Weekly Market Wrap: The Crypto Bull Cycle is Back!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

With the stock markets running into strong resistance, this could be a critical point to see if it can push to test new highs and resume the uptrend.

As the war drags on, and inflation continues creeping upwards, it is also possible that the stock markets head into a period of sideways movement until the outcome of the war is clearer.

On a more positive note, the crypto bull market looks to be back on track after taking a 3-month break, which could likely take it to new highs.

[Photo: Sinaia, Romania – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Forex Market Highlights

Bitcoin, USD and the commodity currencies continue to dominate.

JPY weakened a lot during the past week, leading to sharp moves in /JPY pairs.

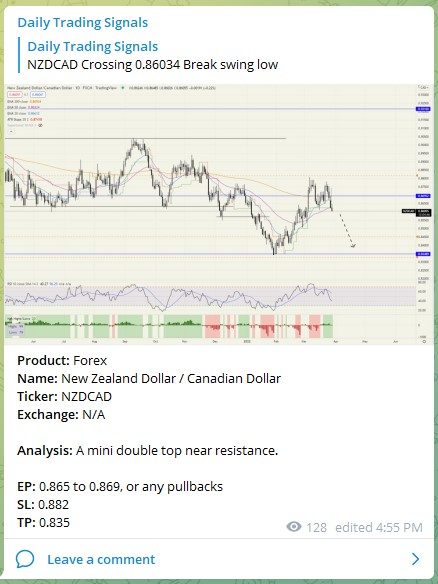

Product: Forex

Name: New Zealand Dollar / Canadian Dollar

Ticker: NZDCAD

Exchange: N/A

Analysis: A mini double top near resistance.

EP: 0.865 to 0.869, or any pullbacks

SL: 0.882

TP: 0.835

Commodities Market Highlights

“The de facto buyers’ strike on Russian crude that began a month ago propelled oil prices to their highest levels in years. Now the real effects are starting to create a second wave of impact on oil markets, disrupting Russian exports and threatening further price increases. ”

https://www.wsj.com/articles/oil-prices-stay-high-as-russian-crude-shortage-hits-market-11648350193

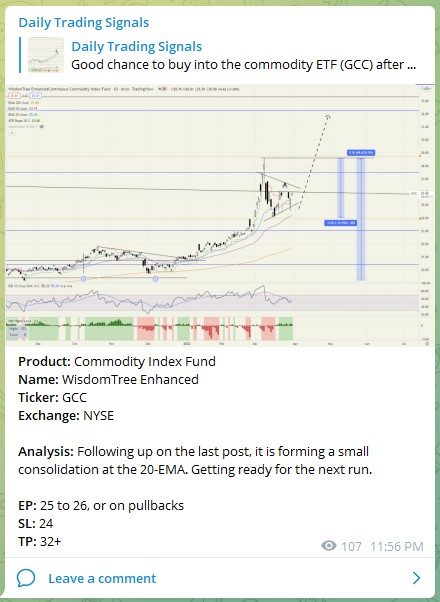

Product: Commodity Index Fund

Name: WisdomTree Enhanced

Ticker: GCC

Exchange: NYSE

Analysis: Following up on the last post, it is forming a small consolidation at the 20-EMA. Getting ready for the next run.

EP: 25 to 26, or on pullbacks

SL: 24

TP: 32+

Stock & Bond Market Highlights

Nothing much has changed since our last post, as prices continue to move as predicted.

Crypto Market Highlights

Following up on Ethereum (ETH), it is now up 58.3% from its lows! ????

With an expected upgrade for Ethereum coming soon, I am more bullish on this than Bitcoin.

I alrdy have about 30% of my portfolio in crypto, with the bulk in Ethereum. If you do not yet have any positions, you can consider buying on any 5-10% pullbacks.

Product: Cryptocurrency

Name: Terra

Ticker: LUNAUSD

Exchange: N/A

Analysis: A potential cup and handle accumulation pattern forming. Keep an eye on the breakout! ?

EP: 97 to 100, or on pullbacks

SL: 87

TP: 150+

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!