When it comes to trading, most people think that trading is stressful and boring because it involves staring at a screen the whole day and watching prices move, and then having to execute trades at lightning speeds to make any profits.

That is quite often what is shown in the movies, and very much dramatized.

In reality, there are many different kinds of trading, and here is a simple infographic depicting the main categories.

Source: Forex Useful

Source: Forex Useful

Generally, what you see in the movies tend to depict scalpers and day traders, which is the most stressful kind of trading. I myself tried it for a couple of years, but it started to take a toll on my health, which I decided was not worth the money, even though it was pretty good.

Position trading is more useful in timing the market to build your long-term portfolio, as I mentioned in my previous blog post: https://synapsetrading.com/how-to-build-a-1m-dollar-portfolio-by-30-the-practical-stuff/

Hence, I find that the most useful kind of trading for anyone who is doing it part-time, or does not want to get too stressed out, is to use a swing trading approach. This means taking tactical positions to capture the medium to long-term trends.

With just 15 minutes a day, it is more than enough for me to place and manage my swing trades, which leaves me more free time to focus on the things that matter in life.

Of course, there are some drawbacks to swing trading as well, for example your income will be more lumpy as compared to intraday trading, and you will need a ton of patience in waiting to enter the perfect trades, and also waiting for trades to play out.

In summary, the type of trading style really depends on each individual personality and amount of free time, but personally I prefer to use the swing trading approach because it gives me the best returns for my time and effort.

Do you know what is your preferred style, and does it play to your strengths? 😀

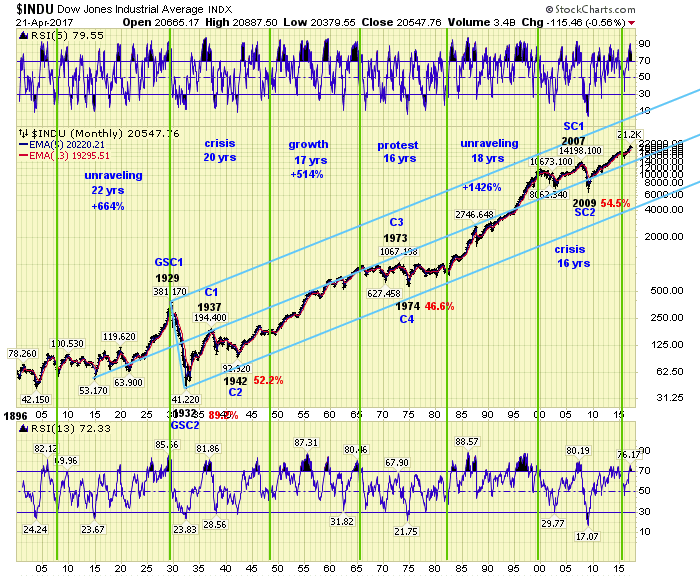

Chart: S&P 500 index (weekly chart)

Chart: S&P 500 index (weekly chart)

Source: The Market Oracle

Source: The Market Oracle