Bullish Harami Cross & Bearish Harami Cross

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Table of Contents

What Is a Harami Cross?

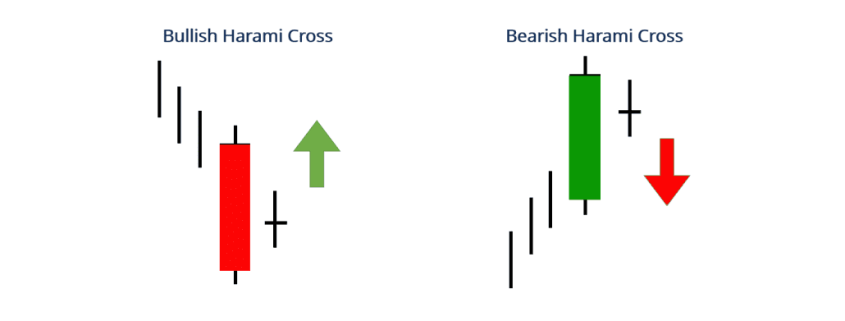

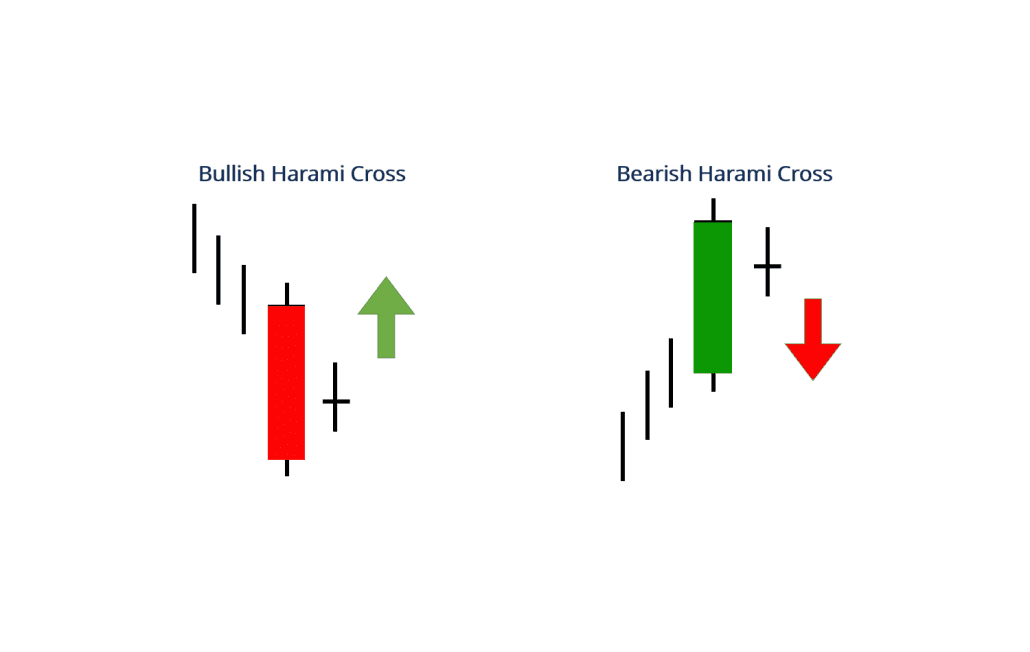

A harami cross is a Japanese candlestick pattern that consists of a large candlestick that moves in the direction of the trend, followed by a small doji candlestick.

The doji is completely contained within the prior candlestick’s body.

The harami cross pattern suggests that the previous trend may be about to reverse.

The pattern can be either bullish or bearish.

The bullish pattern signals a possible price reversal to the upside, while the bearish pattern signals a possible price reversal to the downside.

Understanding the Harami Cross

A bullish harami cross pattern forms after a downtrend.

The first candlestick is a long down candle (typically colored black or red) which indicates that the sellers are in control.

The second candle, the doji, has a narrow range and opens above the previous day’s close.

The doji candlestick closes near to the price it opened at.

The doji must be completely contained within the real body of the previous candle.

The doji shows that some indecision has entered the minds of sellers.

Typically, traders don’t act on the pattern unless the price follows through to the upside within the next couple of candles.

This is called confirmation.

Sometimes the price may pause for a few candles after the doji, and then rise or fall.

A rise above the open of the first candle helps confirm that the price may be heading higher.

A bearish harami cross forms after an uptrend.

The first candlestick is a long up candle (typically colored white or green) which shows buyers are in control.

This is followed by a doji, which shows indecision on the part of the buyers.

Once again, the doji must be contained within the real body of the prior candle.

If the price drops following the pattern, this confirms the pattern.

If the price continues to rise following the doji, the bearish pattern is invalidated.

Harami Cross Enhancers

For a bullish harami cross, some traders may act on the pattern as it forms, while others will wait for confirmation.

Confirmation is a price move higher following the pattern.

In addition to confirmation, traders may also give a bullish harami cross more weight or significance if it occurs at a major support level.

If it does, there is a greater chance of a larger price move to the upside, especially if there is no nearby resistance overhead.

Traders may also watch other technical indicators, such as the relative strength index (RSI) moving up from oversold territory, or confirmation of a move higher from other indicators.

For a bearish harami cross, some traders prefer waiting for the price to move lower following the pattern before acting on it.

In addition, the pattern may be more significant if it occurs near a major resistance level.

Other technical indicators, such as an RSI moving lower from overbought territory, may help confirm the bearish price move.

Trading the Harami Cross Pattern

It is not required to trade the harami cross.

Some traders use it simply as an alert to be on the lookout for a reversal.

If already long, a trader may take profits if a bearish harami cross appears and then the price starts dropping after the pattern.

Or, a trader in a short position may look to exit if a bullish harami cross appears and then the price starts rising shortly after.

Some traders may opt to enter positions once the harami cross appears.

If entering long on a bullish harami cross, a stop loss can be placed below the doji low or below the low of the first candlestick.

A possible place to enter the long is when the price moves above the open of the first candle.

If entering a short, a stop loss can be placed above the high of the doji or above the high of the first candle.

One possible place to enter the trade is when the price drops below the first candle open.

Harami cross patterns don’t have profit targets.

Therefore, traders need to use some other method of determining when to exit a profitable trade.

Some options include using a trailing stop loss, finding an exit with Fibonacci extensions or retracements, or using a risk/reward ratio.

Concluding Thoughts

The harami cross pattern is a significant indicator for traders looking to identify potential reversals in market trends.

While it can signal a change in direction, it’s essential to use it in conjunction with other technical indicators and strategies to confirm its validity.

Whether trading a bullish or bearish harami cross, proper risk management through the use of stop-loss orders and careful analysis of market conditions is crucial.

Incorporating the harami cross into a broader trading strategy can enhance decision-making and potentially improve trading outcomes.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

The Synapse Network is our dedicated global support team, including event managers, research teams, trainers, contributors, as well as the graduates and alumni from all our previous training program intakes.

Leave a Reply

Want to join the discussion?Feel free to contribute!