Rising Window & Falling Window Pattern

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Table of Contents

Rising and Falling Window Candlestick Pattern

The support and resistance zones of Window candlestick patterns are highly rigid.

In the case of a Falling Window candlestick pattern, a stiff resistance region is generated, which provides a higher probability of trade opportunities during consecutive re-tests of the resistance area.

Similarly, a stiff support region is generated in the case of a Rising Window candlestick pattern, also offering better trade opportunities during consecutive re-tests of the support area.

In today’s blog, we will discuss how to use the Rising and Falling Window Candlestick Pattern in detail.

What is Rising Window Candlestick Pattern?

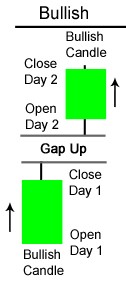

To form a Window (whether rising or falling), there must be space between the real bodies of two candles, and even their shadows should not overlap.

During an uptrend, a Rising Window is a price gap that forms.

The space between the candles represents the distance between the high of the previous candle and the low of the current candle.

This trend indicates that the bulls are in control, and the price is likely to continue rising.

Examine the size of the gap to better understand the pattern’s message.

For example, a large gap denotes a significant price increase, while a small gap indicates a modest and possibly insignificant price change.

Formation

The Rising Window, also known as a “gap up,” appears when the price continuously rises.

It is always regarded as a bullish signal.

This pattern is common, though less frequent on charts with longer time scales.

Trading with Rising Window Candlestick Pattern

The chart typically begins with an upward trend.

At the start of this movement, the bulls create a gap up (i.e., a Rising Window) to demonstrate their strength.

The uptrend continues with predominantly white candles increasing steeply.

Eventually, when the trend reverses, the bears become strong enough to form a downward gap, known as a Falling Window.

This pattern indicates a significant shift in investor sentiment, with both a gap up and a gap down.

What is Falling Window Candlestick Pattern?

A Falling Window candlestick pattern refers to a price gap during a downward trend.

It must occur while the price trend is down, and it is always a bearish signal.

This continuation pattern is more common on charts with shorter time scales, though it is less frequent on longer time scales.

Due to its prevalence, it’s crucial to pay attention to the specific characteristics of each Falling Window, as these details can help determine the importance of the signal and whether it warrants attention.

Formation

When observing the two candles that follow the Falling Window, examine them closely.

If these candles do not close the window or fill the gap (including their shadows), a Downside Tasuki Gap pattern may have formed.

For this pattern to qualify, the first and second candles must be bearish, while the third must be bullish.

After a significant downturn, as indicated by the gap down, the bulls may attempt to push the price back up.

However, if they fail, the decline is likely to continue.

What is the Falling Window Candlestick Pattern?

A Falling Window candlestick pattern is a bearish continuation pattern that results from a gap down between two consecutive candlesticks.

There is a “window” or space between the first and second candlesticks because the opening price of the second is lower than its closing price.

What is the Rising Window Candlestick Pattern?

The Rising Window is a bullish continuation pattern in Japanese candlestick charting.

It typically manifests as a rejection from lower prices and appears as a pause following an upward price trend.

This pattern is considered bullish, as it suggests a continuation of the upward movement after the Rising Window appears at the right time.

Concluding Thoughts

The Rising and Falling Window candlestick patterns are important tools for traders to identify potential trade opportunities.

By recognizing the stiff support and resistance regions these patterns create, traders can better assess the likelihood of successful trades during re-tests of these areas.

While these patterns provide valuable insights into market trends, it is essential to consider additional technical indicators and broader market conditions to make informed trading decisions.

Always be mindful of the context in which these patterns appear, and use them as part of a comprehensive trading strategy.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

The Synapse Network is our dedicated global support team, including event managers, research teams, trainers, contributors, as well as the graduates and alumni from all our previous training program intakes.

Leave a Reply

Want to join the discussion?Feel free to contribute!