What is the Best Investment During a Recession?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Are you curious about what a recession is, how it happens, and what its effects are on the financial markets?

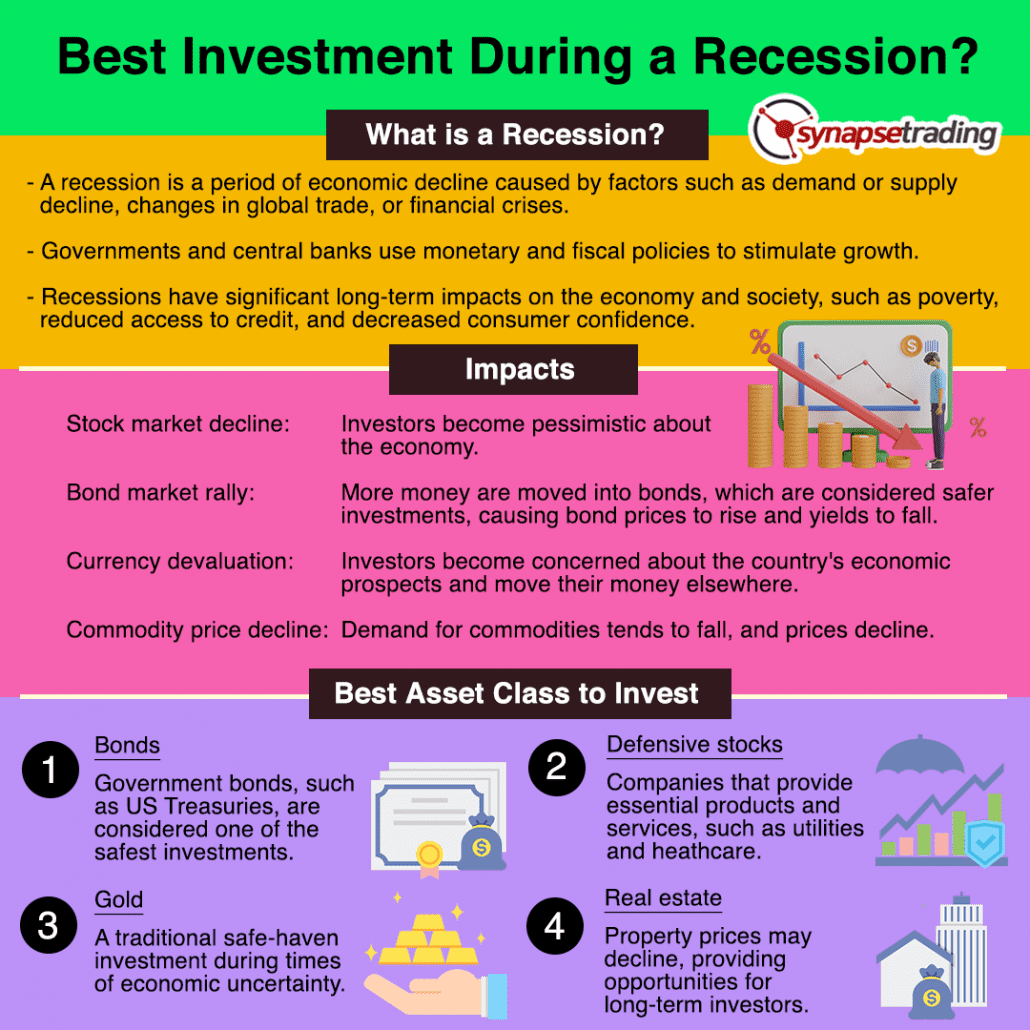

A recession is a period of economic decline, and its causes can vary from tight monetary policy to geopolitical events.

However, the impact of a recession can be widespread, including increased poverty rates and reduced access to credit.

But, there are strategies that investors can adopt to minimize the negative effects of a recession.

In this blog post, I will talk about the early warning signs of a recession, and the best asset class to invest in during a recession.

Table of Contents

What is a Recession?

A recession is a period of economic decline characterized by falling Gross Domestic Product (GDP), rising unemployment rates, and contracting consumer and business spending.

It is typically caused by a variety of factors, such as a decline in demand, an increase in supply, or a change in consumer behavior.

Recessions can be triggered by a variety of events, such as an economic shock, a geopolitical event, or a financial crisis.

They can also be caused by external factors, such as changes in global trade patterns or shifts in commodity prices.

To combat a recession, governments and central banks often use a combination of monetary and fiscal policies to stimulate economic growth, such as lowering interest rates, increasing government spending, and providing tax incentives.

Recessions can have significant long-term impacts on both the economy and society, such as increased poverty rates, reduced access to credit, and decreased consumer confidence.

Causes of a Recession

A recession can be caused by various factors, including:

- Tight monetary policy: When the central bank raises interest rates to control inflation, it can cause a recession as it reduces borrowing and spending.

- Bursting of asset bubbles: If there is a speculative bubble in asset prices, such as in real estate or the stock market, a sudden drop can cause a recession.

- External shocks: Major events such as natural disasters, wars, or pandemics can disrupt the economy and lead to a recession.

- Fiscal policy: Changes in government spending or taxation can affect the economy and lead to a recession.

- Supply shock: A sudden change in supply, such as a major oil price increase, can lead to a recession.

- Banking crises: A major banking crisis can cause a recession by reducing lending and investment.

- Trade imbalances: Large trade imbalances or protectionist policies can cause a recession by disrupting international trade.

These are just a few of the factors that can contribute to a recession, and often a combination of multiple factors can lead to a recession.

What are the Early Warnings Signs of a Recession?

There are several early warning signs that may indicate a potential recession.

Some of these signs include:

- Inverted yield curve: This occurs when short-term bonds have a higher yield than long-term bonds, which is a sign that investors have lost confidence in the economy’s long-term prospects.

- High levels of debt: When individuals, corporations, or governments take on excessive debt, it can create a financial burden that can be difficult to sustain in the long run.

- Slowdown in job growth: If job growth begins to slow down or unemployment begins to rise, it may be an indication that the economy is weakening.

- Decrease in consumer spending: When consumers start to cut back on spending, it can signal a decrease in consumer confidence and a weakening economy.

- Decline in the stock market: A significant decline in the stock market can indicate that investors are worried about the economy’s prospects.

It is important to note that no one indicator can predict a recession with certainty, and there are often multiple factors that contribute to an economic downturn.

However, by keeping an eye on these early warning signs, policymakers and investors can take steps to mitigate the impact of a potential recession.

How Does a Recession Affect the Financial Markets?

A recession can have a significant impact on the financial markets.

Here are some historical examples of how recessions have affected the markets:

- Stock market decline: During a recession, stock markets tend to decline as investors become pessimistic about the economy. For example, during the 2008 recession in the United States, the S&P 500 fell by around 56% from its peak in October 2007 to its low in March 2009.

- Bond market rally: When stock markets decline, investors often move their money into bonds, which are considered safer investments. This can cause bond prices to rise and yields to fall. For example, during the 2008 recession, the yield on the 10-year US Treasury bond fell from around 4% in mid-2007 to below 2% by the end of 2008.

- Currency devaluation: In some cases, a recession can cause a country’s currency to lose value. This can happen if investors become concerned about the country’s economic prospects and move their money elsewhere. For example, during the Asian financial crisis in the late 1990s, the Thai baht lost around 50% of its value against the US dollar, while the Indonesian rupiah lost around 80% of its value.

- Commodity price decline: During a recession, demand for commodities such as oil, copper, and gold tends to fall, which can cause prices to decline. For example, during the 2008 recession, the price of oil fell from a high of around $145 per barrel in July to a low of around $30 per barrel in December.

It is worth noting that not all recessions have the same impact on the financial markets, and there can be significant variation in how different sectors and asset classes perform during a recession.

What is the Best Asset Class to Invest During a Recession?

During a recession, investors typically look for safe havens that can weather economic downturns.

The best asset classes to invest in during a recession include:

- Bonds: Government bonds, such as US Treasuries, are considered one of the safest investments during a recession. During the Great Recession of 2008-2009, the US Treasury bond market gained 12.7% as investors flocked to safety.

- Defensive stocks: Defensive stocks are companies that provide essential products and services, such as utilities, healthcare, and consumer staples. During the 2008-2009 recession, the S&P 500 healthcare sector was one of the few sectors that did not decline as much.

- Gold: Gold is a traditional safe-haven investment that tends to perform well during times of economic uncertainty. During the 2008-2009 recession, gold prices rose more than 25%, as investors sought protection from the stock market’s decline.

- Real estate: Real estate can also be a good investment during a recession, as interest rates tend to be low, and property prices may decline, providing opportunities for long-term investors. During the 2008-2009 recession, housing prices fell sharply, but by 2012, they had rebounded and were rising again.

It’s important to note that no investment is entirely recession-proof, and all come with some degree of risk.

Investors should diversify their portfolios and consult with financial professionals to determine the best investment strategy for their individual needs and risk tolerance.

Concluding Thoughts

In conclusion, understanding the causes, warning signs, and impacts of a recession is critical for policymakers, investors, and the general public.

It’s important to keep a close eye on early warning signs such as an inverted yield curve, high levels of debt, or a slowdown in job growth.

Moreover, investors should take a cautious approach during a recession and seek safe haven assets such as bonds, defensive stocks, gold, or real estate.

Now that I have covered all the strategies for a recession, what can you do to prepare for a potential recession?

Also, how can you ensure that your investment portfolio is diversified and resilient to market downturns?

Let me know in the comments below.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!