Weekly Market Wrap: Gold & Commodities Are Bullish!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

Last week’s labor market update offered mixed interpretations, showcasing the ongoing robustness of employment growth with 303,000 jobs added in March, suggesting a strong but moderating labor market.

Despite expectations of a softening employment environment, the market remains resilient, with unemployment at a historically low 3.8%.

This backdrop maintains consumer spending strength, although job openings have started to decline, hinting at a gradual market cooling.

Meanwhile, wage growth has slowed to 4.1%, signaling easing inflationary pressures but complicating Fed’s rate cut expectations.

Market reactions were notably measured, with stocks dipping in response to signs of a strengthening economy, potentially delaying anticipated Fed rate cuts.

The upcoming CPI report will be critical for adjusting expectations around the Fed’s policy moves, especially if core CPI trends cooler, bolstering the case for a summer rate cut.

Amidst this, the labor market’s enduring vitality, coupled with moderating wage increases, presents a nuanced picture for investors, balancing between continued economic growth and the potential for easing monetary policy.

This week’s financial landscape is brimming with pivotal updates that could sway market sentiments.

The release of the Consumer Price Index (CPI) inflation data for March on Wednesday is particularly significant, with Federal Reserve officials scrutinizing the figures to inform potential adjustments to interest rate policies.

Additionally, remarks from several Fed officials throughout the week, along with insights from the latest Federal Open Market Committee (FOMC) meeting minutes and the Michigan consumer sentiment survey results, are anticipated to offer valuable perspectives on the economic outlook and monetary policy direction.

Simultaneously, the onset of the 2024 first-quarter earnings season promises to shed light on the financial health of the nation’s banking sector, with JPMorgan Chase, Wells Fargo, and Citigroup set to disclose their financial performances.

These reports could provide critical insights into the banking industry’s resilience and profitability, further influencing market trends and investor strategies in the context of ongoing economic uncertainties and the Fed’s monetary policy trajectory.

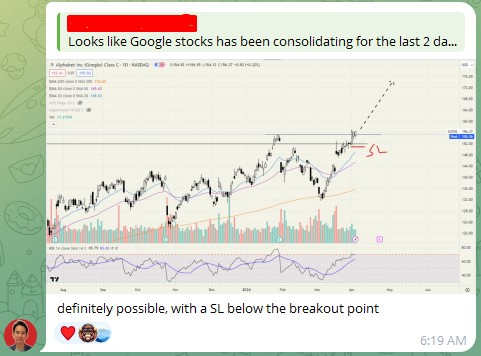

Daily Trading Signals (Highlights)

Energy Stocks ETF (XLE) – Strong +22.37% run-up on this ETF, which I mentioned in previous videos. Took some profits on it.

Definitely possible, with a SL below the breakout point

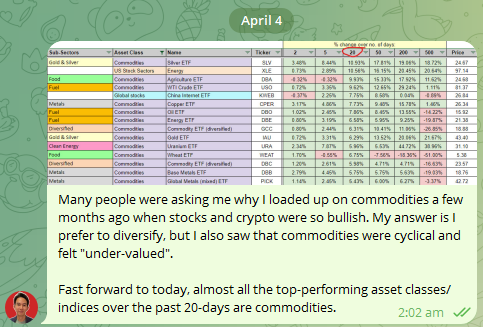

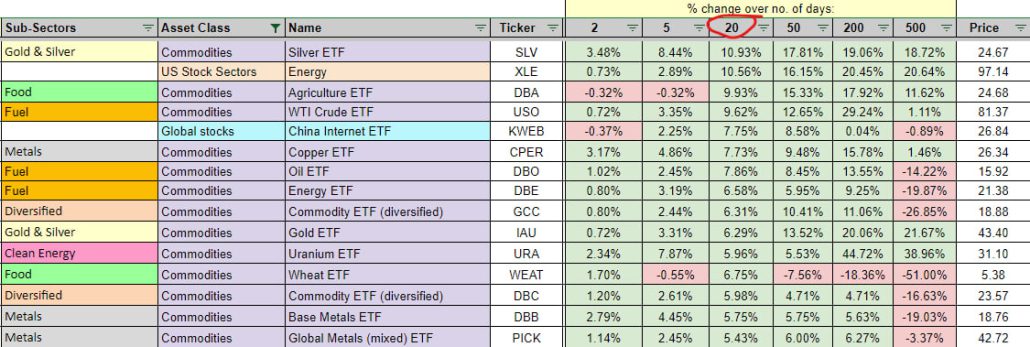

Many people were asking me why I loaded up on commodities a few months ago when stocks and crypto were so bullish. My answer is I prefer to diversify, but I also saw that commodities were cyclical and felt “under-valued”.

Fast forward to today, almost all the top-performing asset classes/indices over the past 20-days are commodities.

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

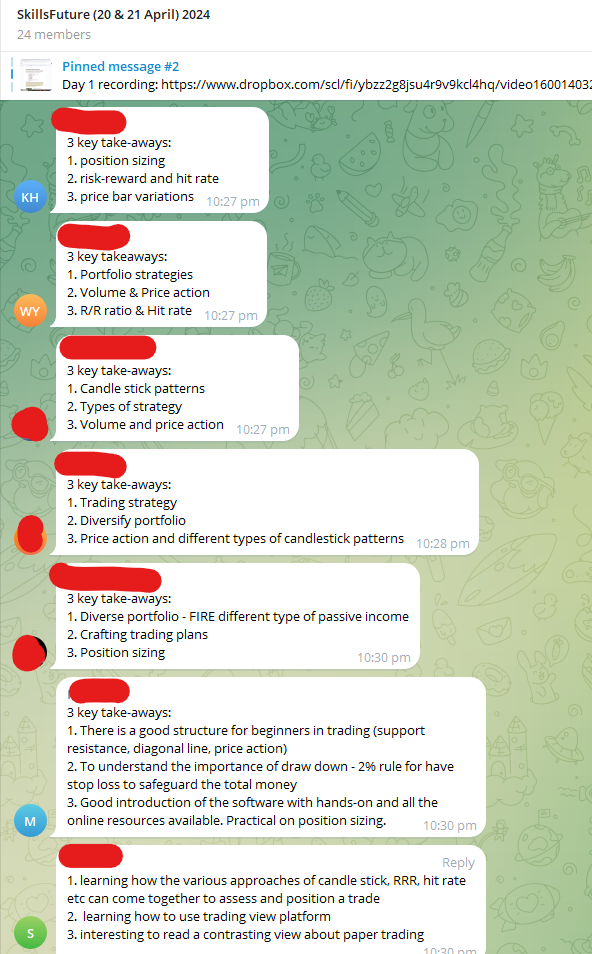

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!