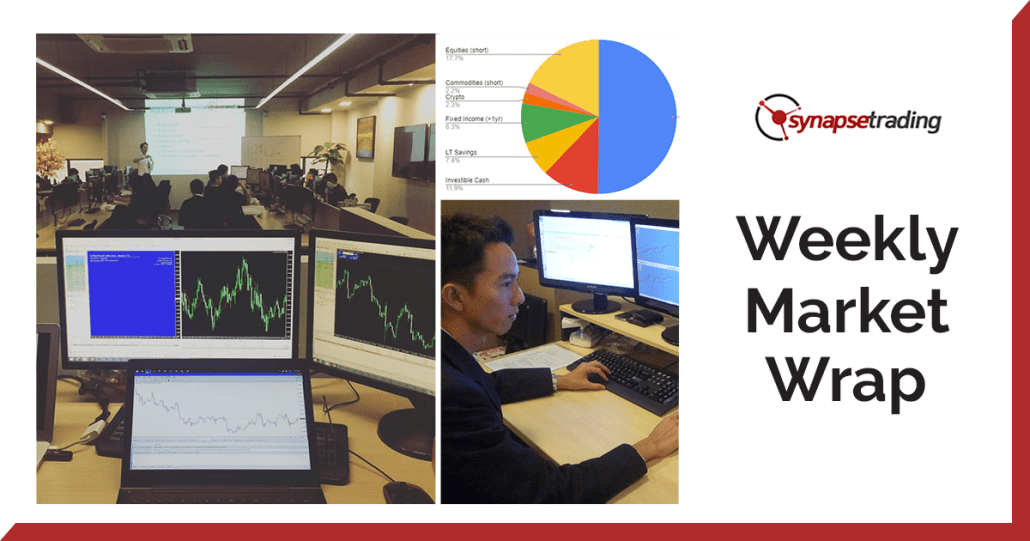

Weekly Market Wrap: CPI and FOMC Coming Up Next Week!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technicals, economics, and portfolio management:

Click here for last week’s market report (05 June 2023)

Click here to subscribe for the latest market report (12 June 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Last week presented a mixture of concerns and optimism in the financial world.

Morgan Stanley strategists painted a bearish picture for US equities, warning of potential corporate earnings falls that could hamper the ongoing rally. This was based on an expected 16% decrease in S&P 500 earnings per share this year, underpinned by a deteriorating liquidity backdrop, slowing revenue growth, and contracting margins.

On the other hand, there were still attractive investment opportunities identified in Japanese, Taiwanese, and South Korean equities, as well as developed-market government bonds and the dollar.

Investors also eyed the Fed’s potential response to the easing of inflation, as predicted by Evercore ISI strategists, which could provide continued support for the stock market.

The financial landscape was also shaped by potential shifts in interest rates and commodity prices.

The strong economic performance has challenged the expected significant interest rate cuts by the Federal Reserve this year, with derivative markets now predicting the Fed’s target rate to reach around 5% by year-end.

In tandem with this, the decreasing global commodity prices offered some relief for central banks in their battle against inflation, though the persistent inflation could still necessitate further rate hikes.

Amid these dynamics, the SEC’s charges against Binance for alleged securities law violations had a noticeable impact on the cryptocurrency market, driving prices down.

The week also saw significant movements in individual stocks, such as Apple reaching its highest price in its stock’s 43-year history, and surprising decisions from global central banks, like the Bank of Canada’s unexpected rate hike.

As we transition into the new week, the focus should remain steadfast on the key economic indicators due for release.

The Labor Department’s consumer prices data set for Tuesday will shed light on the current inflation scenario. This has been a persistent concern for both investors and policymakers alike, and further escalations could prompt market volatility.

Additionally, Wednesday’s producer price data will provide a broader perspective on the state of inflation across various sectors. These figures together will set the stage for the Federal Reserve’s policy meeting conclusions, adding another dimension to the inflation narrative.

The Federal Reserve’s decision on interest rate adjustments will undoubtedly be a highlight of the week. As the market continues to grapple with inflation, a change in the interest rate could significantly influence market sentiments.

A keen eye should also be kept on retail sales and consumer sentiment updates due later in the week, providing insights into consumer spending and confidence amidst current economic conditions.

Moreover, investors should tune into the earnings reports from Oracle, Adobe, Kroger, and Lennar Corporation for a more comprehensive understanding of the corporate landscape and sector-specific performance. These reports could potentially offer hints at market trends to come.

Daily Trading Signals (Highlights)

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

NZDCAD – Following up on this trade, it has hit our TP! Congrats to those who followed! 💰🔥💪🏻

Now that prices are in the oversold zone, there is likely a rebound before the next leg down.

EURGBP – This has hit our TP for 163 pips profit, but since the price is still very bearish, you can consider taking half profits and letting the other half run.

Congrats to those who took this trade! 💰🔥💪🏻

AUDNZD – Prices nearing top of range, and RSI in overbought zone, will watch for bearish price action here to take a short position.

Do note that current short-term price action is very bullish, so there needs to be a few bearish price bars to justify a short-term price reversal.

USDSGD – Prices have hit our first TP, and now looks to be forming a potential bull flag or cup & handle pattern.

If the breakout is successful, there is a good chance for another leg up.

EURAUD – Following up on this trade, prices have started falling, putting this trade in the money, and it is halfway to our TP. 💪🏻💰🔥

Bitcoin (BTCUSD) – Price dropping back to the support zone after the news of Binance getting sued came out.

Can either wait for the dust to settle, or take the chance to accumulate some long positions and just place a SL below the support zone.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!