What is the NFP (Non-Farm Payroll) and How to Trade it?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

The Non-farm payroll (NFP) is one of the most watched economic indicator by traders and investors, as it provides insight into the health of the US labor market.

Released on the first Friday of each month, the NFP report tracks the change in the number of employees excluding farm employees, government employees, and non-profit organizations.

It is widely followed by economists, investors, and policy makers and can have a significant impact on financial markets.

In this blog post, you’ll learn about the origin of the NFP, how the data is collected and calculated, and what the key numbers in the report mean.

We’ll also explore how traders and investors use the information from the NFP to make their investment decisions.

Table of Contents

What is the NFP and its Origin?

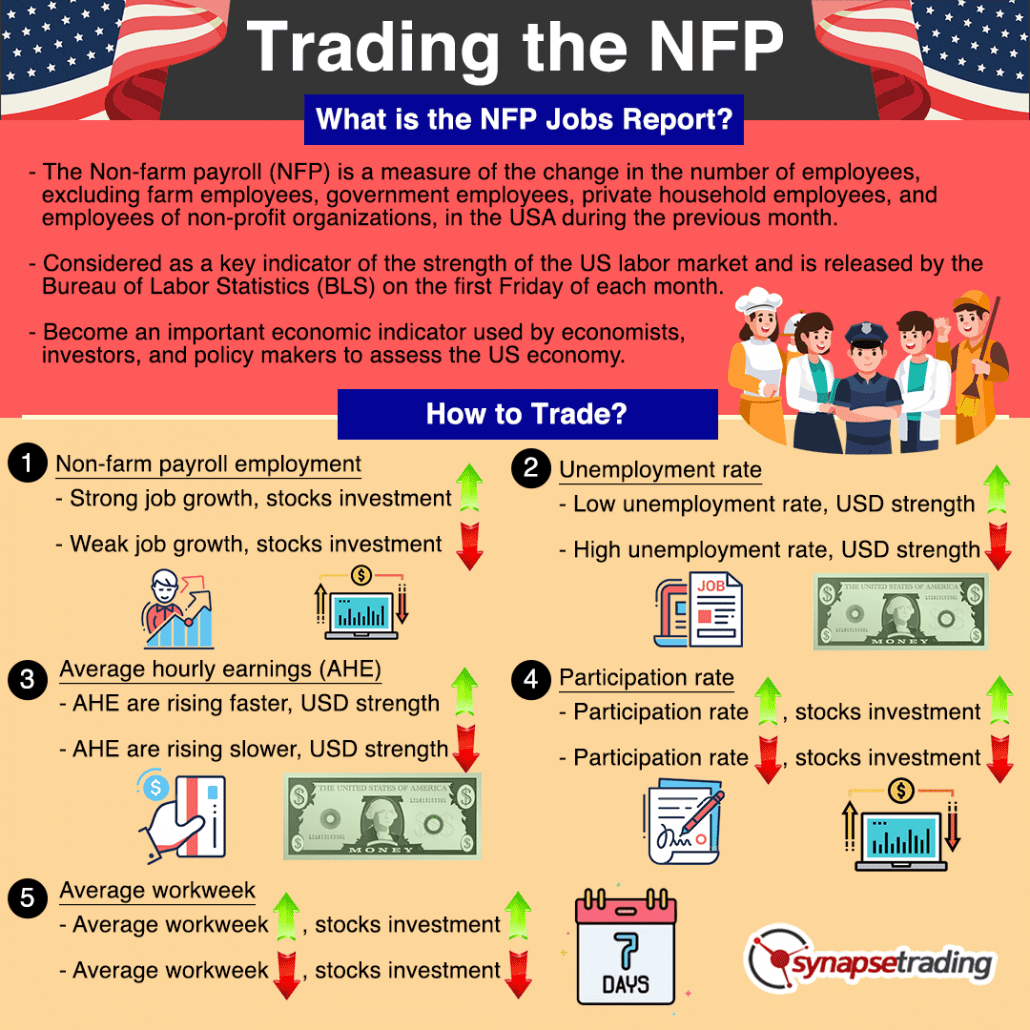

The Non-farm payroll (NFP) is a measure of the change in the number of employees, excluding farm employees, government employees, private household employees, and employees of non-profit organizations, in the US during the previous month.

It is widely considered as a key indicator of the strength of the US labor market and is released by the Bureau of Labor Statistics (BLS) on the first Friday of each month.

The NFP report has its origin in the early 20th century when the US government started collecting data on employment and labor force characteristics.

The NFP report was established as a regular monthly release in the 1940s and has since become an important economic indicator used by economists, investors, and policy makers to assess the health of the US economy.

How is the Data Calculated?

The NFP data is collected and tabulated by the Bureau of Labor Statistics (BLS), which is a branch of the US Department of Labor.

The BLS uses two surveys to calculate the NFP: the Establishment Survey and the Household Survey.

The Establishment Survey, also known as the payroll survey, collects data from a sample of approximately 141,000 businesses and government agencies and covers roughly one-third of all non-farm employment in the US.

The survey collects data on the number of employees on payrolls and the number of hours worked by each employee.

The Household Survey, also known as the survey of households, collects data from a sample of approximately 60,000 households and covers the remaining two-thirds of non-farm employment in the US.

The survey collects information on the employment status of individuals, including those who are unemployed and looking for work.

The NFP data is calculated as the difference between the total number of employed persons in the Establishment Survey and the Household Survey in the current month compared to the previous month.

The NFP data is seasonally adjusted to account for regular patterns in the labor market, such as seasonal hiring during the holidays.

What are the Key Numbers of the NFP Report?

The Non-farm payroll (NFP) report released by the Bureau of Labor Statistics (BLS) contains a number of important data points that traders and investors pay attention to:

- Non-farm payroll employment: This is the main number in the NFP report and is a measure of the change in the number of non-farm jobs in the US during the previous month. A positive number indicates job growth, while a negative number indicates job losses.

- Unemployment rate: This is the percentage of the labor force that is unemployed but actively seeking work. A lower unemployment rate is typically seen as a sign of a strong labor market, while a higher unemployment rate is seen as a sign of weakness.

- Average hourly earnings: This measures the average pay per hour of all non-farm employees and is an important indicator of wage growth and inflationary pressures. A significant increase in average hourly earnings can signal an increase in inflation, which can lead to higher interest rates and a stronger US dollar.

- Participation rate: This is the percentage of the civilian non-institutionalized population that is either employed or actively seeking work. A lower participation rate can indicate a lack of job opportunities, while a higher participation rate can indicate a strong labor market.

- Average workweek: This measures the average number of hours worked per week by all non-farm employees. A decrease in the average workweek can indicate a slowdown in economic activity, while an increase can signal economic strength.

Each of these data points provides valuable information about the state of the US labor market and economy and traders and investors often pay close attention to them when making investment decisions.

However, the relative importance of each number will vary depending on the current economic conditions and the outlook for future growth.

How is this Data Relevant to Traders and Investors?

The NFP data is relevant to traders and investors because it provides valuable information about the state of the US labor market and the overall economy.

A strong NFP report, meaning an increase in the number of non-farm payroll jobs, is often seen as a positive sign of a growing economy and can lead to increased demand for stocks and a stronger US dollar.

On the other hand, a weak NFP report, meaning a decrease in the number of non-farm payroll jobs, is often seen as a negative sign of a slowing economy and can lead to decreased demand for stocks and a weaker US dollar.

Traders and investors pay close attention to the NFP data and may adjust their portfolios in response to the report.

For example, if the NFP report shows strong job growth, traders and investors may increase their investments in stocks, while if the report shows weak job growth, they may decrease their investments in stocks and instead invest in safer assets such as bonds.

In addition to the overall level of job growth, traders and investors also pay attention to other details in the NFP report, such as the average hourly earnings and the unemployment rate.

These data points can provide further insight into the health of the US economy and the direction of future monetary policy, which can also have an impact on financial markets.

News Trading on NFP Data

Here are specific examples of how traders might use each of the data points from the NFP report to make trading decisions:

- Non-farm payroll employment: Traders might use the non-farm payroll employment number to assess the overall health of the US labor market and economy. For example, if the NFP report shows strong job growth, traders might see this as a positive sign and increase their investments in stocks, as a growing economy is generally seen as supportive of corporate profits. On the other hand, if the NFP report shows weak job growth, traders might decrease their investments in stocks and look for safer assets such as bonds.

- Unemployment rate: Traders might use the unemployment rate to assess the strength of the labor market and the potential for future interest rate changes. For example, if the unemployment rate is low and declining, traders might expect the Federal Reserve to raise interest rates in order to keep inflation in check. This could lead to a stronger US dollar and a decrease in demand for riskier assets such as stocks.

- Average hourly earnings: Traders might use the average hourly earnings data to assess inflationary pressures and the potential for future interest rate changes. For example, if the average hourly earnings are rising faster than expected, traders might expect the Federal Reserve to raise interest rates to combat inflation. This could lead to a stronger US dollar and a decrease in demand for riskier assets such as stocks.

- Participation rate: Traders might use the participation rate to assess the health of the labor market and the potential for future economic growth. For example, if the participation rate is declining, traders might see this as a sign of a weak labor market and decrease their investments in stocks. On the other hand, if the participation rate is increasing, traders might see this as a sign of a strong labor market and increase their investments in stocks.

- Average workweek: Traders might use the average workweek data to assess the potential for future economic growth. For example, if the average workweek is increasing, traders might see this as a sign of a strong economy and increase their investments in stocks. On the other hand, if the average workweek is declining, traders might see this as a sign of a weak economy and decrease their investments in stocks.

It’s important to note that these examples are general and that traders might also consider other factors, such as broader economic and market conditions, when making investment decisions.

Additionally, the impact of NFP data on financial markets can vary depending on expectations and the magnitude of the surprise in the report.

Concluding Thoughts

In summary, the Non-farm payroll (NFP) report provides valuable information about the state of the US labor market and by extension, the overall economy.

Whether you’re a seasoned trader or just starting out, understanding the NFP is crucial to making informed investment decisions.

Traders and investors pay close attention to the NFP data, including the non-farm payroll employment, unemployment rate, average hourly earnings, participation rate, and average workweek, and adjust their portfolios in response to the report.

Now that I have covered all about the importance of the NFP report, is it something that you will add to your trading toolbox?

Let me know in the comments below.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!