Looking at the “Trade Ideas” whiteboard at the centre of the trading arcade, I have updated the key directions for the day. The strongest currencies were AUD and JPY (missed out NZD), while the weakest was Gold. Note that this was updated at 2.30pm, before the major moves in these currencies actually occured later on.

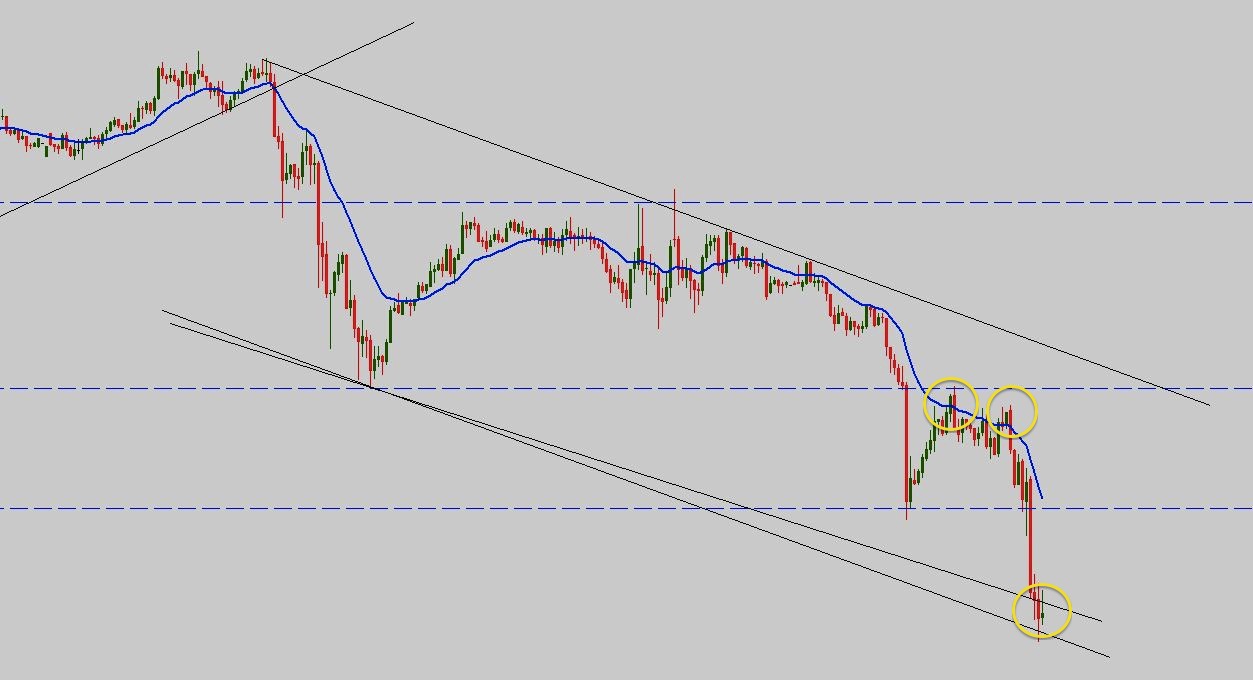

I did a couple of swing trades using some of the trend plays and breakout plays, but my best trade for the day was gold. Looking at the chart above, I managed to catch the turning point just before the plunge.

Overall, today was a pretty good day, since I did not have any losing trades. I also came to a realisation that the stoploss and targets were only guides, and not an excuse to delay action. For example, the SL is only a last resort, the worst-case scenario, not an excuse not to admit you are wrong. “Take a loss when you want to, not when you have to.”

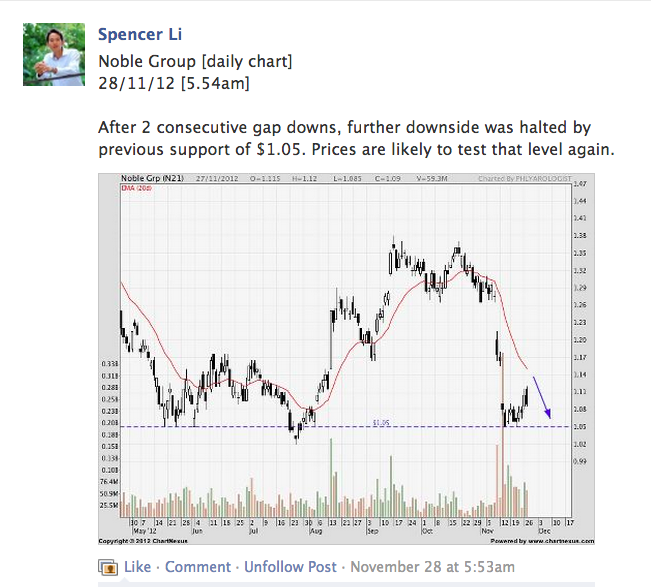

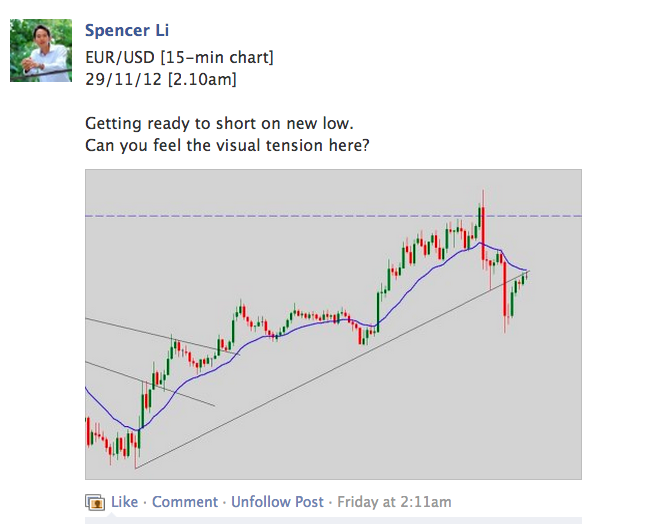

Notice that all the calls on the “trade ideas” whiteboard are spot-on. I have shared in the forum and we have placed our trades for tonight, let’s watch if the GBP/USD trades lower the next few days.