How Will Brexit Affect the Various Markets?

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

Last week, there was much turmoil and excitement in the market. Fortunes were made and lost. And many markets spiked strongly, hitting record new highs or lows.

The pound has crashed more than 12%.

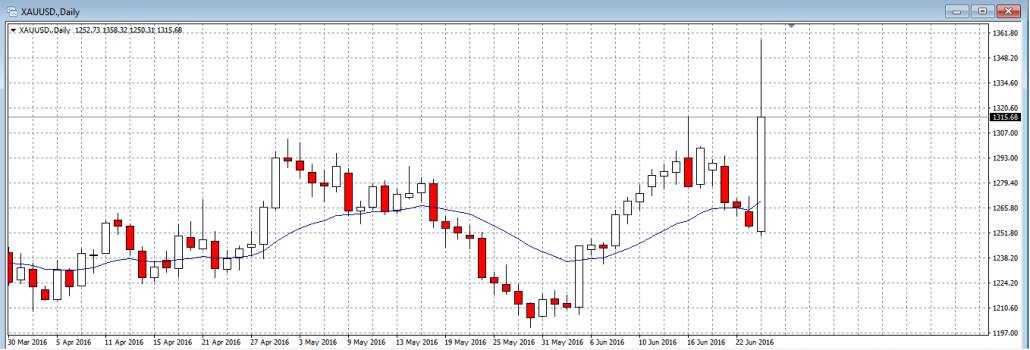

Gold rose more than 5% in a day:

And Oil has started to tip under the 20-EMA (daily chart):

The ASOS site crashed as too many shoppers started to buy on the cheap pound.

Fox news network wrongly reports that the UK has left the United Nations:

It seems that almost anything that deals in pounds or derives revenues from the UK is at risk of being dumped. For example, Comfortdelgro runs bus and taxi services in the UK, deriving more than 20% of its operating profit there.

The STI has rolled over on the daily chart, and is convincingly under the 20-EMA.

But on the multi-year chart, if we zoom out a lot we see it has quite a bit of room to move down before it can be considered a bargain buy. I’ve talked about it in my previous workshops, when I showcase my 30-year forecasting chart for long-term investors.

There’s a lot of talk about the Brexit being a financial snowball that will end in financial mayhem. There are also people on the internet talking about a huge correction in real estate prices in Singapore:

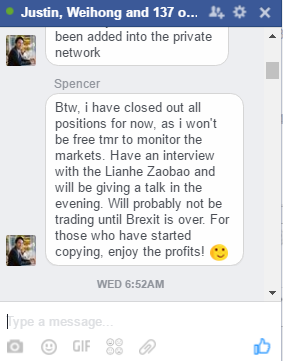

Overall, I’m glad I stayed out of the Brexit and closed all my positions prior to the Brexit (last wednesday!). Having announced it on my private “live” chat to my program graduates, I sat back and calmly watched the world burn. Just kidding! 😀

What’s clear to me is that although the charts look a little ugly at the moment, the STI is still not undervalued.

For example, China Aviation still remains sky high, after having taken profit on a 5.83 R/R trade (meaning I made 5.8 times of what I risked for the trade):

Here’s the screengrab of when I took the trade,

And where it ended up last Friday. Looks like a really nice bounce setup but that’s for another time.

For now, since most charts are kind of messy and prices and in the middle of the spike range, I will be focusing more in intraday scalping trades to have consistent income even during such volatile times.

This is a defensive play, so instead of going for big wins, I am going for many small wins instead. Good luck!

Sources:

http://www.telesurtv.net/english/analysis/Trump-and-4-Other-Crazy-Things-That-Happened-over-Brexit-20160624-0026.html

http://sbr.com.sg/residential-property/in-focus/here%E2%80%99s-why-brexit-bad-news-singapore-property

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!