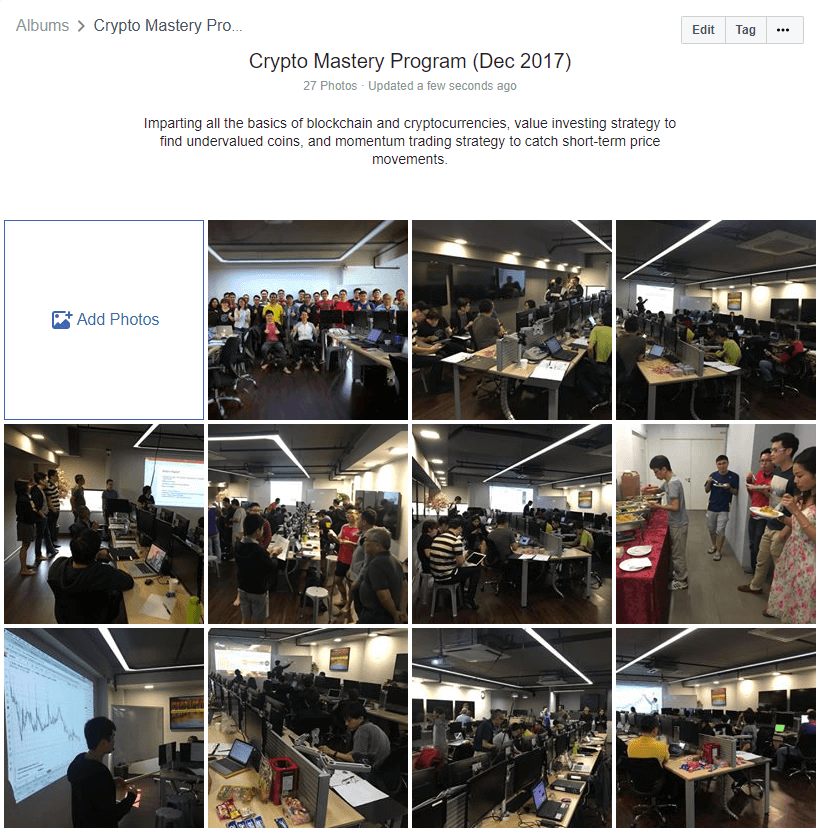

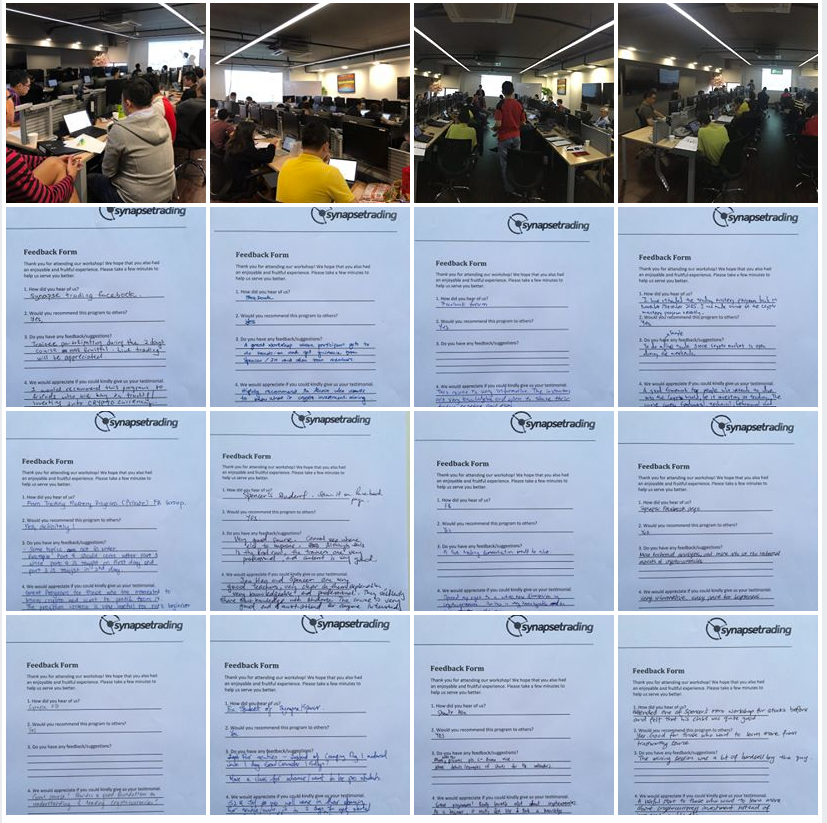

Last weekend, we conducted out first run of the “Crypto Mastery Program”, and it was a full-house turnout for our first batch of crypto enthusiasts!

Based on the feedback we got, this is the first and only fully comprehensive course on Cryptocurrencies in Singapore, which covers:

- Fundamentals of Blockchain technology, cryptocurrencies, bitcoins, Alt coins, etc

- Value investing strategies to find undervalued coins for long-term investment

- Technical analysis & short-term trading strategies to capture smaller price movements, and to time the entry for long-term investments

- ICOs (initial coin offerings) and how to profit from them while avoiding the scams

- How to mine for coins with zero technical knowledge (includes free tour to mining farm)

- How to create a diversified portfolio of crypto assets to ride this next big wave of wealth creation

This course is taught by 2 trainers:

- Spencer Li – Self-made millionaire professional trader with 10+ years of experience, and specialises in technicals & price action

- Ong Jun Hao – Crypto trader who made 100x returns in less than a year, and specialises in fundamentals & news analysis

Registration is open for 2018: https://wp.me/P1riws-78a

Training Feedback from Attendees:

“Attended CMP on 2-3 Dec 2017. Great course with very resourceful contents, covered wide range of topic from Background, ICOs, Mining, Investing, Trading and Portfolio Allocations. Comprehensive explanation from both Spencer and Jun Hao on fundamental valuation and technical trading perspective. The course contents are suitable both beginners and advanced traders who are looking to step into Cryptocurrency.” – ZT

“Great programme! Really learned alot about cryptocurrencies. As a beginner, it really felt like I took a knowledge express train. Jun Hao & Spencer are also very willing to share their knowledge!” – Aw Jian Yang

“A useful start to those who want to learn more about cryptocurrency investment instead of jumping in blindly.” – Susan Tan

“SL & JH are well verse in their domain. For newbie/noob, it is 2 days well spent to get started in Crypto World.” – Gary Koh

“Great course! Provides a good foundation to understanding & trading cryptocurrencies!” – Ed

“Very informative, easy pace for beginners.” – Al

“Opened my eyes to a whole new dimension on cryptocurrencies. Jun Hao is very knowlegeable on cryptocurrency.” – Eugene

“Jun Hao and Spencer are very good teachers, very clear in their explanation, very knowledgeable and professional. They selflessly share their knowledge with students. The course is very good and must attend for anyone interested in cryptocurrency investing and trading.” – Adrian

“Great program for those who are interested to know crypto and want to profit from it. The program content is very useful for both beginner and advanced traders. Definitely must attend couse.” – Kwaw Zaw Than

“A good framework for people who intends to dive into the crypto world, be it investing or trading. The course covers fundamental, technical, behavioral and news analysis, which makes it comprehensive. Thank you Spencer and Jun Hao for the wonderful sharing.” – Darrell Su

“This course is very informative. The instructors are very knowledgeable and open to share their trading experience and tips.” – CW Tay

“Highly recommended to those who wants to know what is crypto/invetsment/mining.” – YC

“I would recommend this program to friends who are keen in trading/investing into cryptocurrencies.” – Goh Lily

“Attended the first cryptocurrency course and it was extremely informative for a complete newcomer such as myself. The theory behind it was in-depth, coupled with practical examples which helped consolidate what we learnt. Turns out cryptocurrency isn’t as complex as is looks and sounds. Both spencer and jun hao were forthcoming, constantly highlighting the pitfalls of dabbling in cryptocurrencies. Great introductory lesson for those just starting out. What i liked was also how the tools could be employed across all financial instruments will also benefit me as an equity investor.” – Wei Keong

(click here to see full album)

(click here to see full album)

Register Early to Avoid Disappointment!

All of slots are closed for 2017, but we have opened new slots for 2018, so those who are keen can start registering now to avoid disappointment, as our last course was sold out within a week after we opened the registration.

Registration link: https://wp.me/P1riws-78a

Good luck to all future “Crypto Millionaires”, and see you all at the top! 😀