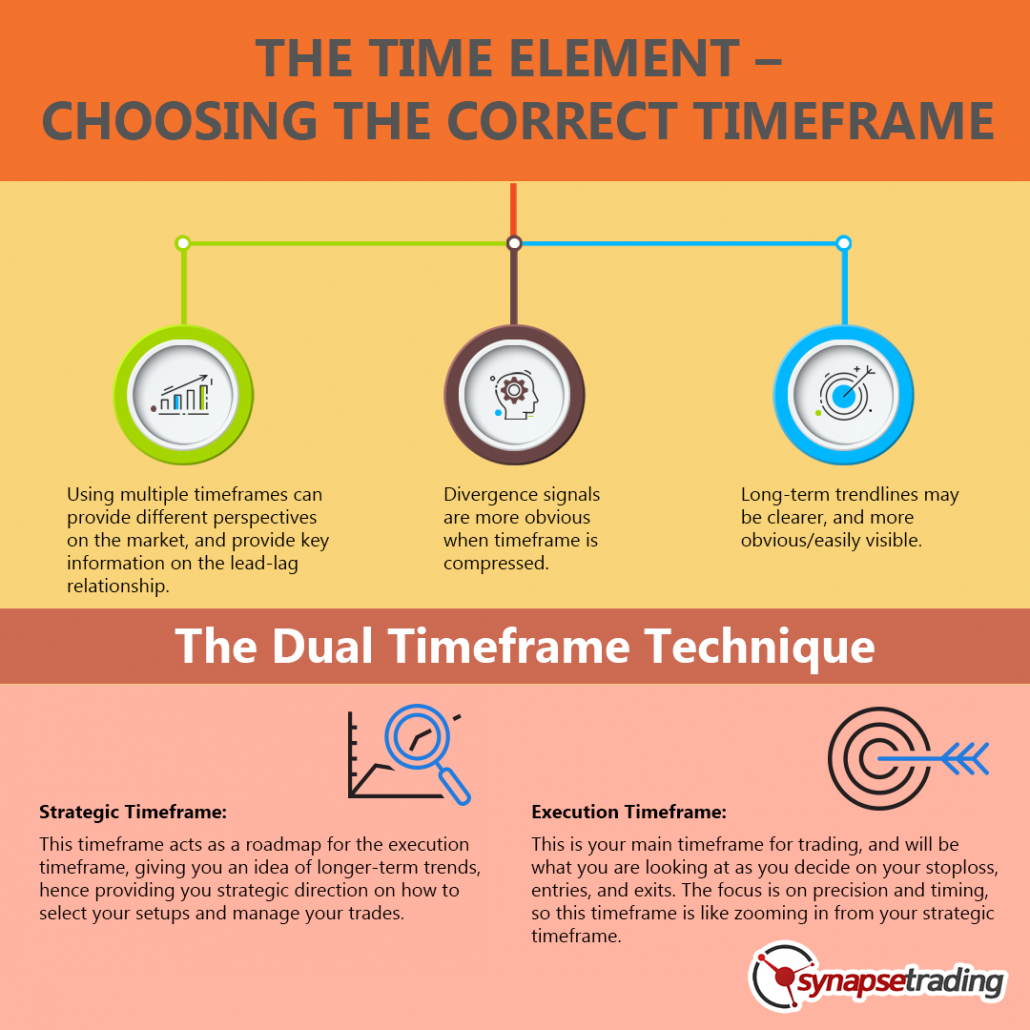

Every trader knows that using multiple timeframes can provide different perspectives on the market, and provide key information on the lead-lag relationship.

Small timeframes lead larger ones, and larger ones drive the smaller ones. Understanding the inter-play is crucial.

Since trends exist on different timeframes, it makes sense to analyse at least two timeframes.

For example, if one’s main timeframe is the daily chart, one can consult the weekly chart to see the big picture.

This allows investors to analyze a particular trend against the perspective of the next higher timeframe.

If one is using swing counts, a lower/higher high/low in the weekly and monthly charts can provide perspectives not seen in daily charts.

Long-term trendlines may be clearer, and more obvious/easily visible.

Certain price patterns are more visible on long-term charts (key reversals, triangles on weekly), as well as long -term support and resistance levels.

A trend change signal on the short-term (daily) may only be a retracement in the long-term (weekly) chart.

On the other hand, a trend change signal in the long-term chart may be a substantial move in the short-term even though a short-term move may seem overdone.

Hence, an overdone breakout on the short-term trend may actually be the start of a major breakout if the long-term chart is still on an uptrend.

Divergence signals are also more obvious when timeframe is compressed, for example a price-volume divergence is more obvious on the weekly compared to the daily.

Divergences on the larger timeframes also point to larger moves, and could herald major reversals.

The Dual Timeframe Technique

This involves using 2 different timeframes to trade, one to provide the roadmap and the other to time the precise entries and exits.

Strategic Timeframe: This timeframe acts as a roadmap for the execution timeframe, giving you an idea of longer-term trends, hence providing you strategic direction on how to select your setups and manage your trades.

Execution Timeframe: This is your main timeframe for trading, and will be what you are looking at as you decide on your stoploss, entries, and exits. The focus is on precision and timing, so this timeframe is like zooming in from your strategic timeframe.

For example, for my strategies, I use:

- Strategic Timeframe: Weekly chart

- Execution Timeframe: Daily chart

- Expected holding period: Can last for a few days to a few weeks (if the trend is strong)

If you are doing intraday trading, then your strategic timeframe might be the daily chart, while your execution timeframe might be the 5-minute or 15-minute chart.

In conclusion, using multiple timeframes allows one to better identify trends, and more precisely pinpoint entries and exits by zooming in and zooming out from the initial point of reference.

This also allows one to better manage risk in line with one’s time horizon and investment timeframe.

If you would like to learn how to get started in trading, also check out: “The Beginner’s Guide to Trading & Technical Analysis”

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.