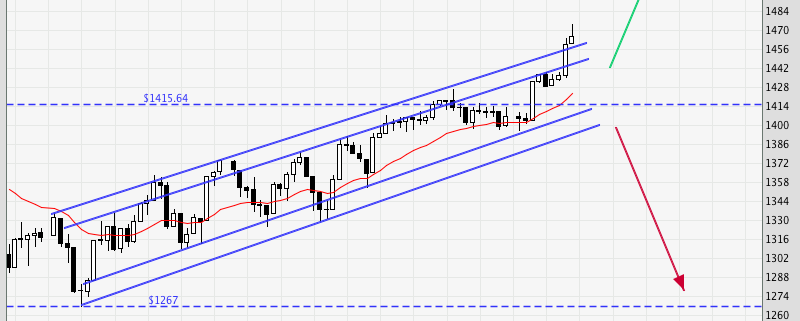

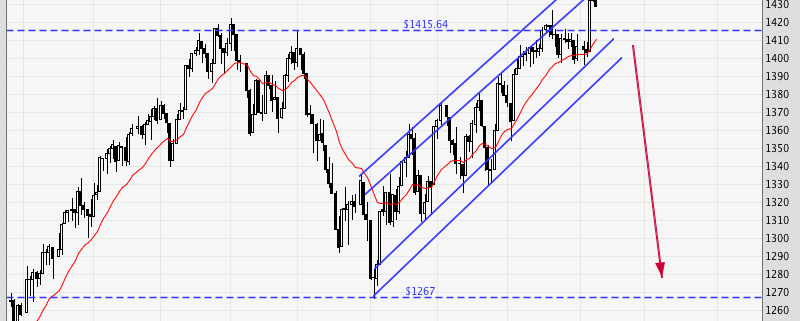

For the past few weeks, I have been rather bearish on the US indices, expecting them to stop the ascend at their respective key resistance levels. However, a major news catalyst (QE3) has changed all that. With the new tweak in money supply, and the added confidence (real or perceived is debatable), we could continue to see the market drift upwards till the elections in November. There is also likely to be “words of encouragement” by the leaders to prod the market in the right direction.

Hence, the reversal could instead occur at the next resistance levels, which would more likely coincide with the end of the elections. This is not a forecast, merely a guess. At this point, I would look to buy on a weak pullback, or be ready to short if I see a sudden strong breakdown of the bulls.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.