Weekly Market Wrap: Stock Market Crash Resumes?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, we saw a surge in the USD and CAD, and continued weakness in the JPY. This caused many of our existing positions to hit our profit target, allowing us to lock in profits. Soon, I will be posting the newest forex opportunities in the signals chat.

The stock markets continue to decline as predicted, with a few bull traps (small rallies) to lure in “value investors”, before breaking to new lows. Since I am net short, this means that the more the market goes down, the more profits we make on our positions.

The crypto markets are exhibiting choppy sideways movement, which is great for swing trading. It also allows me to hedge my long-term investment positions, which have made me additional profits while waiting for the long-term bull trend to resume.

[Photo: Sarajevo, Bosnia & Herzegovina – See my full travel photo log!

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Forex Market Highlights

Currency comparisons

Product: Forex

Name: Aussie Dollar vs Canadian Dollar

Ticker: AUDCAD

Exchange: N/A

Analysis: Small rising wedge (bearish) after running into major resistance at the top of the wide range.

EP: 0.938

SL: 0.953

TP: 0.918, 0.900

“Took profit at 0.918. Thanks for the call!”

Product: Forex

Name: Aussie Dollar vs Canadian Dollar

Ticker: AUDCAD

Exchange: N/A

Analysis: Following up on this, our first TP has been hit and it is now 295 pips in the money! ????

EP: 0.938

SL: 0.953

TP: 0.918, 0.900

Product: Forex

Name: US Dollar / SG Dollar

Ticker: USDSGD

Exchange: N/A

Analysis: Following up from the last analysis, it has finally hit our TP, netting a profit of 378 pips! ????

The next possible level to look at is $1.400.

EP: 1.370 to 1.375, or any pullbacks

SL: 1.365

TP: Near 1.400

Commodities Market Highlights

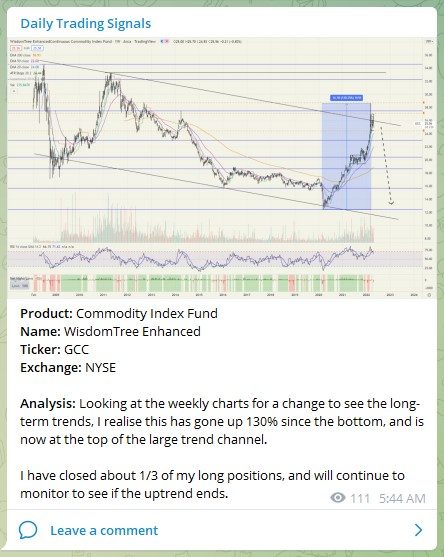

Product: Commodity Index Fund

Name: WisdomTree Enhanced

Ticker: GCC

Exchange: NYSE

Analysis: Looking at the weekly charts for a change to see the long-term trends, I realise this has gone up 130% since the bottom, and is now at the top of the large trend channel.

I have closed about 1/3 of my long positions, and will continue to monitor to see if the uptrend ends.

Stock & Bond Market Highlights

Product: Bond ETF

Name: ishares 20+ Year Treasury Bond ETF

Ticker: TLT

Exchange: NASDAQ

Analysis: Looking at the long-term weekly chart of this bond ETF, it seems to be at a major support level.

Is it possible that the market has already fully priced in all potential future rate increases for this cycle?

Not starting to buy yet, just giving a heads-up while keeping an eye on it.

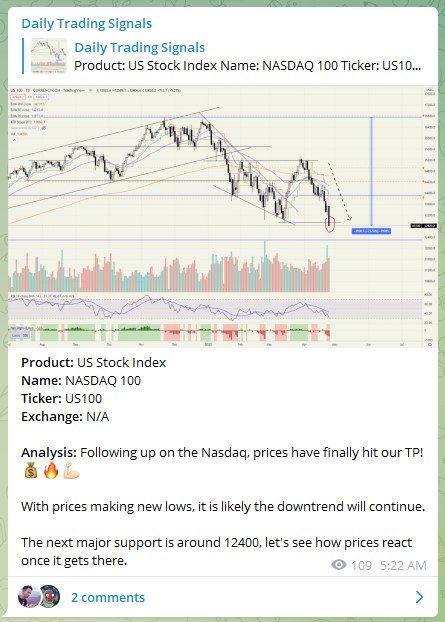

Product: US Stock Index

Name: NASDAQ 100

Ticker: US100

Exchange: N/A

Analysis: Following up on the Nasdaq, prices have finally hit our TP! ????

With prices making new lows, it is likely the downtrend will continue.

The next major support is around 12400, let’s see how prices react once it gets there.

Crypto Market Highlights

Closing some of my hedges (taking profit) for BTC and ETH! ????

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!