Advanced Block Pattern

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

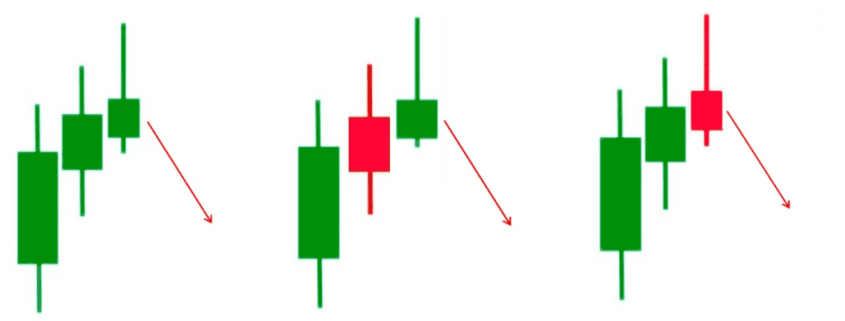

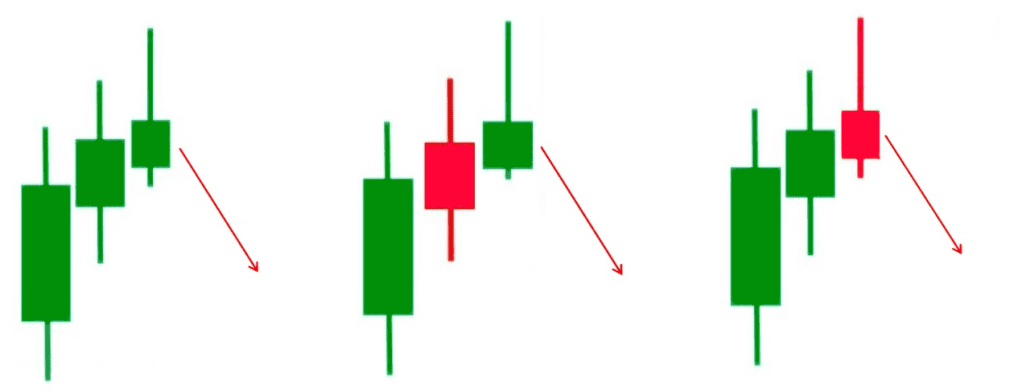

An advance block is a candlestick trading pattern that typically suggests a potential reversal from an upward trend to a downward trend. This pattern is formed by three consecutive candlesticks and is generally considered bearish. However, some analysts note that the pattern can also lead to a continuation of the bullish trend instead of a reversal.

Table of Contents

Key Characteristics of an Advance Block

The advance block candlestick pattern is identified by the following features:

- Upward Trend: The pattern appears after an established upward trend or a significant bounce within a broader downtrend.

- Three Candles: The pattern consists of three consecutive white (bullish) candlesticks, each with progressively shorter real bodies.

- Open Positions: The opening prices of the second and third candles fall within the real bodies of the previous candles.

- Upper Shadows: The upper shadows of the candles, particularly the last one, become progressively taller, indicating increasing selling pressure.

Interpretation of the Advance Block Pattern

The advance block pattern is often seen as a precursor to a bearish reversal, particularly when it occurs during temporary upward moves within a larger downtrend.

The pattern suggests that the bullish momentum is weakening, as indicated by the progressively shorter real bodies and the increasing upper shadows.

A reversal is confirmed if the price drops below the midpoint of the first candle’s real body in the following sessions.

Trading Psychology Behind the Advance Block

In this pattern, the first candle represents strong bullish sentiment, pushing the price to a new high.

However, the second candle opens lower, signaling a potential loss of momentum. This lower opening may cause concern among bulls who expected higher prices following the strong first candle.

The third candle’s lower opening and weaker performance further indicate that buying power is diminishing.

If the security fails to continue gaining and instead reverses, it confirms the bearish reversal, suggesting that traders are beginning to take profits or initiate short positions.

Limitations of the Advance Block Pattern

- Reliability: The success rate of the advance block pattern in predicting reversals is only slightly better than random, making it a less reliable standalone signal.

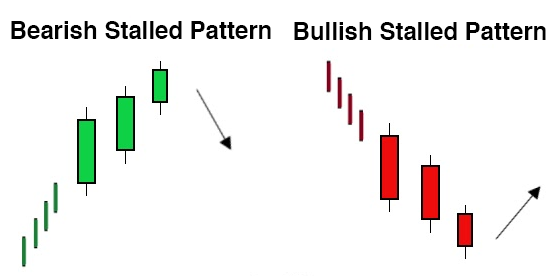

- Bullish Continuation: The pattern can sometimes lead to a continuation of the bullish trend, especially if the security continues to rise and trades above the third candle’s shadow.

Concluding Thoughts

The advance block candlestick pattern is a useful tool for traders looking to anticipate potential reversals in upward trends.

However, its reliability is not particularly high, and it is best used in conjunction with other technical indicators or chart patterns.

Understanding the context of the overall trend and looking for confirmation in subsequent price action can help traders make more informed decisions when encountering this pattern.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

The Synapse Network is our dedicated global support team, including event managers, research teams, trainers, contributors, as well as the graduates and alumni from all our previous training program intakes.

Leave a Reply

Want to join the discussion?Feel free to contribute!