Weekly Market Wrap: Is the Recent Rally a Bull Trap?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

The last 1-2 weeks, we have seen sizable rallies (20-40%) in various market like stocks, crypto, etc. Does this mean the bear market is over?

It is actually quite common to see such large rallies during a bear market, but personally I won’t be going too aggressive since it could just be in the middle of a bear market.

The better approach would be to stay nimble, taking swing trading positions to ride these bear market rallies, but always be ready to get out the moment the bear market resumes.

The last few weeks have been very good for crypto trading, and I counted 9 successful profitable swing trades in a row so far, so stay tuned to continue watching how far this winning streak can go!

I will be posting daily portfolio updates and trading opportunities in my “Daily Trading Signals” Telegram group, so join us if you want to start profiting with us!

[Photo: Bialowieza Primeval Forest, Hajnówka, Poland – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Portfolio Highlights

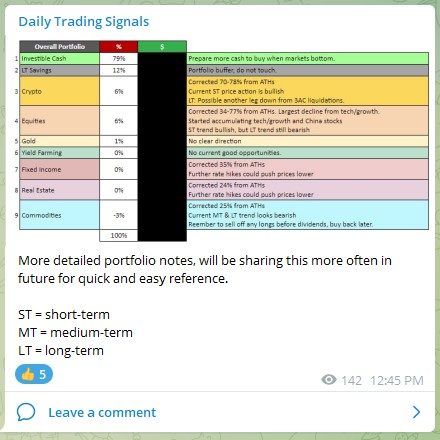

Portfolio updates (20 Jul 2022)

Currently have about 6% in stocks and 6% crypto to ride the current bullish momentum.

More detailed portfolio notes, will be sharing this more often in future for quick and easy reference.

ST = short-term

MT = medium-term

LT = long-term

Portfolio Updates (22 Jul 2022)

Taking profits off long positions in stocks and crypto, especially the latter which has a strong run-up the past few days.

Forex & Commodities Market Highlights

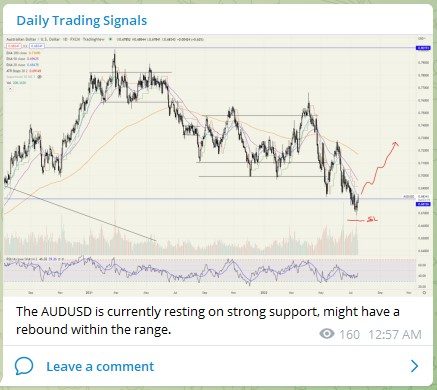

Currency strength is shifting away from the USD for now.

The AUDUSD is currently resting on strong support, might have a rebound within the range.

The NZDUSD might also be having a rebound, but in the form of a falling wedge.

Similar to the NZDUSD, the GBPUSD is also forming a similar wedge shape.

The USDSGD looks like it is correcting back to the bottom of the uptrend channel.

Stock & Bond Market Highlights

So in 1981 consumers were looking at 10% savings account yields, 17% mortgages, 10% bond yields and 9% inflation.

Today it’s 1% savings account yields, 5% mortgages, 3% bond yields and 9% inflation.

The last time inflation was this high it basically took two recessions in short order to slow the rapid rate of change in prices.

https://awealthofcommonsense.com/2022/07/the-last-time-inflation-was-this-high/

Solid breakout for ARK Innovation ETF (ARKK), we might see the bullish momentum continue for a while.

I have been accumulating longs on this for quite a while, might add on a little more. ????

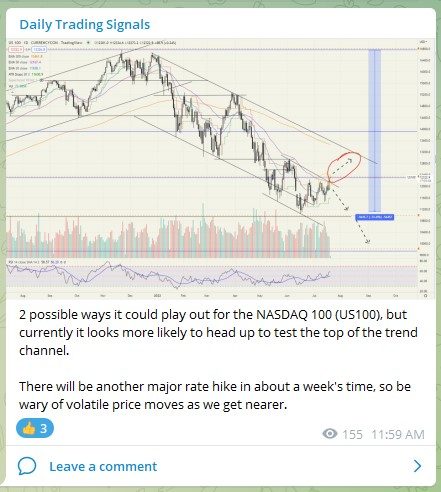

2 possible ways it could play out for the NASDAQ 100 (US100), but currently it looks more likely to head up to test the top of the trend channel.

There will be another major rate hike in about a week’s time, so be wary of volatile price moves as we get nearer.

https://www.wsj.com/articles/a-new-bull-market-cant-start-until-investors-give-up-11658482203

https://www.wsj.com/articles/the-stock-market-is-on-sale-that-doesnt-make-it-cheap-11658388069

Crypto Market Highlights

Can consider taking a small position on Ethereum (ETHUSD) to ride the rebound, with a tight SL around $1250.

Ethereum (ETHUSD) is now above $1500, congrats to all those who took this trade! ????

Taking profits from my recent Ethereum (ETHUSD) long positions. ????

Tricky situation for Ethereum (ETHUSD) because after the breakout to new highs there wasn’t very strong follow-through, so I decided to take my profits and wait on the sideline till I get a better setup.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!