Weekly Market Wrap: Mixed Results for Banks Earnings, Tech Next

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For our “Daily Trading Signals”, we have now also included a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technicals, economics, and portfolio management:

Click here for last week’s market report (17 April 2023)

Click here to subscribe for the latest market report (24 April 2023)

Click here to see the archives of all our past market reports

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

Last week, concerns grew about the historical trend of stocks rallying after the Federal Reserve finishes raising interest rates, as earnings growth falters and stocks look expensive relative to history. Elevated inflation may continue to weigh on earnings in the coming quarters.

Microsoft’s Bing is challenging Google in the lucrative search market, raising the cost of retaining this business. This comes as global online advertising is in a slump, and traffic acquisition costs (TAC) reached nearly $49 billion last year.

Tesla’s operating margin declined due to aggressive price cuts and inflation in materials.

The Walt Disney Company is expected to lay off thousands of employees starting next week as part of its cost-cutting initiatives. Economists are predicting a recession later this year as the Federal Reserve raises interest rates, which businesses and consumers haven’t experienced in 15 years.

In other news, Goldman Sachs reported an 18% decrease in first-quarter profit, while Morgan Stanley saw a 19% drop in Q1 profit due to a slowdown in deal-making.

Meanwhile, China surprised economists with strong 4.5% growth in the first quarter despite its housing market crash and a conservative monetary stance.

This week, investors should closely monitor the earnings reports from major tech companies, including Apple, Amazon, Google parent Alphabet, Microsoft, and Meta Platforms, as well as other noteworthy companies like Coca-Cola Company, McDonald’s, Visa, Mastercard, and ExxonMobil, among others.

These reports will provide valuable insights into the performance and future prospects of these industry giants.

Additionally, keep an eye on the Case-Shiller National Home Price Index for February, new and pending home sales for March, and the BEA’s advance estimate for the first-quarter GDP to get a clearer picture of the current state of the economy.

Furthermore, don’t miss the key update on inflation with the Personal Consumption Expenditures (PCE) Price Index—the Federal Reserve’s preferred inflation gauge—for March. This indicator will help assess the extent of inflationary pressures in the economy and potentially influence the Fed’s monetary policy decisions.

Daily Trading Signals (Highlights)

CADCHF – Congrats on hitting the first TP! 💰🔥💪🏻

High chance of another leg down, so can close half and use a trailing SL.

NZDCHF – Prices have fallen to support, and hit the profit target for 287 pips profit! Congrats to those who took this trade! 💰🔥💪🏻

CADJPY – A potential range trading opportunity.

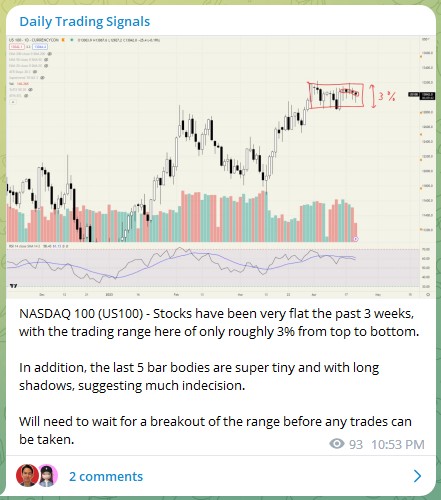

NASDAQ 100 (US100) – Stocks have been very flat the past 3 weeks, with the trading range here of only roughly 3% from top to bottom.

In addition, the last 5 bar bodies are super tiny and with long shadows, suggesting much indecision.

Will need to wait for a breakout of the range before any trades can be taken.

NASDAQ 100 (US100) – Stocks have been very flat the past 3 weeks, with the trading range here of only roughly 3% from top to bottom.

In addition, the last 5 bar bodies are super tiny and with long shadows, suggesting much indecision.

Will need to wait for a breakout of the range before any trades can be taken.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!