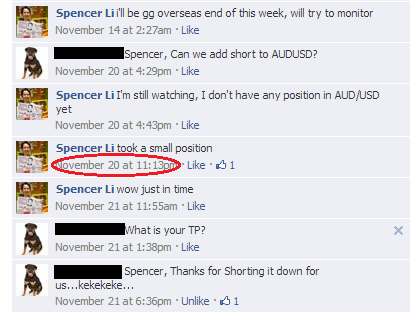

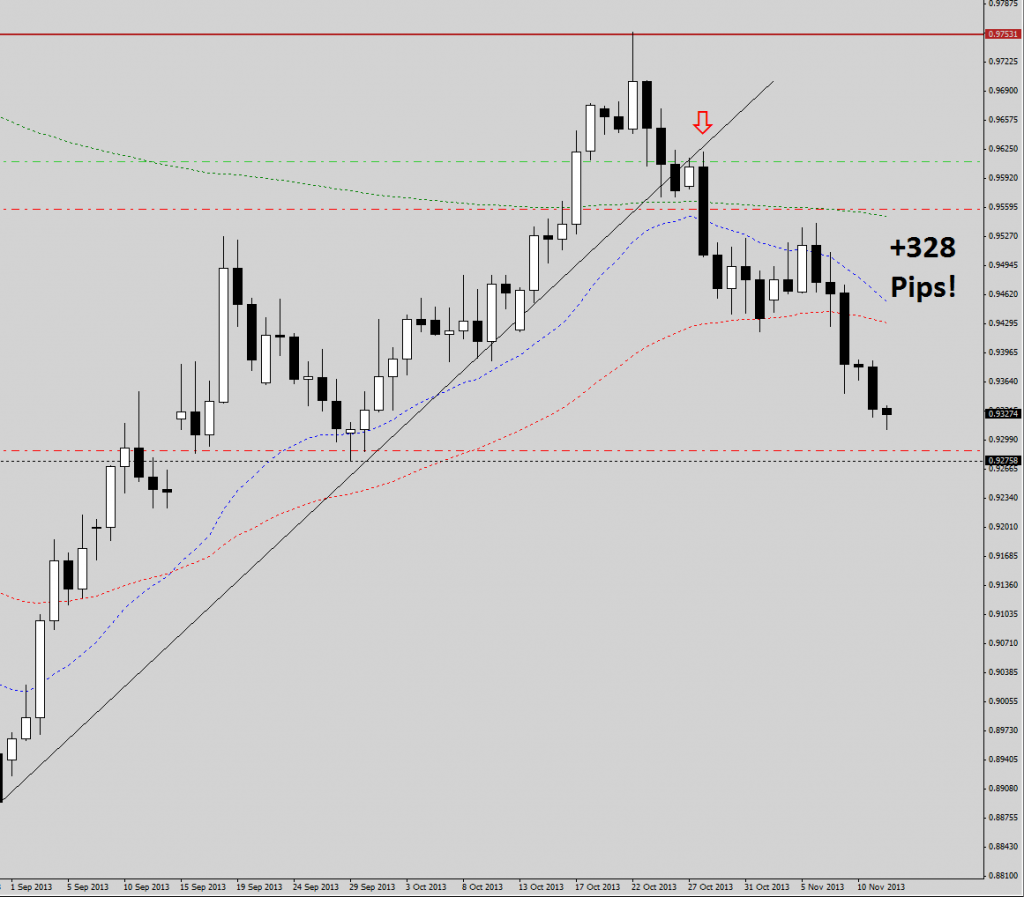

Before I jetted off for my holiday, I left a parting gift by posting to go long on USD/JPY and to go short on AUD/USD. I took a few lots of positions myself, which I mentioned in yesterday’s “holiday windfall” post.

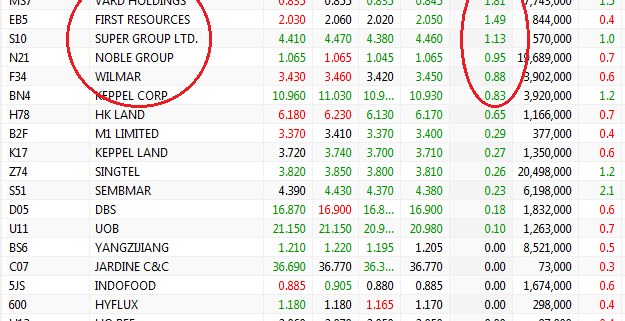

Many of my students also took the trade, but of course most of them traded smaller lot sizes in line with our risk management parameters (refer to P&L screenshot below).

This shows that you do not need to risk a lot of capital just to “punt” for windfall gains, or spend hours clicking in front of the screen just to make a few quick bucks. It is all about strategy, timing & positioning, which can be done with as little as 30 mins a day.

I will finally reveal this secret of my hands-free trading technique in my last seminar of this year, but I will limit it to only 30 seats.

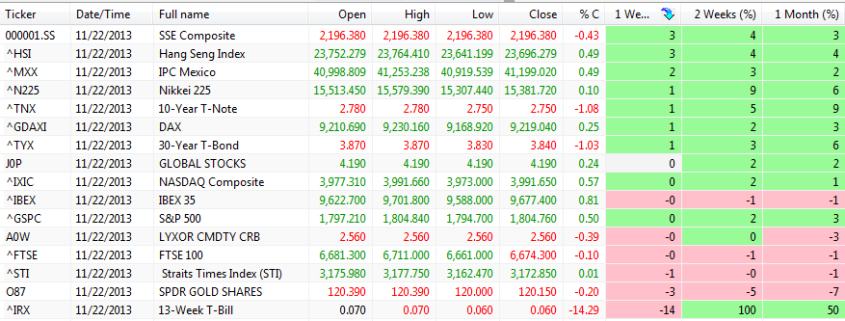

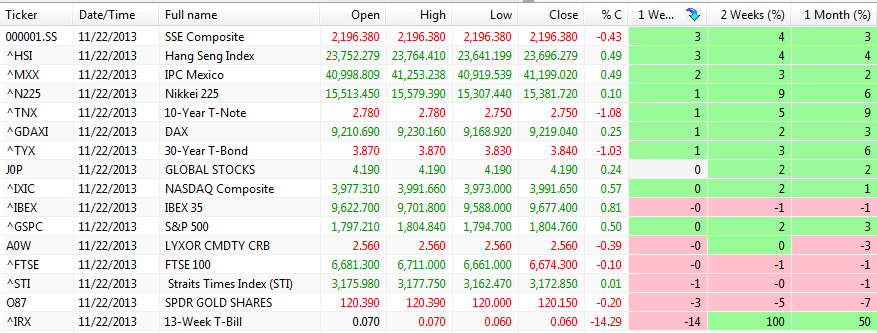

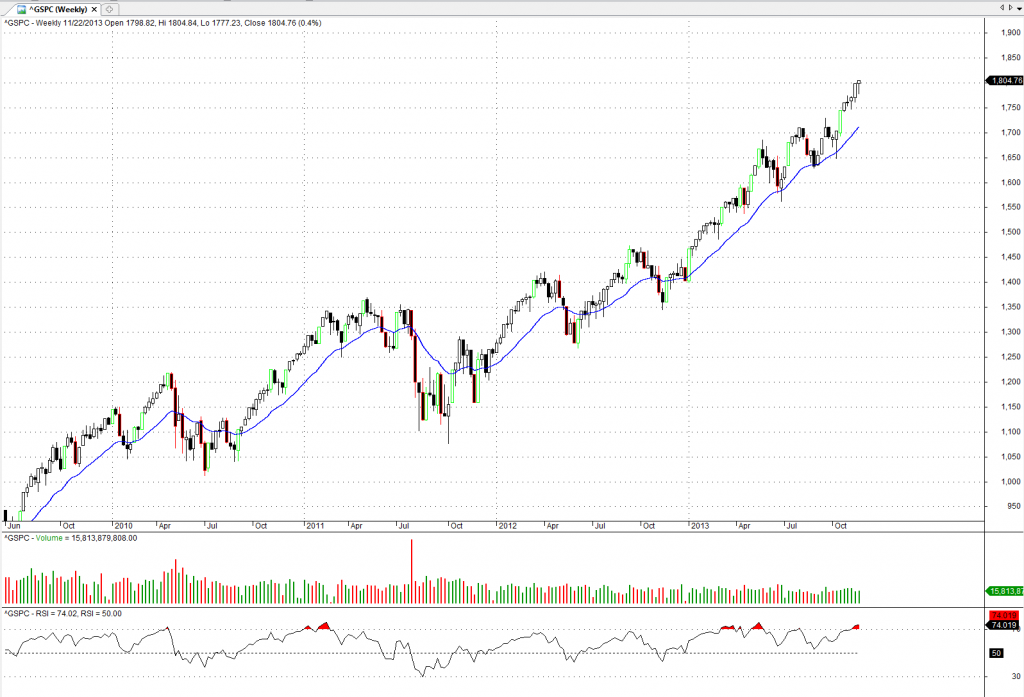

Took profits on some positions, and continued to trail my stoploss for a larger move.

Took profits on some positions, and continued to trail my stoploss for a larger move.

YangZiJiang – Still not moving yet, but keep an eye on it. Very promising.

YangZiJiang – Still not moving yet, but keep an eye on it. Very promising.