funding rates in crypto futures turned highly positive, meaning many traders were leveraged long, and anecdotal reports of retail frenzy emerged. Yet, unlike the 2017 or 2021 episodes, this time there is a belief that institutional support via ETFs and major asset managers endorsing crypto could make the cycle more durable.

By the end of November, some analysts warned of a potential short-term pullback or consolidation in crypto, given such a rapid run-up. Indeed, early December saw Bitcoin dipping slightly as some profit-taking occurred. But the overall sentiment in the crypto market was bullish entering the final month of 2025. The successful resolution of key uncertainties such as regulatory approvals and macro turning point has re-energized the space. If Ethereum’s Fusaka upgrade goes smoothly and if the Fed indeed cuts rates, crypto proponents argue there could be further upside as liquidity conditions improve. Skeptics, on the other hand, caution that crypto remains highly volatile and macro-sensitive. For instance, if the Fed were to delay cuts or if the economy fell into recession, crypto could retrace.

For now, November will be remembered as a breakout month that cemented crypto’s resurgence, with Bitcoin making history by reaching new heights and reclaiming the mantle of digital gold in spectacular fashion.

Commodities and Other Assets

Oil markets experienced a dramatic downturn in November, flipping from a concern of scarcity to an outlook of oversupply. The price of crude oil plunged to its lowest levels in over two years. U.S. benchmark WTI crude fell roughly 17 percent in November, sliding from the mid 70s per barrel at the start of the month to around 58 dollars by month-end. International Brent crude likewise dropped from approximately 80 dollars to about 62 dollars.

Multiple factors drove this steep decline. On the supply side, there were growing signs of ample supply and even glut potential heading into 2026. The U.S. Energy Information Administration raised its domestic output forecasts, projecting U.S. oil production will hit record highs thanks to shale drilling efficiencies. Similarly, non OPEC producers like Brazil and Guyana have been ramping up output. OPEC Plus itself maintained production cuts during November, but rumors swirled that some members were cheating on quotas given the high prices earlier – leading traders to suspect actual supply was higher than official figures.

Additionally, concerns about Iranian oil returning to markets grew as diplomatic negotiations over Iran’s nuclear program made headway including a U.S.–Iran prisoner deal in October that some saw as a thaw. If sanctions on Iran were eased, that could unleash hundreds of thousands of barrels per day, further boosting supply.

On the demand side, a few developments pointed to softness. Global economic growth forecasts were revised down slightly, with Europe barely skirting recession and China’s recovery weaker than hoped, meaning lower oil demand growth. U.S. demand showed mixed signals. Gasoline consumption was decent, but distillate demand – a proxy for industrial activity – was lackluster. Moreover, November is a seasonally weaker period for crude demand as refinery maintenance season in the U.S. curtails crude buying.

Together, these supply demand shifts created a sentiment that the 2024 oil market might be oversupplied. Once oil prices broke key technical levels (WTI breaking below 65 dollars in mid-month), momentum selling kicked in. By late November, traders were focused on the possibility of peace deals in conflict areas reducing geopolitical risk premiums. The Israel–Hamas ceasefire eased fears of Middle East supply disruptions, and tentative Ukraine peace chatter suggested Russian oil flows – which had been ongoing but under sanctions – would remain stable or even increase. In fact, Russian Urals crude has been trading well below the G7 price cap, indicating plentiful Russian exports despite the war. JP Morgan even published a forecast citing Brent at 57 dollars in 2027 due to structural forces, underscoring the bearish long-term sentiment that took hold.

By end of month, oil analysts’ narrative shifted from 100 dollar oil back to lower for longer. OPEC Plus was set to meet in late November or early December, and many expected the cartel to announce new production cuts to try to floor prices. The swift collapse in oil prices was a boon for global inflation, aiding central banks’ fight, but it raised concerns for oil-exporting nations and the energy industry’s capital expenditure plans.

Natural gas markets diverged regionally. U.S. Henry Hub gas prices actually rose modestly in November (from around 3 to 3.25 dollars per MMBtu) as early winter cold spells in parts of the U.S. boosted heating demand. European natural gas, in contrast, fell amid unusually warm late-fall weather and high storage levels. Dutch TTF gas futures dropped approximately 10 percent to around 30 euros per MWh, far below crisis levels of 2022. The ample European gas storage near 95 percent full entering winter and steady LNG inflows have calmed fears of a winter crunch, even with the Israel–Hamas conflict initially raising concerns about Middle East LNG supply.

The metals sector saw some striking moves, particularly in precious metals. Gold prices soared to all-time highs during November, hitting 4,135 dollars per ounce at one point. This is more than double gold’s price just 3 to 4 years ago, and reflects a confluence of bullish drivers: falling real interest rates as nominal yields drop and inflation, while lower, remains above 2 percent in many places, a weaker dollar which makes gold cheaper in other currencies, and robust safe-haven demand. Geopolitical uncertainties – from wars to trade tensions – and central banks’ voracious gold buying, particularly by China, Russia, and Middle East countries diversifying reserves, have provided strong support for gold.

In November specifically, the anticipation of Fed rate cuts was a catalyst. When weak U.S. data emerged like soft consumer confidence and signs of labor market cooling, markets assumed a December Fed cut was a done deal, which fueled gold’s rally.

Some observers also pointed to hedging against equity volatility – with stocks near highs, savvy investors increased gold allocations as a hedge. Notably, gold’s surge came even as immediate crisis fears such as a U.S. default or a broad war receded, implying structural demand beyond just panic buying. By the end of November, gold had settled slightly below the peak, around 4,050 dollars, as profit-taking set in and the dollar bounced off lows.

Silver followed gold’s lead, jumping to about 55 dollars per ounce, its highest since 2011, given silver’s dual role as precious and industrial metal – benefiting from both safe-haven flows and optimism around solar panel demand.

Industrial metals like copper and aluminum had a more muted month. Copper traded roughly flat around 4.00 dollars per pound. Economic data from China, which consumes half the world’s copper, was mixed, and while U.S. construction and EV demand are supportive, the market is fairly balanced. Some excitement came from reports of low exchange inventories and predictions that 2026 could see a copper deficit due to surging electric vehicle and grid investments – but those are longer-term factors. For now, copper seems range-bound as traders await a clearer global growth trend.

Aluminum prices eased slightly on improved supply, as China ramped up smelter output as power costs fell, and moderate demand. Lithium, the battery metal, continued its downward correction; lithium carbonate prices in China fell again in November, nearly 70 percent off their 2022 peak, as a wave of new mining supply especially from Australia and Africa alleviated the once-insatiable EV battery demand crunch. This has been a relief for EV producers like Tesla, who noted lower battery input costs, but a challenge for lithium miners whose share prices have slumped.

In currencies, aside from the dollar softening broadly (DXY near 99 to 100), some specific moves stood out. The Japanese yen hit around 155 per USD, then firmed to approximately 150 as BOJ hike expectations grew – still far weaker than 130 at the start of 2025. The British pound rose to 1.27 dollars, a multi-month high, on bets the BoE would eventually ease less aggressively than the Fed given U.K. inflation still a bit higher.

Emerging market currencies generally strengthened as global risk appetite improved – for example, the Brazilian real gained 3 percent versus USD, and the Indian rupee recovered slightly from record lows after the RBI intervened. One exception was the Turkish lira, which hit new record lows (TRY 30 per USD) as Turkey’s central bank, despite huge rate hikes this year, struggled to rein in inflation – a reminder that not all EMs are out of the woods on inflation.

Lastly, bond markets had notable moves beyond sovereign yields. Corporate bonds rallied as spreads tightened, and even some distressed debt saw buyers. The U.S. 10-year TIPS inflation-protected yield fell under 2 percent again, after nearing 2.5 percent earlier – a boon to many asset valuations. Global bonds enjoyed their best month of 2025, with major aggregate bond indices up over 2 to 3 percent in November as prices rose. One headline in fixed income: Italy’s 10-year yield dropped from 5 percent to 4.3 percent after the ECB’s no-hurry-to-cut stance reassured investors about policy stability. Italian bonds had been hit in October on deficit worries, but recovered in November.

Another was Chinese government bonds rallying when the PBoC cut banks’ reserve ratio in an attempt to stimulate growth – the 10-year Chinese yield fell to 2.5 percent, a multi-year low, highlighting China’s distinct easing cycle.

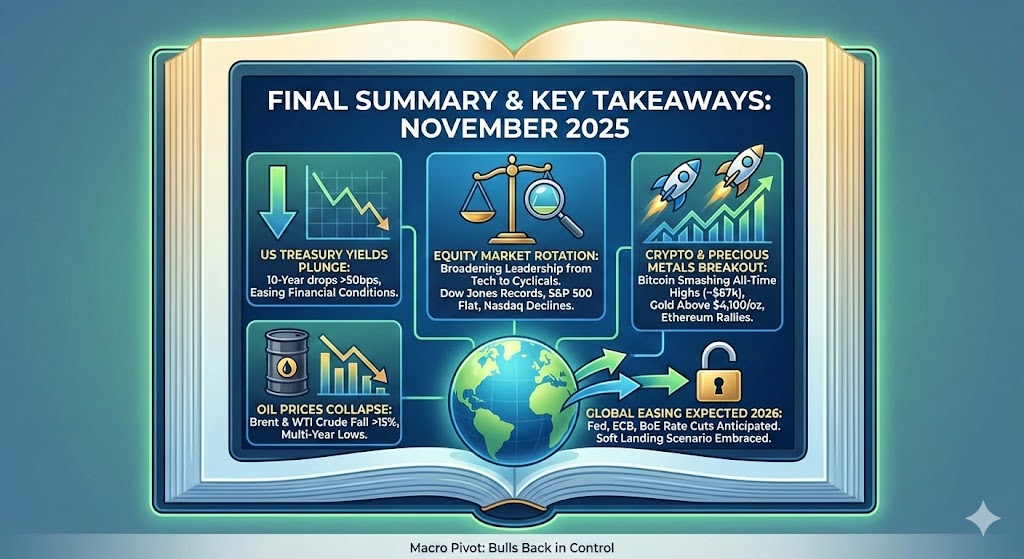

Final Summary and Key Takeaways

November 2025 marked a pivotal month across financial markets, characterized by a sharp pivot in macro expectations, a widening of equity market leadership, and breakout moves in crypto and precious metals. The dominant theme was the market’s conviction that the global monetary tightening cycle is effectively over.

Inflation continued to cool in the U.S. and Europe, prompting bond markets to price in multiple rate cuts starting in early 2026. U.S. Treasury yields plunged across the curve, with the 10-year yield falling over 50 basis points during the month, easing financial conditions and reigniting risk appetite.

Equity markets responded with resilience, though the path was not uniform. The S&P 500 ended November nearly flat, but under the surface there was a clear rotation out of mega-cap tech and into cyclicals like financials, industrials, and small caps. This shift suggested healthier market breadth and reflected expectations that rate relief would benefit economically sensitive stocks. Notably, the Dow Jones Industrial Average outperformed, hitting record highs, while the Nasdaq saw its first monthly decline in several months. International markets also performed well — European indices reached new all-time highs, Japan’s Nikkei tested 52,000, and Latin America rallied strongly. China remained a laggard, though Hong Kong equities rebounded slightly.

Earnings season was mostly encouraging. Major tech players like Apple, Nvidia, Google, and Microsoft posted strong results, with AI and cloud themes driving momentum. Retail and industrials produced some of the month’s biggest single-day stock gains on surprising earnings beats, showing that pockets of the real economy remain robust. However, stock market gains were not evenly distributed. Valuations for tech giants remained elevated, prompting profit-taking even on good news, while stocks that missed expectations saw steep drawdowns. Market participants rewarded execution and forward visibility, while punishing weak guidance.

Crypto markets stole the spotlight. Bitcoin smashed its previous all-time highs, rising over 30 percent in November to trade near 87,000 dollars. Ethereum followed with a 20 percent rally, breaking above 3,000 dollars. Institutional interest, spot ETF flows, the upcoming halving, and favorable macro conditions drove this surge. Crypto’s strong performance coincided with gold’s breakout to record highs above 4,100 dollars per ounce — a sign that alternative assets are in demand as investors hedge against inflation, currency debasement, and central bank policy shifts.

Oil prices, in contrast, collapsed. Brent and WTI crude both fell over 15 percent, hitting multi-year lows amid supply surpluses, soft demand, and fading geopolitical risk premiums. This decline in energy prices helped support the disinflation narrative and added fuel to the bond rally. Industrial metals were mixed, while silver tracked gold higher. Currency markets saw the dollar weaken broadly, lifting many emerging market and developed currencies.

The macro narrative now revolves around a synchronized global easing cycle in 2026. Markets are expecting the Fed, ECB, and even the BoE to begin cutting rates in Q1 or Q2. Whether this rate optimism proves premature will be the key risk heading into December and early 2026. For now, markets are embracing a soft landing scenario — one where inflation continues to recede, growth remains positive, and central banks start to ease without triggering instability.

In conclusion, November delivered a broad-based risk rally driven by falling yields, optimism on policy, and investor willingness to look beyond short-term headwinds. Stocks, crypto, gold, and bonds all rallied in concert, suggesting a macro pivot. The challenge going forward will be whether this optimism is matched by economic and earnings data in the new year. But for now, bulls are back in control.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.