Three Outside Up & Three Outside Down Pattern

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

The three outside up and three outside down are three-candle reversal patterns that appear on candlestick charts. The pattern requires three candles to form in a specific sequence, showing that the current trend has lost momentum and might signal a reversal of an existing trend.

In particular, the pattern is formed when a bearish candlestick (one that closes lower than it opened) is followed by two instances of a bullish candlestick (which closes higher than it opens), or vice versa.

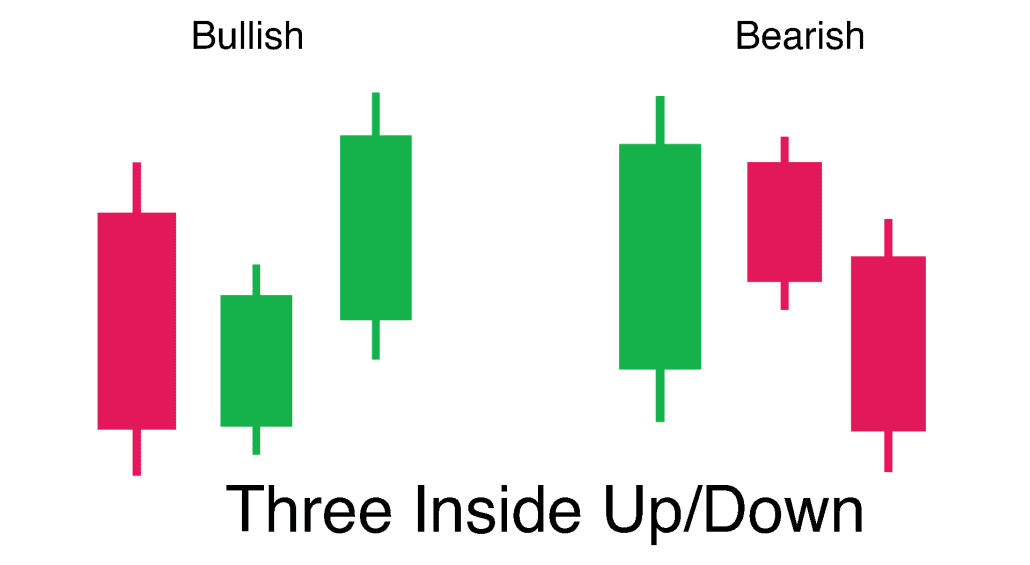

The three outside up and three outside down may be compared with a three inside up/down candle.

Table of Contents

How 3 Outside Up/Down Candlesticks Work

The Three Outside Up Pattern

- The market is in a downtrend.

- The first candle is bearish.

- The second candle is bullish with a long real body and fully contains the first candle.

- The third candle is bullish with a higher close than the second candle.

The Three Outside Down Pattern

- The market is in an uptrend.

- The first candle is bullish.

- The second candle is bearish with a long real body that fully contains the first candle.

- The third candle is bearish with a close lower than the second candle.

The first candle marks the beginning of the end of the prevailing trend as the second candle engulfs the first candle. The third candle then marks an acceleration of the reversal.

The three outside up and three outside down patterns occur frequently and are reliable indicators of a reversal. Traders can use these indicators as primary buying or selling signals but still watch for confirmations from other chart patterns or technical indicators.

3 Outside Up Trader Psychology

The first candle continues the bearish trend, with the close lower than the open indicating strong selling interest while increasing bear confidence. The second candle opens lower but reverses, crossing through the opening tick in a display of bull power. This price action raises a red flag, telling bears to take profits or tighten stops because a reversal is possible.

The security continues to post gains, lifting the price above the range of the first candle, completing a bullish outside day candlestick. This increases bull confidence and sets off buying signals, confirmed when the security posts a new high on the third candle.

3 Outside Down Trader Psychology

The first candle continues the bullish trend, with the close higher than the open indicating strong buying interest while increasing bull confidence. The second candle opens higher but reverses, crossing through the opening tick in a display of bear power. This price action raises a red flag, telling bulls to take profits or tighten stops because a reversal is possible.

The security continues to post losses, seeing its price drop below the range of the first candle, completing a bearish outside day candlestick. This increases bear confidence and sets off selling signals, confirmed when the security posts a new low on the third candle.

Concluding Thoughts

The three outside up and three outside down patterns are valuable tools in technical analysis, offering traders insights into potential trend reversals. While these patterns are reliable, they should be used in conjunction with other technical indicators to confirm the trend change. By understanding the psychology behind these patterns, traders can better position themselves to take advantage of shifts in market sentiment.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

The Synapse Network is our dedicated global support team, including event managers, research teams, trainers, contributors, as well as the graduates and alumni from all our previous training program intakes.

Leave a Reply

Want to join the discussion?Feel free to contribute!