After Crashing 20%, Is Facebook Stock a Good Buy Now?

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

Just last month, I made a trip to the Facebook HQ in Silicon Valley, and I was very impressed by the work culture and vibe of the whole community there. It made me glad to be a shareholder of Facebook, and since then, I have been waiting for an opportunity to buy more of it. 😀

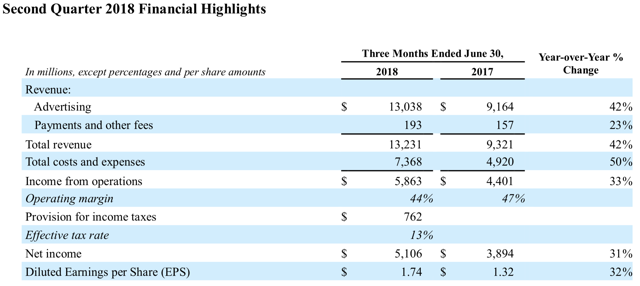

Yesterday, after a disastrous Q2 earnings call, Facebook’s stock has plunged almost 20% so far; is this the start of something really bad, or the long-awaited chance to buy this stock?

Personally, I am a big fan of the tech sector, and I have been accumulating positions in the US tech giants since I liquidated all my Singapore stocks portfolio in 2015. but I am not going to jump in blindly, so let me sum up some of the key considerations:

- The comment that spooked investors was the CFO’s prediction that revenue growth rates would continue to decelerate in the “high single-digit percentages” in Q3 and Q4.

- While the results were not as fantastic as in the past, the disparity to analysts’ revenue and user growth forecast were not very major.

- Facebook is likely being extremely conservative and has plenty of opportunities to gain back the momentum.

- They are constantly innovating and acquiring new companies, some of these might turn out to be big winners

- Its valuation based on PE is still ok compared to other stocks in the tech sector (about 30x)

The last time there was a plunge in FB shares due to the Cambridge Analytica scandal, it dropped almost 10% overnight in March. However, prices recovered very quickly, and before long prices were back to hitting all time highs, bringing valuation close to a $1 trillion market cap.

Some of the key risks could include more regulations that will hurt its bottom line, or anti-trust actions that attempt to split up the company.

But there are also upsides, such as the company leveraging on its technological innovations and data to expand to other industries and eat up the value chain.

So, in conclusion, I will not buy in immediately as I do not want to be catching a falling knife, instead I will wait for selling momentum to wane and the dust to settle before scooping up more of this stock. This is to ensure that I can get in at the best price. After all, I am still optimistic for the long run.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!