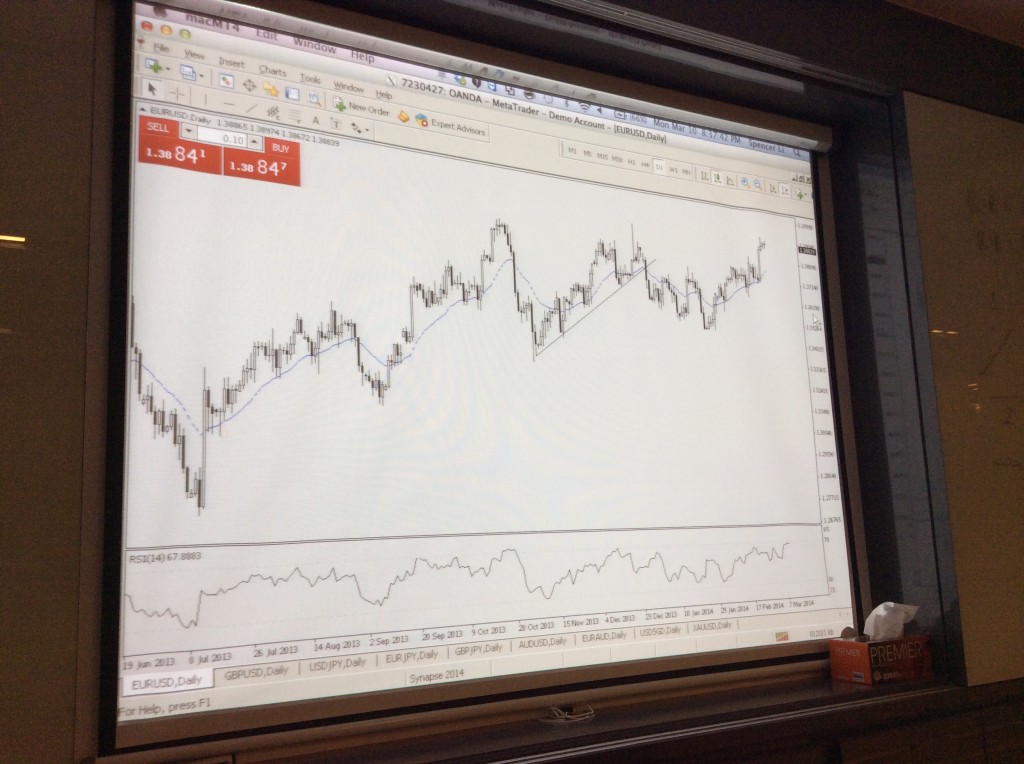

Recently, we started a new LIVE! Forex Trading chat group, to discuss the market in real-time and provide more trading opportunities.

We are making this secret group very exclusive, and we are looking for serious traders who are willing to learn and get the results they want.

It doesn’t matter whether you are new or experienced, because when we trade together, what matters is the profits and results that you create for yourself, and making profits together makes it all the more exciting and memorable.

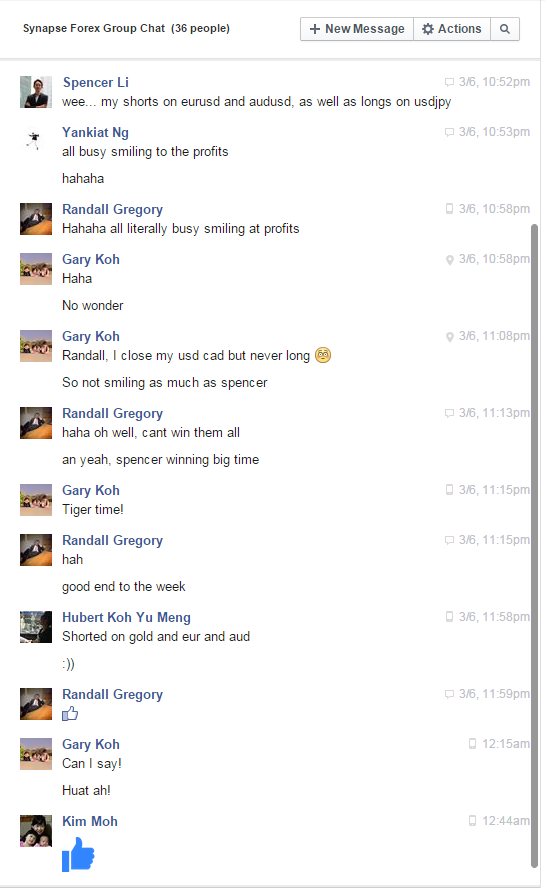

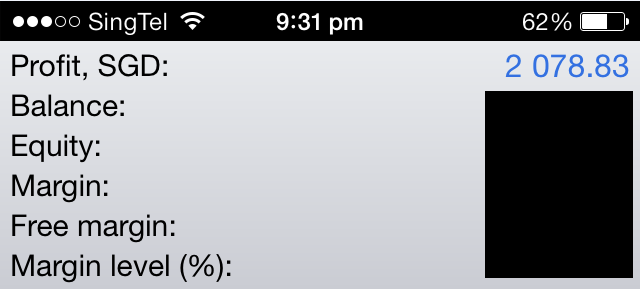

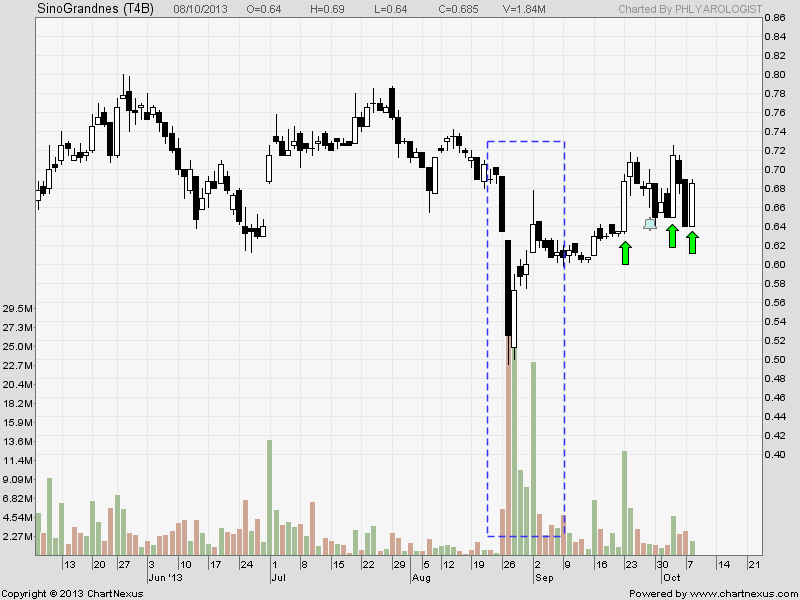

Although it has only been active for 1-2 months, we have seen very good feedback, and together, we have managed to capture many good trades.

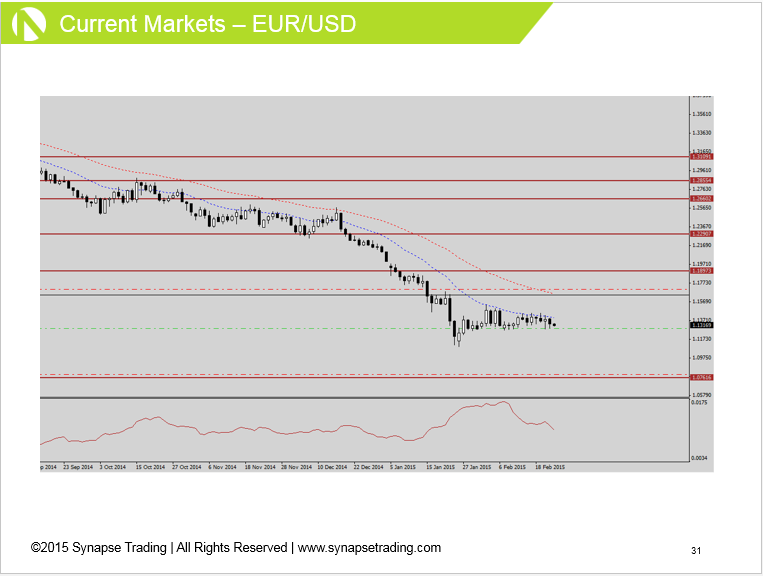

Just last week, we have seen extraordinary profits on EUR/USD, AUD/USD, USD/JPY, and Gold.

Congrats to everyone for chipping in, and don’t forget to enjoy the profits which are part of our hard work together!

If you are keen to join us, you can drop by for our next upcoming event:

https://synapsetrading.com/free-workshop-7-best-kept-secrets-professional-traders-live/

Good luck! 😀

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.