Pre-elections QE3 Boost – How Sustainable?

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

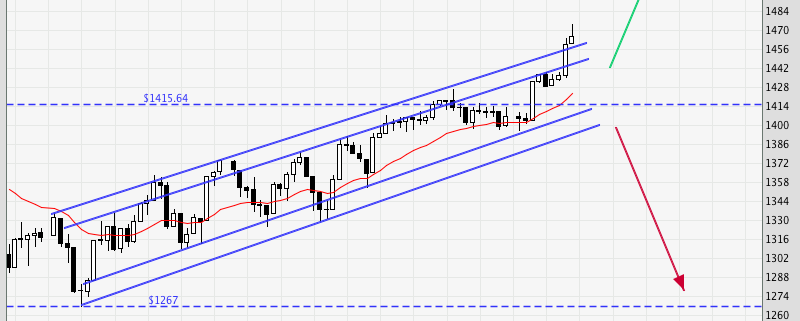

For the past few weeks, I have been rather bearish on the US indices, expecting them to stop the ascend at their respective key resistance levels. However, a major news catalyst (QE3) has changed all that. With the new tweak in money supply, and the added confidence (real or perceived is debatable), we could continue to see the market drift upwards till the elections in November. There is also likely to be “words of encouragement” by the leaders to prod the market in the right direction.

Hence, the reversal could instead occur at the next resistance levels, which would more likely coincide with the end of the elections. This is not a forecast, merely a guess. At this point, I would look to buy on a weak pullback, or be ready to short if I see a sudden strong breakdown of the bulls.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!