Weekly Market Wrap: Tech Stocks Lead the Rally Again!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

Last week in the markets saw a gentle start to 2024 following the strong rally at the end of 2023.

While the S&P 500’s slight pullback reflects a period of consolidation, underlying market movements suggest a shift, with pressure on small-cap stocks and investment-grade bonds.

Tech and communication services sectors continue to lead, with health care and consumer staples sectors showing outperformance.

Looking ahead, important economic indicators due this month include U.S.

GDP growth data and the PCE inflation report, which will shed light on economic health and inflation trends.

The Federal Reserve’s rate decision at the end of January will also be crucial, with current market expectations leaning towards rate cuts later in the year.

These data points will guide investor strategies amidst the anticipated market volatility early in the year.

Investors should brace for an eventful week as several industry giants are poised to report their earnings, with Netflix kicking off on Tuesday, Tesla following on Wednesday, and Intel rounding out on Thursday.

Additionally, a vital glimpse into the U.S. economy’s performance in the fourth quarter will be provided with the government’s preliminary GDP report, also expected on Thursday.

The week will also be packed with a suite of economic data releases that could impact market movements, including new and pending home sales and durable-goods orders.

Market participants will closely scrutinize PMIs and the Personal Consumption Expenditures Price Index, the Fed’s favored inflation metric, to gauge economic health and inflationary pressures.

Daily Trading Signals (Highlights)

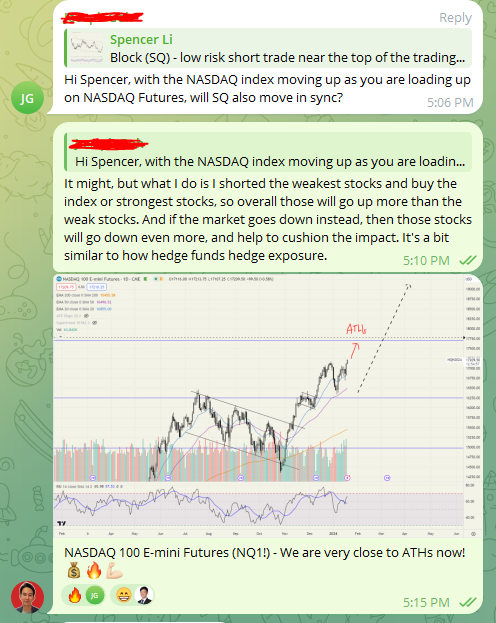

NASDAQ 100 E-mini Futures (NQ1!) – We are very close to ATHs now! 💰🔥💪

Advanced Micro Devices (AMD) – Breaking to new all time highs!

NextEra Energy (NEE) – Clean energy stocks are not doing too well in general, and this stock just broke down from a bearish rising wedge on the weekly chart, at the confluence of multiple EMA resistances.

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!