As early as 24th October we started to prepare for this big trade, posting it in my blog and various forums, so that everyone can take this trade together and make some serious money. Let’s follow the journey of this exciting trade!

https://synapsetrading.com/singapore-forex-trading-audusd-the-crucial-weekly-pattern/

https://synapsetrading.com/singapore-forex-trading-audusd-follow-up-from-reaping-profits/

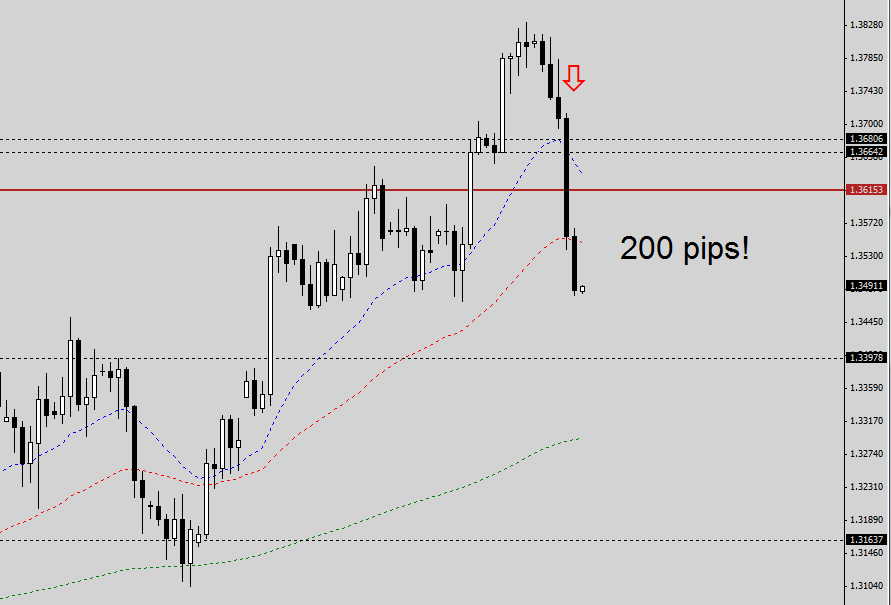

One good trade is all you need!

One good trade is all you need!

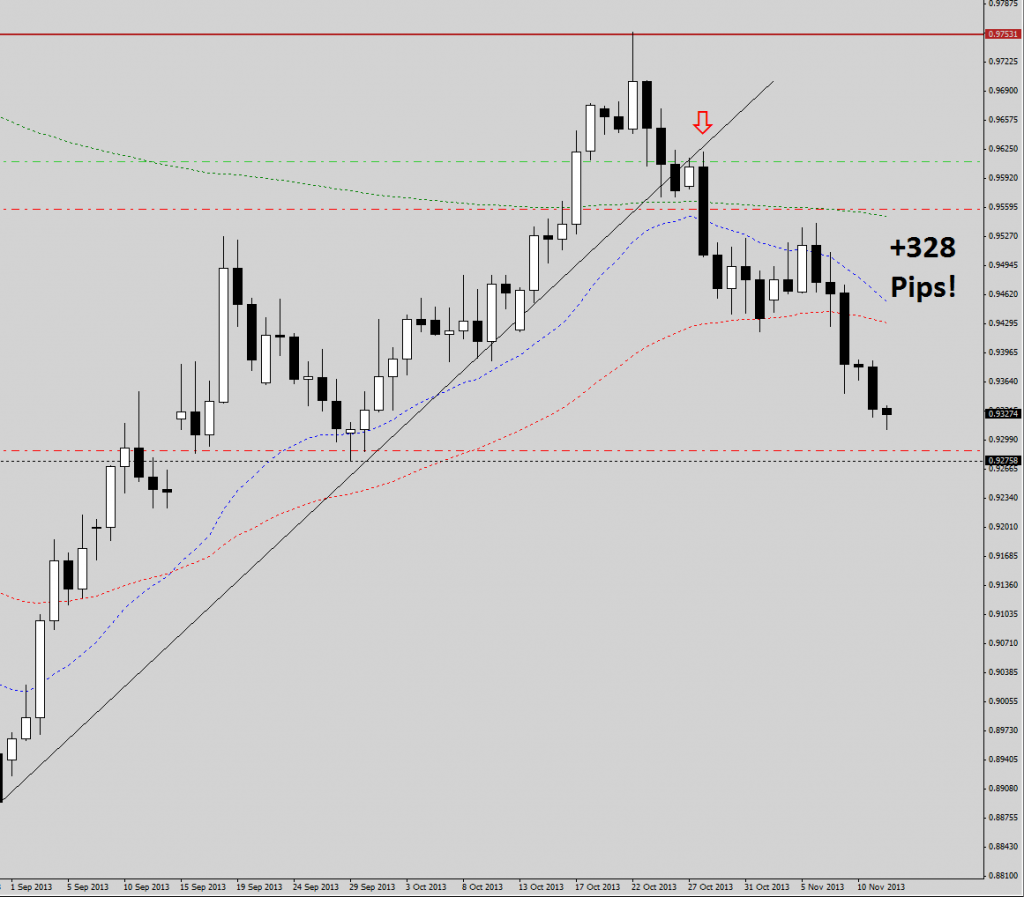

Initiated multiple short positions, and adding on to my winning positions, just like the Jesse Livermore method.

Initiated multiple short positions, and adding on to my winning positions, just like the Jesse Livermore method.

Manage trades with a tight stoploss, and let your profits run!

Took profits on some positions, and continued to trail my stoploss for a larger move.

Took profits on some positions, and continued to trail my stoploss for a larger move.

Total pips so far: +328 pips! Waiting for my last 0.2 lots to hit the final TP of 0.93.

Total pips so far: +328 pips! Waiting for my last 0.2 lots to hit the final TP of 0.93.

After taking profit on most of my positions, this is the last remaining 0.20 of my standard lots. I queued to TP at 0.930, which was eventually hit.

After taking profit on most of my positions, this is the last remaining 0.20 of my standard lots. I queued to TP at 0.930, which was eventually hit.

This show that with precision and patience, small positions can add up to large profits!

If you are interested, come join the Synapse Network and trade together with us!

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

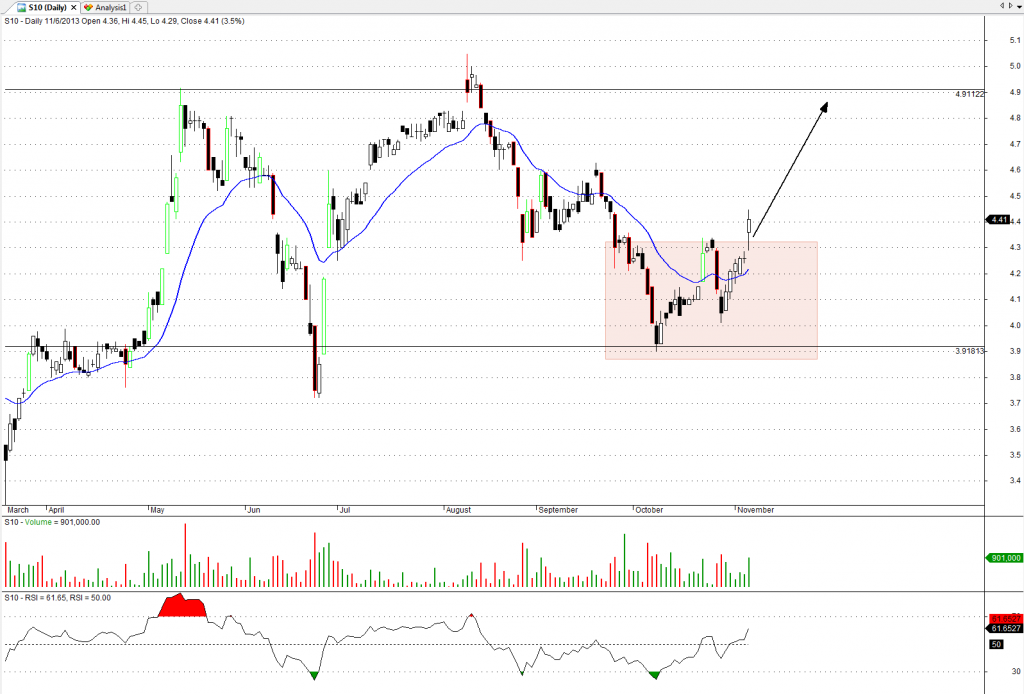

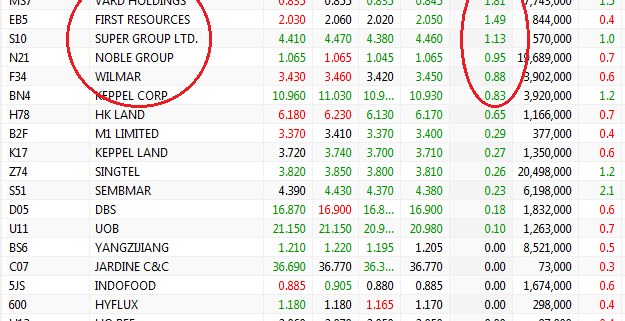

YangZiJiang – Still not moving yet, but keep an eye on it. Very promising.

YangZiJiang – Still not moving yet, but keep an eye on it. Very promising.